Since April 2024, if you have a cash account (not margin account), IBKR will, if possible, automatically perform any necessary currency conversion to fulfill your order. For example, VWRA trades in USD on the London Stock Exchange. If you 1) have a cash account, 2) do not have (enough) USD for the purchase and 3) have enough of (an)other currency(ies) to cover the trade and commission, IBKR will proceed to automatically perform (a) currency exchange(s) for you.

Note that this only works with cash accounts and you cannot opt out of it. The only way to prevent an automatic conversion is to perform a manual conversion so that you have a sufficient amount of the correct currency for your trade(s) AND make sure the instrument(s) you trade settle(s) at the same time as the manual conversion (more on this below).

Autoconversions are never performed in margin accounts. If you have a margin account and you purchase a USD-denominated instrument without having sufficient USD in your account to cover the trade and commissions, you will end up with a negative USD balance and you will pay margin interest on this loan until you bring the balance back to positive.

Note that IBKR charges in theory 0.03% of the amount for an automatic conversion in the form of a wider spread compared to a manual conversion, whereas for a manual conversion, IBKR charges a fixed $2 commission up to $100,000 equivalent converted amount, or 0.002% beyond $100,000. So, in theory, an automatic conversion is cheaper for a currency exchange below $6,666 and manual conversion is cheaper for a currency exchange above $6,666.

However, from practical experience, it seems IBKR charges closer to 0.0327% for an automatic conversion (instead of the 0.03% stated in their schedule of fees). This lowers the manual / automatic breakeven amount to $6,122 instead of $6,667.

I have absolutely no idea how IBKR decides which currency to convert first if you hold several different currencies. I suspect it may be “First in, first out”, so that the currency you have been holding the longest will be sold first, but I am not sure. In TWS, you can view your non-base currency holdings as currency pair positions, and assign a “liquidate last” tag to the currencies you prefer to keep.

ATTENTION: if you opt for a manual conversion, be aware that most currency conversions settle at T+2, meaning at the end of the second business day that follows the trade. Example: you convert on the Monday, you conversion trade will settle on Wednesday by the end of the day. Therefore, you can safely purchase instruments that also settle at T+2, such as UCITS ETFs like VWRA, IGLA etc immediately after a manual conversion. But if you immediately purchase an instrument that settles earlier, such as a US stock (T+1), the system will slap you with a double automatic conversion for the amount of the trade, back to your original currency and back again to the trade currency. This will cost you about 0.065% in spread, on top of the $2 you paid for your manual conversion. Therefore, wait one day after your manual conversion to trade instruments that settle at T+1. And wait two days to trade instruments that settle at T+0, such as mutual funds or Paxos cryptocurrencies. If you have such a settlement mismatch in a margin account, no autoconversion will be performed, but you will borrow the amount of the trade on margin for the duration of the settlement mismatch and pay margin interest for this loan.

NOTE: commissions for trades also settle at T+0 and are generally due in the currency of the trade. One exception is the commission for manual currency exchanges, which is always charged in base currency. Therefore, If you do not have enough of the correct currency in your cash account to cover the commissions of your trades (including the commission for the manual conversion trade), IBKR will proceed to perform an automatic currency exchange towards your base currency to cover the commissions, possibly a double automatic conversion similar to the one described in the previous paragraph if you have not left any non-base currency behind when performing your manual conversion. Therefore, if you have a zero or low settled based currency balance before your manual conversion, it is best practice not to convert your entire deposit: leave enough behind to cover the commissions of your trades. This way, only a single autoconversion will be performed to cover the commissions, instead of an undesirable double autoconversion.

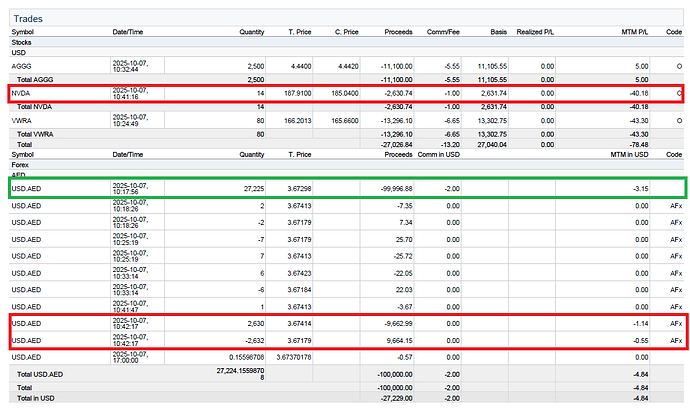

See attached screenshot of an undesirable double automatic currency conversion (red), due to the trader manually converting AED to USD (green) and immediately trading the Nvidia US stock which settles at T+1 (red). You can also see that no such double conversion occurs for the UCITS ETFs trades (VWRA and AGGG) which settle at T+2. And finally, since this trader had a zero base currency balance prior to performing the manual conversion of the entire AED amount she deposited, further multiple double conversions occur to cover the trade commissions. These double conversions would have been single conversions if the trader had left a small amount of AED behind to cover the trade commissions.

Also observe on the screenshot the wider spreads of the autoconversions compared to the manual conversion.

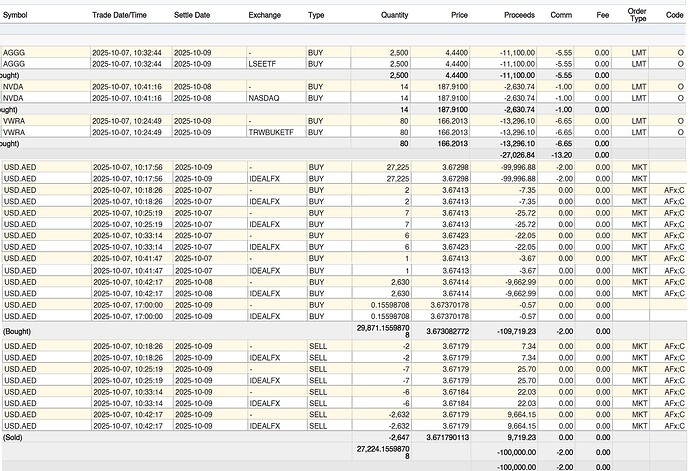

See the settlement dates for each trade below

References:

Section 30.C. Interactive Brokers LLC Client Agreement: https://gdcdyn.interactivebrokers.com/Universal/servlet/Registration_v2.formSampleView?formdb=3203&lang=en

See one before last bullet point of the footnotes concerning the 0.03% fee for auto-conversion: https://www.interactivebrokers.com/en/pricing/commissions-spot-currencies.php