— This post is primarily addressing beginners and is referring to the equity/stocks part of a portfolio. Please consider your total net worth (incl. pillar 2/3) and the overall asset allocation (stocks, bonds, cash etc.) based on your risk profile (time horizon, mentality). —

BANK/BROKER

You prefer a different or additional bank/broker? That’s fine, there’s a number of good ones. But do take a look at the argumentation below and compare it to your own choice.

-

Very low fees: close to zero for ETF/stock transactions, close to zero for currency exchange, no custody fee, no Swiss stamp duty

-

High-quality, long-established broker

ETF/FUND

Vanguard Total World Stock (VT)

You prefer different or additional ETFs/funds? That’s fine, there’s plenty of good ones. But do take a look at the argumentation below and compare it to your own choice.

-

TER: 0.07%

= very low annual fee -

Fund size / AUM: ~$30B

= very big fund (which is good for lower spreads/costs) -

Domicile: USA

= favorable ratio of reclaimable withholding taxes, as majority of [cap-weighted] global stocks are U.S.-based -

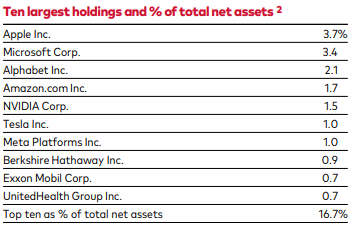

Diversification: ~9700 companies/stocks

More on what’s in it:

~67% large-cap companies

~18% mid-to-mid/large-cap companies

~15% small-to-small/mid-cap companies

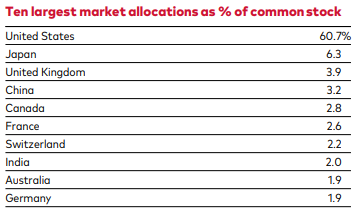

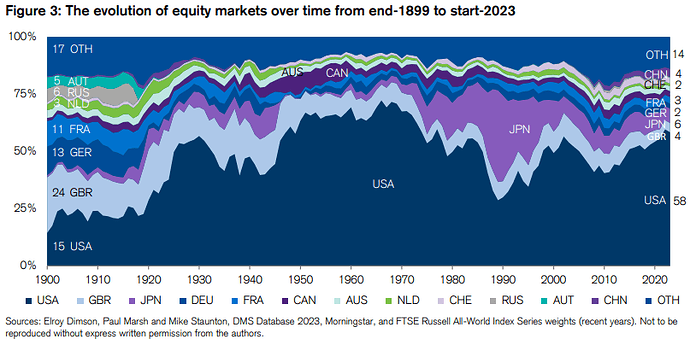

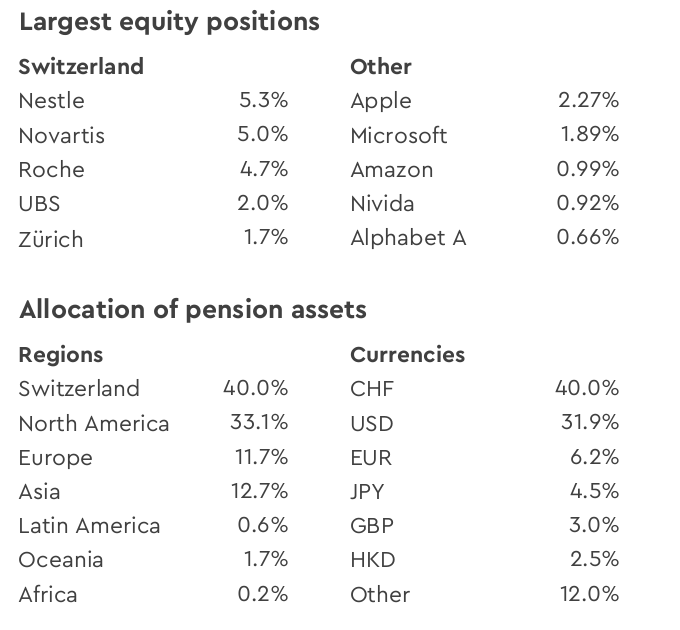

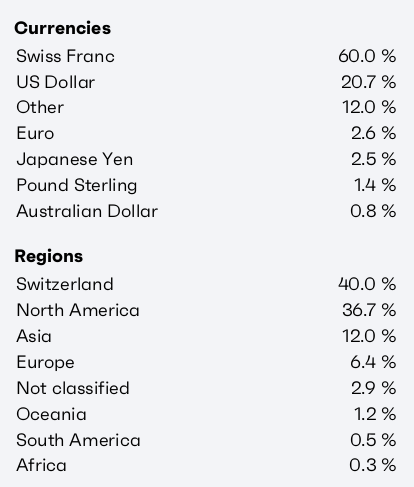

Countries/Markets:

Why it’s important to have a broad diversification if you’re not a seasoned investor:

Also: The Case for Global Investing

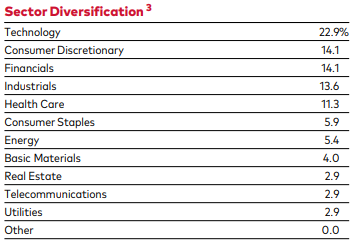

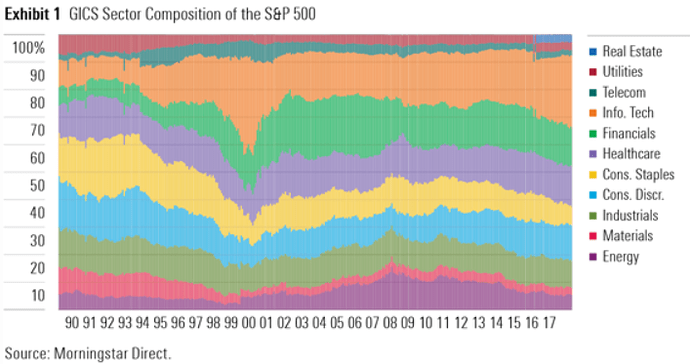

Sectors:

Why it’s important to have a broad diversification if you’re not a seasoned investor:

Companies/Stocks:

There’s not a very high exposure to a single company or the top ten companies.

PILLAR 3A

See posts below