Does anyone have a tip for a book or a website that explains in detail how to calculate all these costs for the investments correctly? Like how does it work with spread, taxes of all sorts and so on. I am never sure that I’m doing it right because you have to know in what sequence these operations should be. Software here is misleading because you don’t see how it’s calculating.

Since it depends on many different variables, which keep changing, sites like this one are by far the best resource. Of course https://www.bogleheads.org/ is also a very useful resource, but rather focused on the US. The Swiss tax system is different.

supposing you go for a buy & hold approach, there is not such an infinite amount of thinks to know.

- bank/ broker: custody fees, commissions => simple to calculate (lookup). in CH down to 0% p.a. & 10s of CHF per trade

- stamp tax in case you trade in switzerland => simple to caluclate

- spreads, in case you do it yourself: trade during exchange opening hours, and you can’t do much wrong. maybe the limit order/ market order thing. for liquid etfs, spreads are tiny. => tricky to determine in advance

- currency conversion costs, down to 0.5% in switzerland => tricky to calculate, as it’s not fully transparent

- taxes: pretty much covered here and here => potential lots of effort to calculate, but doable

if you know these things and are aware of them, then you costs will be small.

however to finally calculat alle costs exactly, you will have to invest huge amounts of time, think of getting all the taxs tables etc.

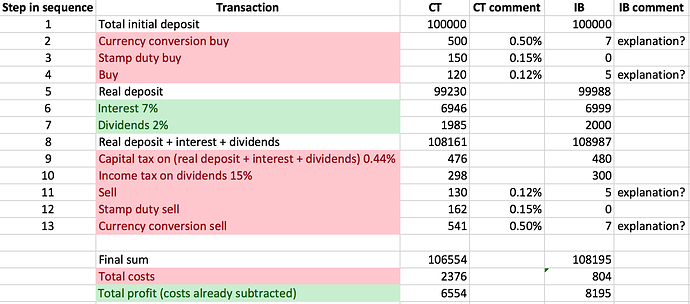

I made a little calculation to compare yearly costs of a 100k deposit in CT and IB. What I am really not sure about is if the sequence of the steps in the following table is correct and which amounts are taken as reference when calculating taxes and other costs. Like do they first tax you and then calculate the transaction cost of CT? The sequence of subtractions makes a difference. In my calculation I took the worst case where they all want as much as possible from you, so the reference amounts for buy and sell are always step 1 and step 8 correspondingly. Does it make any sense? Can anyone comment what’s wrong in the calculation and how to do it right?

Assumptions:

- one year deposit

- 7% price rise and 2% dividends

- 15% income tax

Conversion at IB:

You pay a 0.002% fee, or at least 2 USD. Plus you have to factor in the spread. The spread can be sth like 0.00006. Half of the spread to buy, half to sell. So you pay 2+3 for buy and 2+3 for sell.

Just search of IB fees, it’s written there. And has also been covered on this forum.

what is capital tax? you mean wealth tax? I’m not sure if it belongs in this comparison. it depends on personal situation. you would also pay it on the 100’000 if you didn’t invest at all.

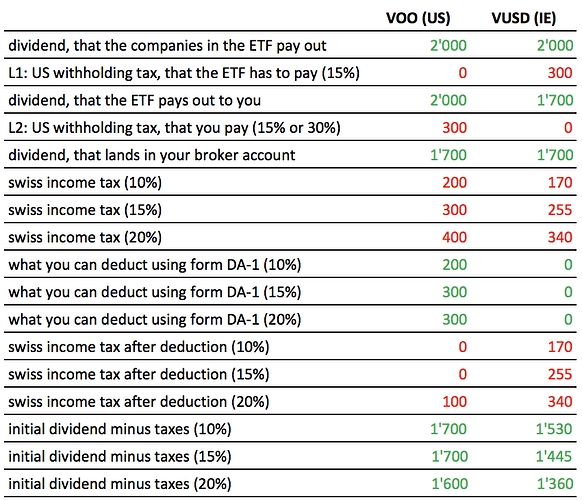

income tax on dividends is NOT 15%. it depends on personal situation. It can be 10% or it can be 20%. With an Irish ETF at CT you will receive a lower dividend, because your ETF will pay the withholding tax in the respective countries (e.g. 15% in USA). So if you had VUSA, you would get 1700. Then you need to pay your income tax on that 1700. And how do you calculate it? Let’s say your taxable income in the whole year was 100’000, including the dividends, and you paid 20’000 taxes. that’s 20%. So 20% on 1700 = 340.

Now with IB and US ETF it’s a bit different. If you hold SPY or VTI, the 15% withholding tax is deducted by the broker, not by the ETF, and thus, visible to you. So you receive 2000, but 300 goes away, so you also get 1700. So when you make your tax declaration in Switzerland, you can say: hey, I already paid 15% on that 2000. And the tax office says: ok, you should pay us 20%, you paid 15% in USA, then just pay us the missing 5% = 100. If your income tax rate is exactly 15%, you pay nothing. If it is 10%, you also pay nothing (but you didn’t reclaim the full 15% from USA, which sucks).

Where I’m not clear is if the Swiss tax office taxes you on the whole 2000 that the US ETF pays to you or just the 1700 that you got after US wtax.

Here I made a comparison between US and IE ETF, with 3 different income tax rates. I hope it’s accurate. Maybe our expert @hedgehog can verify ![]() .

.

Normally, with “pauschale Steueranrechnung” process, you’re taxed on the full amount of divivend, i.e. 2000 in yorur example, pay the full amount of swiss taxes on it, but they compensate you 15% US withholding taxes by a direct wire to your bank account. I suppose they could also tell you they’ll deduct them in the final tax bill instead of wiring.

If you earn too little, you won’t get full 15% back. They have tables with maximum reimbursement limits for different incomes. The goal is to prevent the tax office from handing out more money than they receive from you…

Yes, I included it in my table. Notice how with 10% and 15% tax rate you get the same 1’700 dividend in the end.