Our 2nd pillar / Pensionskasse is not inflation-adjusted, as opposed to AHV. Isn’t this kind of a bad deal? Of course, Switzerland hasn’t experienced much inflation recently. But if you look back further in history, we’ve had up to 12% inflation in the 70ies.

Why focus on inflation? When inflation is high interests rates are also high, over time the real returns should be similar.

Both the (minimum) interest rate and the (minimum) conversion rate for compulsory pension fund benefits are dictated by law. In times of high inflation, that can be a bad deal.

If you have a lot of non-compulsory pension fund benefits (e.g. your employer pays extra), then the pension fund may raise the interest rate and conversion rate, and that may help to compensate. Pension funds are allowed (but not obligated) to adjust their rates upwards to compensate for inflation. However, that would only be the case if a pension fund is reaping above-average returns and has the financial reserves to compensate for the higher interest or conversion rate. Some pension funds already pay higher-than-required interest. But even those hardly match current inflation rates.

I have received my new pension fund certificate for next year… and I’m not happy at all.

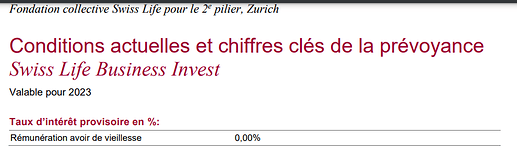

My pension fund (managed by Swisslife) will apply 0% of interest for 2023.

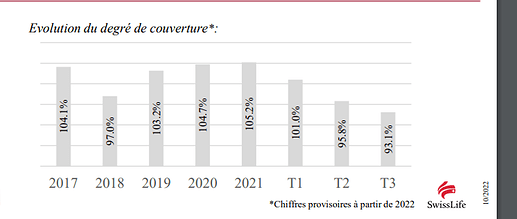

Maybe, they will review the amount at the end of the year, but I don’t think so as the coverage rate is 93%.

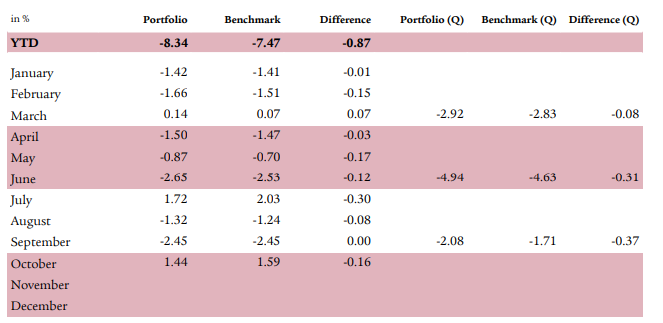

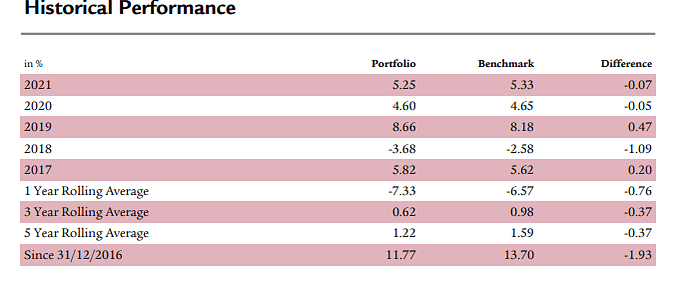

How much did the fund lose this year?

All pension funds are required to pay at least 1% of interest in 2023.

Berufliche Vorsorge: Der Mindestzinssatz bleibt bei 1% (admin.ch)

Only on the mandatory part. If the pension fund has a lot of non-mandatory funds, they do a theoretical calculation and can apply 0% to all the funds.

I will ask how they have done the calculation

Isn’t that per individual insured person? (your mandatory part gets 1%, the rest gets 0%, unless they have a good year).

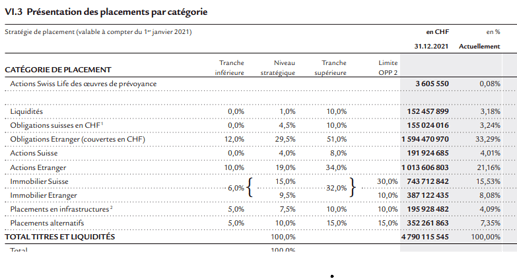

That fund is really heavy on bonds (>60% if you count mortgages), I wonder how they can sustain things long term (and they were hit really hard by the interest rates hikes).

Nope, if the pension fund is " Umhüllende", it’s based on a “Schattenrechnung”, which is the typical profile of an insured person in the fund.

https://www.previs.ch/fr/-/schattenrechnung

For info

Asset classes

Got it, then happy to be with a much saner fund that applies the mandatory interest to the mandatory part ![]()

For the bond part, I was looking at those for Swiss Life: Download – Swiss Life but mayb ethat’s a different one.

I find the low coverage rate worrisome.

What is the ratio of contributors vs retirees of your fund ?

It is really a shame that we cannot select this 2nd pillar fund independently of our employer.