Once a year for the tax declaration.

I do a snapshot of different asset every quarter.

I review my check accounts monthly to compute the saving rates.

Not sure I believe you. Not even sure I believe dead people telling me they’re not checking their portfolios from the other side ![]()

Blockquote

you addicts ![]()

![]()

I check it usually when I transferred my latest savings and need to buy/reblance the ETFs in my portfolio. Which comes down to monthly, with a few exceptions.

I tried using the auto-rebalance feature for IB, but not with great success thus far.

@rumblebelly @FunnyDjo

Have you guys been able to check the PF that infrequently since the start of your investment careers?

Or did anything made you “immune” to wanting to see how it’s performing? If so, what exactly? ![]()

I think it is a gradual chante as the first year i was checking monthly.

I over the years, I accumulated different brokers as well so it makes it more complicated to check them all.

I tend not to pick stock as it will generate more stress and follow up

Luk_nuts,

I totally hear ya about NOT checking when markets are down. I don’t see it - it’s not there. Right? ![]() But that’s how I lost a whole bunch of cash, when markets were going down down DOWN, and once my portfolio was 1/3 of it’s size (and I was in margin) I panic-sold a lot, realized a HUGE loss, and of course, everything went up from then

But that’s how I lost a whole bunch of cash, when markets were going down down DOWN, and once my portfolio was 1/3 of it’s size (and I was in margin) I panic-sold a lot, realized a HUGE loss, and of course, everything went up from then ![]() Lesson, check once in a while and make small decisions. Don’t make panic moves.

Lesson, check once in a while and make small decisions. Don’t make panic moves.

I’m still on my spreadsheets (personal as well as investment) daily, but cutting from 5-6 hrs per day to 3-4. Friends advised to do fewer transactions and less buy/sell, trying to time the market and make an quick buck. I now mostly spend time on automating and formulas and massaging my portfolio into 70/30 dividends/growth split.

My next milestone 1 hr/day max, just to keep a pulse. Next milestone would be 1 hr/wk. I really should do more LIFE things rather than sit at the comp.

I wouldn’t change anything about my portfolio, so why bother checking. ![]()

Since I started this thread, I haven’t had the urge to check anything, so I guess it helped. ![]()

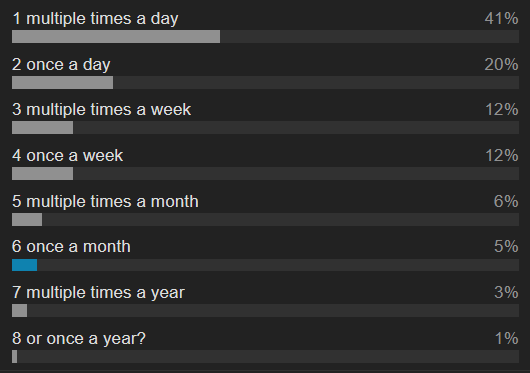

These factors influence how often I check my portfolio:

Mindset

Why check in the first place? What are the benefit and disadvantages? How could the information turned into action? Buy more after it already increased and buy less after a fall (a.k.a. buy high, sell low)? Or buy less after it increased and buy more after a fall? Would I have the stomach to execute that? How big do the changes have to be in which period? And what if it continued to fall more?

I find this chart from Ben Carlson enlightening. (From this blog post). The longer the holding period, the higher the probability of positive stock returns.

Stage in financial independence journey

Being early in my wealth accumulation, I care about my portfolio value in a decade, not now. A higher portfolio value and a closer FIRE date would certainly change the risk tolerance and the asset allocation.

Luckily, I am mostly satisfied with my work and personal life and currently not in a rush to reach financial independence.

System

I have an Investment policy statement (IPS) specifying my asset allocation and the triggers for changing it. I specified a long term holding approach and that short term fluctuation do not warrant a change. Even if I was pursuing a trend following strategy, I’d only check the signal outside my portfolio.

There is only one globally diversified ETF I invest in, and thus I don’t need to rebalance. Not owning any highly volatile assets (derivatives, individual stocks and so on) helps.

Having a password manager limits my broker log ins to my personal computer.

My smartphone has no broker apps.

One broker is for monthly investments and another to hold most of the funds.

I’d separate expense and wealth tracking, but I track neither (not recommended).

I try to pull only actionable news.

Character

Being lazy but patient, I strive to be efficient. I’d rather relax or acquire skills than check my portfolio.

Personal circumstances

Having a kid also limits my time and energy. Furthermore, I am getting older and less energetic, which incentivizes me even more to focus.