Yesterday I watched a youtube video sth like how billionaire families avoid paying taxes while getting richer.

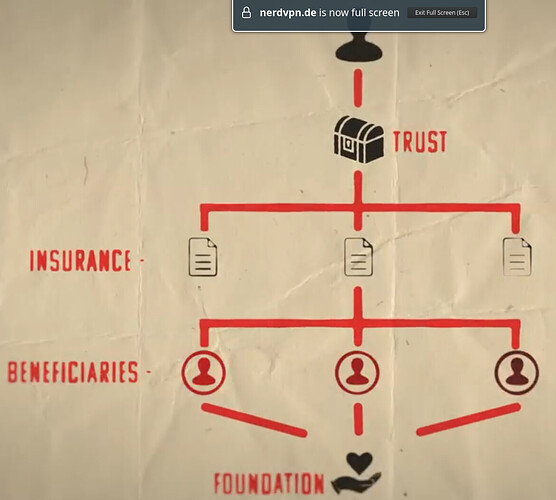

It was like the whole family has one “trust fund” and then every beneficiary (relative of the family) has his own life insurance.

The funds of the whole family are invested thru the Trust compounding over the years.

When they need money they can get it from there life insurance, and as it is borrowed money they don’t have to pay taxes for it.

So they live from their funds, their funds are compounding and this structure allow them to avoid taxes.

https://invidious.nerdvpn.de/watch?v=1vZsxpqbngo

Unluckily we are not gonna have billionaire problems, but if our net worth grow a lot maybe we can build a structure that helps us to avoid taxes legally.

Can we create a kind of entity just for managing our money in Switzerland? So we get decoupled from our money and then we could become a tax residence in a high taxable EU country as a person with no assets while we avoid paying taxes on our capital gain investments and avoid paying income/dividend taxes from the money we get from our entity in Switzerland cos it is a loan.

1 Like

Why do you want to be that anti-social and not pay taxes? Society needs taxes and your life is at risk if no-one paid them.

3 Likes

I said:

but if our net worth grow a lot maybe we can build a structure that helps us to avoid taxes legally.

Do you pay voluntary taxes on your capital gains in CH? prob not because you do not have to. You would be more “social” if you would pay voluntary extra taxes.

Anyway your comment is more about morals than tax liabilities.

I was asking if we can build a legal structure where we have our investment compounding with no capital gain taxes, and our person get borrow money from it.

Afaik trust don’t work in Switzerland the way they do in the US, so no advantages there.

You could create your company, but then the company itself is taxed (plus having to deal with it with accountants etc).

Edit: and company ownership is still declared/taxed in country of residence obviously

What works in Switzerland are Insurance Wrappers. Transfer your assets into a unit linked life insurance. This gives you tax free dividends; yet you still pay wealth tax. At the same time, the Insurance Company will wan their share of the pie and it doesnt make sense. 3% of dividend yield at 50% tax rate gives you a tax drag of 1.5%; life-insurances probably apply an expense rare of at least 0.8%, so half of the tax evasion benefit goes to them and you carry all risk.

When you talk about inter-generational wealth - remember that one of the bigges risks, once you have enough funds to use a professional asset manager at low cost… one of your biggest residual risks is the guillautine. Wherher its physical copping off heads like at the French Times or just financial ones. The only way to mitigate this risk is by paying a fair share of taxes, doing good to society and making sure you have the reputation and standing that people don‘t apply the physical guiotine. Maybee run an art collection (as an invest) that you open to public like some families do or try the former russion method of sponsoring asports club. Re the financial guillautine, the best way is to avoid financial constructs that were set up for one specific reason only - as a populist government could somewhen propose to tax these setups at 99.9% one-off Wealth Tax.

Conclusion: pay your share of taxes, be a good and productive member of society and don‘t use financial constructs that middle class folks don‘t use.

1 Like

No, because Switzerland collects its tax revenues through different channels. You won‘t pay capital gains tax either… why do you worry about cap gains tax? Just pay the tax you are expected to pay and play a fair amoun thereof. If you move to a country that (partially) relies on capital gains tax => pay them.

Btw… The fact that you mention „avoid tax“ amd „legally“ in one sentence sais everything… there is nothing like legal avoidance under the Swiss tax laws, there is only avoidance that gets caught faster and other one where you get away with it until it goes wrong. This is not the US/Ukwith its legal/tax system.

Ordinary Investment account and lombard credit… and if you want to be fancy use the lofe insurance wrapper as collateral for the lomard loan. But truly - that won‘t make financial sense anymorey. It only serves the purpose of redirecting your tax cost from the state to an insurance company. Plus you are back in the financial guillautine section…