Every factor, every country, every sector will once shine bright in the sun. There is no point in chasing past winners. Reversion to mean will eventually occur.

I strongly disagree. Winners keep on winning. Loosers keep on losing. If you can separate one from the other, you get outperformance.

Yeah that’s why there are so many successfull actively managed funds that outperform index funds.

I don’t know about you, but I’m having lots of fun in this bull market. I only wish I wasn’t so conservative (majority of funds in passive ETFs).

Maybe it’s just me but I want a strategy that will work for 50+ years (accumulating phase + retirement). So I’m doing what John Bogle said.

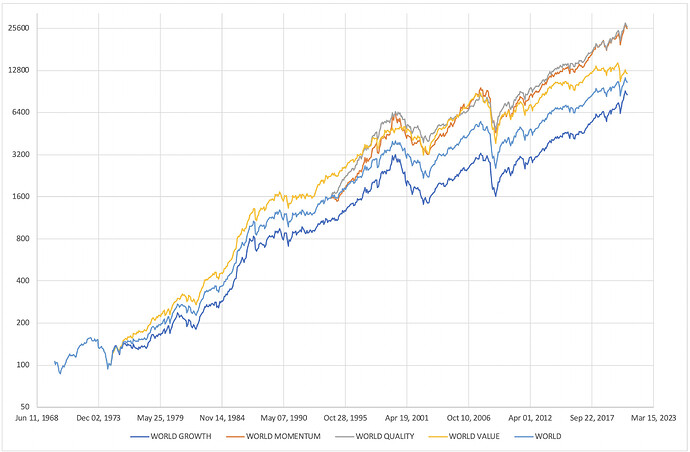

We can see that this seems to hold true for Value vs Growth. Value has been superior for at least 50 years, but recently the gap is very small (see chart).

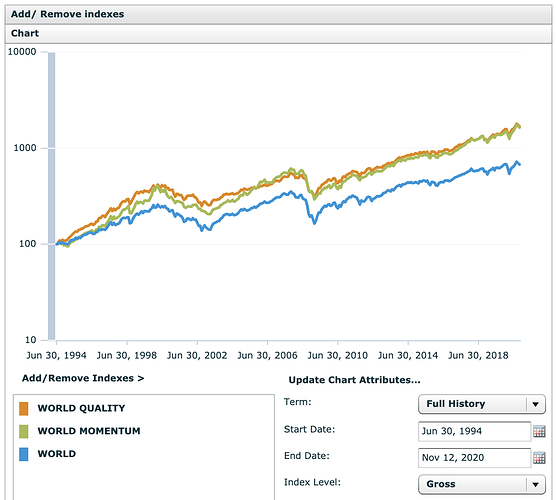

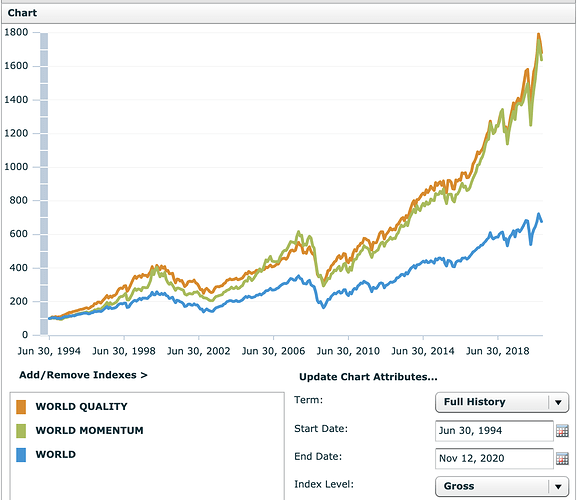

If the same will happen to Quality & Momentum, time will tell. Right now we only have 25 years of data. (MSCI has price data since 1975, but no point to compare without dividend). But I have to say the advantage is impressive. And it’s funny how Q & M go almost neck and neck.

Try 10 year rolling returns. It’s 100 times more usefull when comparing returns. Start/end date scew things a lot.

Mhm… I seem to be quite late to the party here, but…

I happened to settle on the MSCI quality index about 3 and a half months ago as main investments ![]()

Though I might not have shared it on the forum back then ![]()

But… see the bottom of this post for the caveat.

Beware, it does not.

This is quality factor ETF. It’s a trap that I almost also fell into myself, cause you do have to read the fine print. I’ve even seen an ETF having switched from the Quality index to the Sector Neutral Quality index. I think it was an iShares one, might be this very one (though I’m too lazy to check).

Again, this also does not track the MSCI Quality, but is a sector neutral factor index ETF.

