Interesting: the opinion of Interactive Brokers’ founder on inflation:

Here a good summary in French of inflation and FX situation in Switzerland on RTS (7 min video, also a shortened text summary that can be translated)

My own takeaways:

- Versus other countries inflation today is moderate in CH at 1.2% thanks to the strong CHF. Higher inflation in other countries will put further upwards pressure on CHF FX rate

- Inflation is somewhat a self-fulfilling prophecy. What happens in CH will depend a lot on salary negotiations

- There is potential upwards pressure on salaries because many employers are looking to shorten supply chains so cannot negotiate with unions with the same threat of off-shoring as they did in the past

Regarding 1 it depends how far the SNB can (and wants to) let the CHF appreciate given its enormous FX reserves (around 1 trillion CHF currently). Theoretically its own capital could become negative but… hum… Do they want to be in such a situation?

Well, it seems like inflation is finally hitting Switzerland. We’re just at about 3% year on year but we’ve got a massive 0.65% increase month over month, which annualized would be 8%. Without surprise, wood, oil based energy, transportation, used cars, some foods and clothing (women get hit much harder than men, here) are the main culprits.

If you’re eating rice, pizza, pork, sausages, fruits, potatoes and preserved vegetables, you’re fine. While coffee gets hit pretty hard, tea drinkers go mostly unscathed too. If you want to buy a TV or a console, now’s a good time for it. Also, consumer medical costs are going down…

Anecdote: Out of curiosity I completed a Credit Suisse online mortgage calculator last week. It proposed a 12 year fixed rate 2.9%. Much higher than the rates we were talking about 6 months ago

I tried to replicate it today and it gave me 3.05%

But second hand, or one of the few that still in stock, otherwise expect an early delivery by summer 2023 ![]()

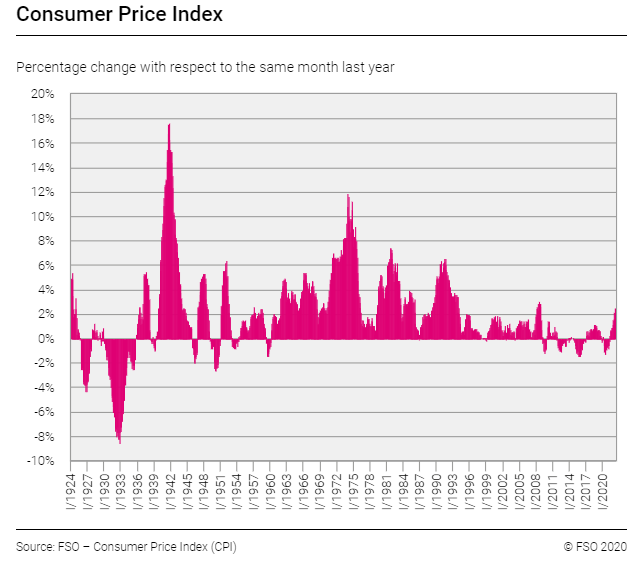

Here is the link to Swiss Federal inflation data in case anyone is interested

Interesting to see that before the 1990s property crash inflation peak was “only” about 6.1% . In other countries like UK it was higher, if I recall

So here we go. Saron up soon….

10 year at over 3 % in some banks.

Clarification question:

A mortgage tracking SARON would not change interest rate until Saron goes above 0 (positive), correct?

Correct. But there are still some fluctuations.

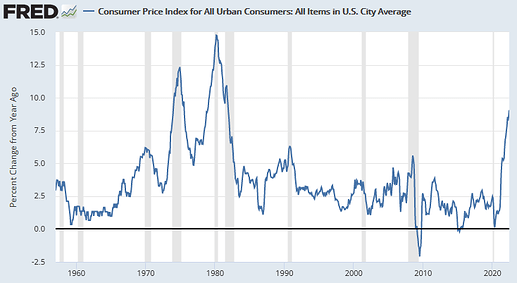

The funny thing is that the US stock market hasn’t reacted negatively to it this time. I’m eager to see what will happen after the next FOMC meeting.

It would react negatively if it expected an enormous rate hike, but apparently it doesn’t expect that…