I am not sure if this is a question I can do here or not, feel free to ignore… how much does children cost ? I mean more or less.

There is probably a big difference between 1-3yo and 4-10 and so on… but I was just curious since someone told me that a kid from 0 to 18 costs half a milllion chf and I believe it seems a bit too high. 27000chf per year?

I’m not sure if this is the right forum for information about buying children. In general, Mustachians prefer a DIY approach.

Depending on the production situation it might be cheaper to take a trip to thailand/vietnam or something and get/make one there XD.

(@ma0 Sorry for the trolling but it was just too tempting)

ahahaha ![]()

![]()

![]()

![]()

yes it’s an unbeloved but still fundamental question. I’s ethically very tricky… I’d expect it would take serious effort to make calculations. Also imagine that most of the time, parents reduce their work load in order to take care on the children. some call it opportunity cost.

from age ~18 to 23 i did cost my parents quite precisely €10’000 per year. this was almost my complete expenses during my studies in ZH. still they recieved Kindergeld & tax reductions for me… or i would expect, no idea how to precisely calculate this.

I have no experience with raising children, but 27’000 CHF doesn’t seem too high for Switzerland. The kid needs a room, so you need a bigger flat. A room can easily cost 800 CHF / month to rent. That’s how much more you can expect to pay for a bigger flat. Then 40 / day for food, clothes, toys and everything else and you already have the cost of 2000 per month.

If one parent doesn’t work and takes care of the kids and does the cooking, then the cost can be minimal. But it’s not a fair comparison. A parent who does not work means a lot of potential money lost. It’s different when you have reached early retirement and have a lot of time on your hands. I would personally only consider having a kid if I didn’t work anymore.

40 chf a day is high. I’m sure we can do better…

Well what i noticed is people buying larger cars, homes, etc

You have health insurance but you receive around 200 chf per month in state aids.

You pay less taxes.

Difficult calculation. IMO it moves from 5-10k to 30k depending on frugality

If both parents are working, then you need a kindergarten or nursery or a nanny. This can cost a few thousand per month. I know a stay at home nanny, she lives in the house with the family, has her own room, has food covered and receives 1000 CHF that she could theoretically save. If you count the room, food and salary, that’s at least 2000 per month.

Now, if you’re not working, the cost is even higher, because it’s all that you would have earned, have you had worked.

What helps is having more kids, then the cost-per-kid goes down.

I have a 3 months old baby and my spending went significantly down because I travel less. Before I was driving every weekend somewhere and spend more on dining out. Now we mostly spend our weekends on close trips in the area or just walking on the countryside. This pushed my spendings 10-20% down.

Otherwise, in the beginning there are some additionals costs - diapers (best price in Lidl/Aldi or even better - in Germany), clothes (bought some on Tutti/Ricardo and got others from my extended family), pram (bought on Tutti for 200 CHF), bed (100 CHF on Tutti). Otherwise, the costs are manageable - especially that you have less opportunities to spend on other stuff (dining out, travelling, etc).

It really boils down to the effort you put into cost optimization. In theory, you could spend all your money on baby stuff, but in practice, it really depends on your will to save and skill in optimization (e.g. browsing Tutti/Ricardo every day  ).

).

You have health insurance but you receive around 200 chf per month in state aids.

You pay less taxes.

That’s right. I pay 100 CHF for insurance, but I get 300 CHF from Canton Zug in family allowance. Not sure though if there’re are some other tax exemptions.

But your case is different because your wife does not work. And this is the alternative cost.

But your case is different because your wife does not work. And this is the alternative cost.

Yes, it is. She didn’t work before as well (she needs to legalize her medical diploma first and it takes a year in Switzerland), so financially it didn’t make any difference for us. But most likely next year she will start working and this means that we will have to pay ~2000-3000 CHF per month for childcare. So this is a significant cost.

I think it’s interesting anyway, since the original question is about costs not savings.

I suppose the first month of a newborn is very expensive (1000chf?) then it slowly go down…and pick up every once in a while when you need to remake the wardrobe

12000chf per year (1000chf per month) was my first rough opinion before I heard someone tell me the 27k figure.

I don’t count housing costs or lost opportunities.

So it’s basically:

- furniture

- insurances

- food

- apparel

- medicines/diaphers

- hobbies

- +1s

- what else?

+1s is a generic category for all the things you used to do and now cost more because of the additional person: flight fares, restaurants, etc. Maybe I"m not that good in categorizing…

I suppose the first month of a newborn is very expensive (1000chf?) then it slowly go down…and pick up every once in a while when you need to remake the wardrobe

If you have an extended family with children, most likely you can get from them the clothes for free or you can just buy used ones for fracture of the cost. I think I’ve spent in total ~1000-1500 CHF during last three months for baby stuff.

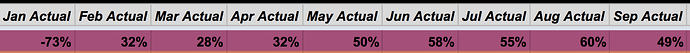

Check out my savings ratios:

My son was born on June 28th and clearly you can’t figure out that from these statistics.

Saw this and could not resist myself

Yup, it boils down to priorities and preferences - whether one wants more meaning in his life or more stuff.

furniture

insurances

food

apparel

medicines/diaphers

hobbies

+1s

what else?

childcare is by far our biggest child related expense.

childcare is by far our biggest child related expense.

Sorry I forgot to mention that. You either pick 2000+CHF expenses in childcare or 3000-9000CHF less in wages…

Is not only about wages. If your spouse works, it contributes to 2nd pillar and avs/ai. If it doesn’t work additionally you need to pay the avs.

Moreover, let’s say your spouse wants to work after 6 years (kid is in school), she/he will start probably from a smaller salary then if they had worked 6 additional years (promotion, yearly increase, etc). So there are a lot of factors to consider. For me if the significant other can make 4k + per month it almost always makes sense financially to pay daycare

This might get philosophical… better to teach him/her yourself or leave it to daycare? Difficult.

My question was more generic though. Just imagine that you are already FIRE, so it doesn’t matter all this. The thing I wanted to know were about the expenses.

There is this link for US but i’m lazy  https://www.cnpp.usda.gov/sites/default/files/crc2015.pdf (14000usd/year)

https://www.cnpp.usda.gov/sites/default/files/crc2015.pdf (14000usd/year)

tldr’ it’s wrong:

http://www.foxnews.com/us/2017/01/10/cost-raising-child-is-more-than-233k-in-us.html