Hello Everyone,

I have a question regarding the tax declaration of a life insurance policy. I would like to avoid/fix a past mistake and hence asking for the help/clarity via this separate thread (as a first timer).

Background: In 2015 I bought a life insurance policy in my home country (non-EU) and paid 5 premiums until 2019 (say total premium 15k CHF). The insurance policy is of type Unit Linked Insurance Plans (ULIPs) with a premium duration of 5 years and maturity duration of 10 years.

I paid these premiums in my home country using money that I earn in Switzerland (2015 to 2019). I have not received dividends or interest so far. I am supposed to get lumpsum in 2025. Let’s say the insurance fund value today is 20.5k CHF.

Since 2020 I started paying taxes in Switzerland but I didn’t realize/forgot to declare this policy during the tax declaration of the last 2 years. I have the following questions:

-

If I am not mistaken, a ULIP life insurance policy is similar to pillar 3b in Switzerland and it’s subject to wealth tax. Right?

-

In my home country, the financial year is from 1st April 2022 to 31st March 2023. This means I have a policy statement & fund values for 31st March 2023. Is it Ok to submit such a statement and use the value from March 2023? Or, should I precisely calculate the fund value on 31st December 2022 by checking historical rates? (I have same problem for bank accounts from my home country!)

-

As this insurance policy was not declared in the last tax declaration and premiums were paid from my foreign bank accounts (during 2015-2019), do you think I should write a short note mentioning I forgot to declare this last year and also provide some proofs showing money used for premiums was from my Swiss income?

-

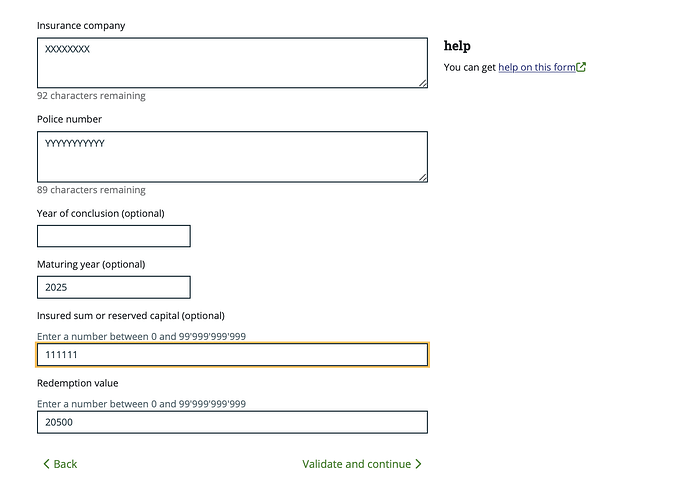

A minor thing: In Vaud tax website, in life insurance declaration there are two fields: Année de conclusion / Year of Conclusion (facultatif) and Année d’échéance / Maturing year (facultatif). What’s the difference between these two dates? In my case, I only know the “maturity date” of my policy:

-

I guess even if tax office will apply wealth tax retroactively, I guess impact won’t be huge considering the amount is just ~20k CHF.

Probably simple/naive questions but thought better to ask them here in advance!