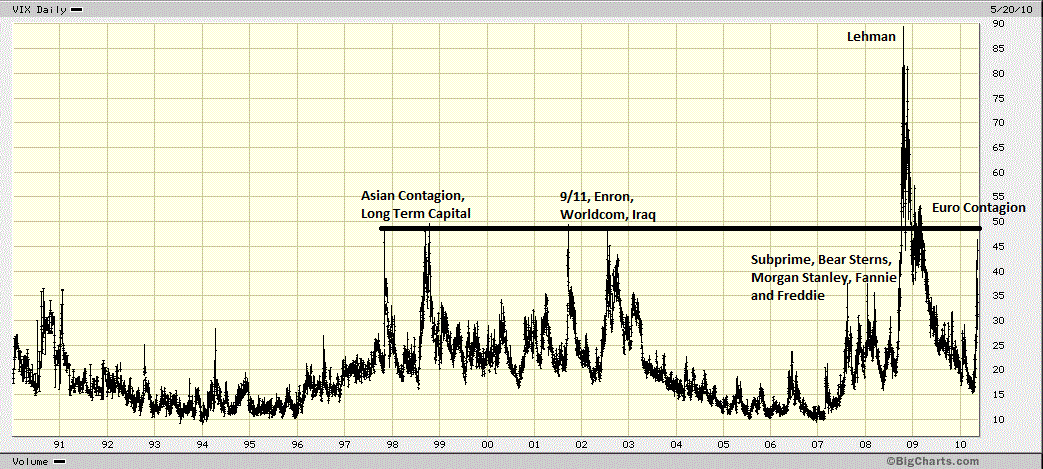

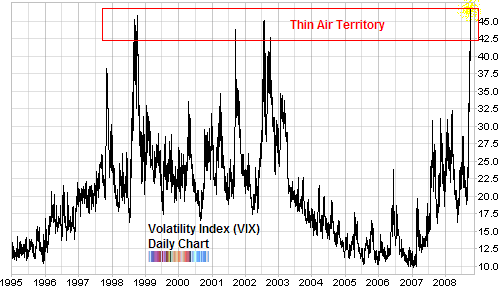

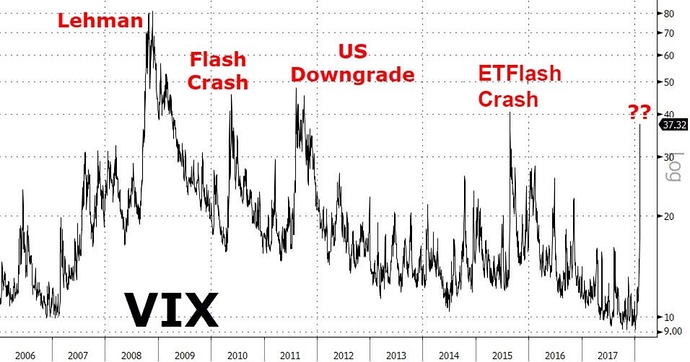

Earlier this week I attempted to purchase a decent chunk of XIV when the VIX hit 40. XIV is (was!) the inverse volatility tracker that lets you earn money as volatility declines. You could buy it anytime the VIX exceeded 25 and keep holding it until markets normalize again - then sell. In the past 5 years there were plenty of windows of opportunity on this, some of which I could take advantage of.

However, I soon learnt the XIV unwinding procedure was most likely the cause for the whole sell-off (1.9bn market value of XIV and more than 225bn worth of stock behind). Now taking time to study more what other WMD (weapons of mass destructions) could be out there. Apparently the volatility tracking product space has assets north of 2 trillion behind it. If the SEC where to forbid and restrict the size of these products, many other product service providers would have to unload their holdings in a short period of time. So far the only other inverse volatility tracker I could find is the EXIV (issued by UBS), but given the high regulatory shutdown risk, I’m staying out of it for now.

Writing options would be something worth considering now. Vols haven’t been that juicy in a long time! But I stay on hold for now.

Here some related articles for interested readers:

Some made huge profits:

While others lost big time (but hey, who the Fxxx keeps “hodling” on to inverse vol trackers with VIX below 10 anyways…):

So they pulled the plugs:

This has to be cleaned-up now: 2 Trillion!!!

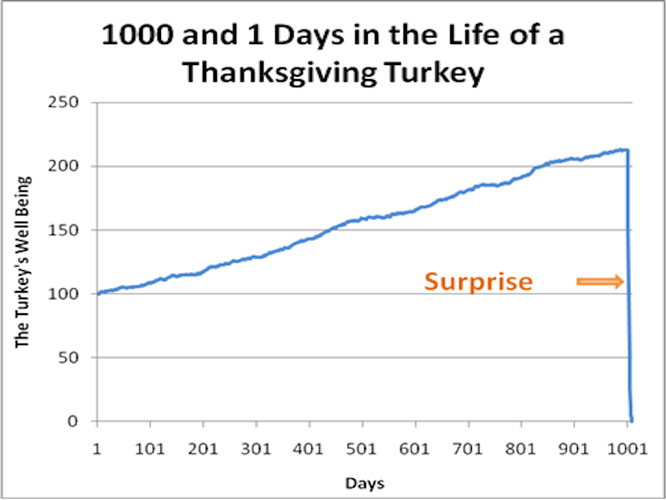

The whole thing reminded me of this scene, you kind of wonder what else is out there:

Anyone else out there following these developments? Any add-ons or deviating views? Would love to see how others in the Mustachian Forum observed these developments. What’s your take on what has happened?

For me the “sell-off”/ plunge/ or stock market correction is only over once it got a name! So far it hasn’t got a name. Would somebody please name it already ;o)

Cheers,

Matt