The funny thing is though: Retail ETFs actually tracking that very index seem impossible to find.

You can look it up on JustETF, ETFdb or Yahoo. I haven’t been able to find one.

(I haven’t yet looked into the specifics of the institutional investor ETFs offered by Finpension).

Thanks for your comment, which ETF did you choose to implement your strategy?

Post above slightly edited to refer to the “Sector Neutral” Indices tracked by the ETFs mentioned.

With European ETFs:

IE00BX7RRJ27 UBS ETF (IE) Factor MSCI USA Quality

LU1681041890 AMUNDI MSCI EUROPE QUALITY FACTOR

The Amundi ETF, though named “factor” ETF similarly to the iShares and Xtrackers above does track the (non-“sector neutral”) MSCI Europe Quality index, whereas IWQU and XDEQ track the “sector neutral” variants of the indices.

What does sector neutral mean? See MSCI World Sector Neutral Quality Index. Or simply: they keep the sector (IT, Health Care, Financials etc…) weighting the same as in “plain” MSCI world.

Personally I see no point whatsoever in doing so and staying “sector neutral” to the MSCI World. Especially since I’ll be diverging from MSCI World’s weighting of stocks anyway. I’m not convinced either that every sectory is just a “good” as any other. If there’s more “Quality” stocks in one sector (for example the overweighted IT and health), why shouldn’t I overweight that sector myself and invest more in it?

I think if you look at log scale charts, and judge the distance between two curves, that’s the same as rolling returns. But here you go. I don’t see here anything 100x more useful.

Does this have a negative bearing on the performance? If not, would this really disqualify the ETF? Why did you decide Quality factor would be the best, anyway? How about the QUAL ETF? It’s only USA, but does it also have this sector neutral nonsense? (edit: I checked, it does)

By the way, guys, can you explain this to me. It’s from Investopedia’s article on factor investing:

Empirical research suggests that stocks with low volatility earn greater risk-adjusted returns than highly volatile assets

So… how can it be that stocks with lower volatility get higher returns? Why would low volatility be a risk factor, we usually associate high volatility with risk. I see this as some sort of casino effect? Investors opt for volatile stock in hope of realising short time returns? Doesn’t seem to make sense to me, any better ideas?

Sorry, I did expand a bit on that by editing my previous post. But to answer: Yes, the sector neutral indices seem to lack behind considerably for most (mid- to longer term) timeframes that you might compare historically.

Honestly, I probably couldn’t explain is as well as Julianek in the opening post. And Terry Smith of Fundsmith. I very much believe you can’t always be right. But even more than picking successful outperformers, you might be able to at least weed out some of the crap in all-market indices.

And then, of course, there’s been a rather long historical overperformance of the Quality index.

As for the sector neutrality, while Cortana’s outright rejection of anything that’s not overall-market seems somewhat fatalist to me ![]() it’s still somewhat comprehensible to me Why you should stick to given sector weightings of MSCI World is totally beyond me. From an investor’s perspective, that is (it might have some academic merit in analysing factor premiums).

it’s still somewhat comprehensible to me Why you should stick to given sector weightings of MSCI World is totally beyond me. From an investor’s perspective, that is (it might have some academic merit in analysing factor premiums).

By the way, the CS Quality ETFs available through Finpension do make no mention of sector neutrality. That they’re having IT overweighted at 36% at the moment, indicates they do indeed follow the “true” quality index. ![]()

Funds with a 30+ years lifespan are actually a minority and it would be interesting to study the investment philosophy of those that last this long. The few that come to mind (Sequoia, Berkshire, Markel, Baupost Group, Chuck Akre) all understand the importance of compounding at a high rate over the long term. Regarding DCF, all I am saying is that i have never seen an actual DCF analysis in any article/analyst presentation that made sense. Add to that that all the analyst research services focus on valuation guidances based on evaluation of next quarter EPS and I have a little opinion of most institutions (especially the sell side research, which will manage to justify any price by tweaking just enough its DCF models…)

Maybe it is simpler to grasp if you invert the problem:

If you wanted to make sure that your investments do NOT grow at a satisfying rate over the next 30 years, how would you go about it? I bet you would make sure to invest in companies that do not go anywhere and provide very little returns to reinvest. After all, if the business does not compound, why should your investment do? (OK, you could say that you would reinvest the dividends. But if it is a bad business, receiving dividends is uncertain, and in any case the dividend yield would be too low to be satisfying).

So if you know that the road to long-term failure is to invest in bad businesses that do not compound at a satisfying and sustainable return on capital, why would you want to include them in your portfolio in the first place? You want to make sure they never land in your portfolio. What remains is quality stocks.

