Hi there,

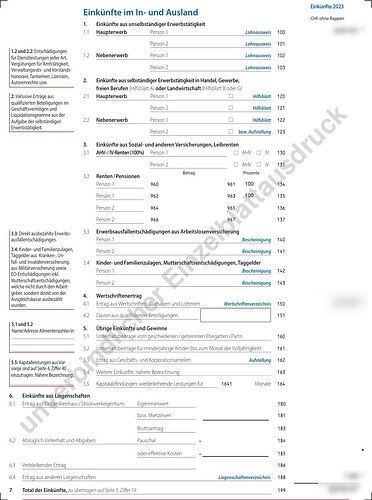

I have completed recently “Steuererklärung” on ZHservices – Online (Zurich) with tax separation feature for isolating income from renting abroad (Liegenschaften) and noticed that the income for renting out from abroad (‘Entrag aus anderen Liegenschaften’ Seite, Ziffer 6.4) has been added to ‘Total der Einkunfte’ (Seite 2, Ziffer 7).

Shouldn’t web app (ZHservices – Online) list it somewhere else in the tax form for purpose of increasing the base for tax rate, instead adding to taxable income (which it isn’t, thanks to double tax treaty)?

Unless, it is just how this software works (not optimal, and forcing questions) and a taxman will do arcana magic with his analytical spells and everything will fall into the correct cosmic order?