(Note that the focus here is on the long-term. Some people make money on the short term investing in bad business because of market re-ratings, but they need to constantly recycle their ideas and this would not be suitable for an index approach.)

Regarding FIRE, I did not find any related resource, as this topic is still maturing in my head. But I bet it would have an impact on many aspects, especially the Withdrawal Rates.

I do not hold any mature opinion about momentum as I did not spend enough time to think about it. However at a first level:

- There might indeed be some overlap between the two approach, because a compounding business with a stable high return on reinvested capital will surely have a strong upward momentum during its lifetime.

- Amazon is a particular animal: it posted losses for a very long time because Bezos has chosen to treat all its growth investments in R&D and in software as expenses, i.e losses. Nothing appears as an asset on the balance sheet. However as soon as Amazon stops its R&D expenses you realize that the company is printing money. Whereas other companies treat investments as capex (which appears on the balance sheet as assets), Amazon just treats them as expenses (and thus pure loss on the PnL statement). It tricked many people for a long time. But it is not the same with TSLA. Even if you add back R&D, Tesla’s earnings still have the profile of a car company (i.e grossly inadequate returns on employed capital). All of the valuation resides in the expectation of an army of robotaxi without competition in the very near future.

Thanks for noticing this, I was as well having difficulties finding an ETF tracking exactly this index. And indeed having a sector neutrality makes no sense to me. There are sectors that are simply more profitable than others, and you would not want having more oil frackers just because they are under-represented…

Well, then… is there any sensible Quality ETF? Keep in mind that even the iShares one has only $2 billion AUM. I wonder why they all do this sector neutral adjustment.

By the way, every one of the MSCI Factor indexes has 70+% USA market share. Should this tell us that the US companies will dominate the World even stronger in the future?

Just to note, that based on what I have read this fund does not use (can’t ?) the double treaty agreement for reclaiming US withholding taxes on dividends

It’s interesting to these that depending on the implementation of the factor “quality” can underperform:

| INDEX HISTORY (%) | YTD | 1YR | 3YR | 5YR | 10YR | SINCE INCEPTION |

|---|---|---|---|---|---|---|

| S&P 500 Quality Index | 3.03 | 10.22 | 10.53 | 10.65 | N/A | N/A |

| S&P 500 Index | 2.77 | 9.71 | 10.42 | 11.71 | 13.01 | 8.83 |

| https://www.invesco.com/us/financial-products/etfs/product-detail?audienceType=Investor&ticker=SPHQ |

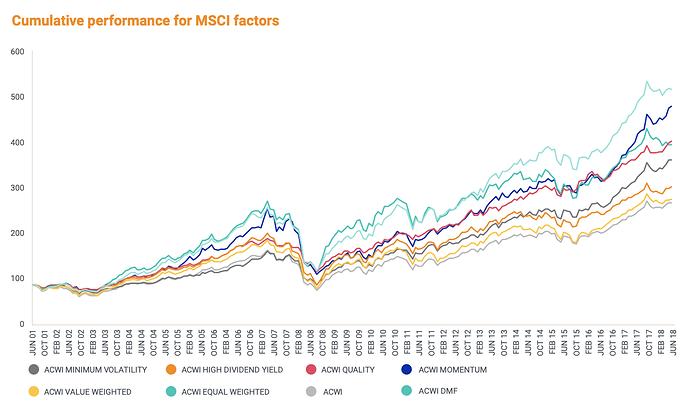

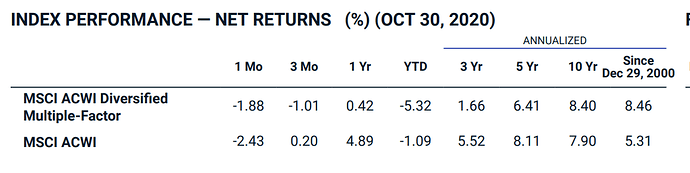

Here’s an interesting chart. Seems like each of the factor indexes outperforms the vanilla ACWI. ACWI DMF is the diversified multiple factor blend (Value, Momentum, Quality and Low Size), and it is also the one with the highest return in the last 20 years. What do you think?

And here is one ETF that tracks it: ACWF

https://www.ishares.com/us/products/272821/ishares-msci-global-multi-factor-etf

I’m quite skeptic about backtestings. A indice provider like MSCI will not create smart factor indices which underperform the vanilla indice. Their goal is to licence indices to asset manager.

I am investing in MSCI US Quality and MSCI Europe Quality on a 50%/50% basis (knowing that Europe has trailed the US for quite a bit).