ZH Kanton, regular taxation, filed return for 2023 in the end of March 2024. DA-1 refund received at the end of June (3 months). Final bill in hand this week (6 months)

Oh they’re quick to tax alright (at the source). This is about getting some of it back ![]()

Hi dear Mustachians!

We filled our first tax return for 2023 this year, we did it with a tax advisor via paper (not electronically).

The only problem was, we had to do it later because the tax office “forgot” to send us the codes need for the registration (they admitted this).

My question is - how long does it usually take until we get the tax return (mainly 3a, transport a lot of courses as doctors), considering we did it in prolonged timeline (I think it was in May)?

We phoned the office, they could not provide much info, they said it can take up to 1-2 years! The tax advisor said that it is usually done till October.

What is your experience?

Thank you!

If you’re taxed at source 2-3y probably. If not it’s around 4-5 months for me.

yes, forgot to mention - I am taxed at source (Quellensteuer)

My 2021 came back only a couple of months ago. They did it together with my 2022. Canton ZH

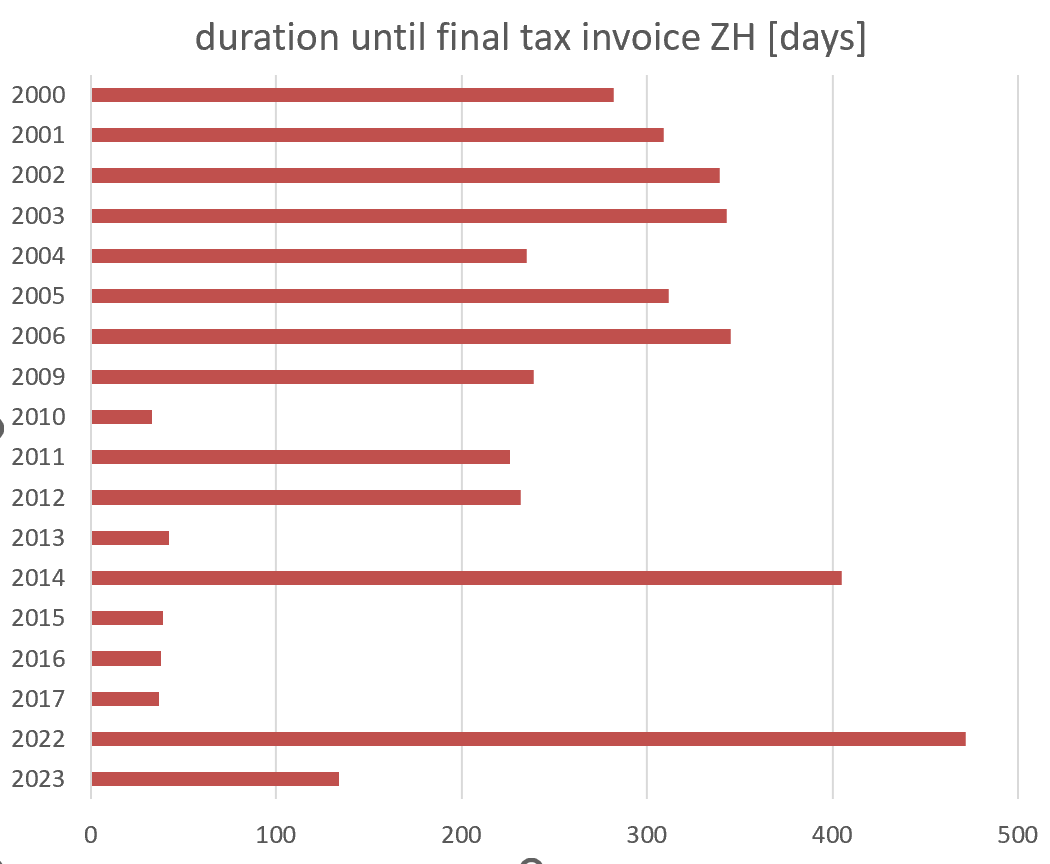

Here is my summary:

On average, I’ve had to wait 226 days for the final invoice from the tax authorities in Zurich. I assumed that I submitted my tax return always on March 31.

I come bearing good and weird news.

Today I got home and I have the letters from the Steueramt and my gemeinde regarding my tax returns. I got around ~2k return for both 2022 and 2023 so definitely a good early Christmas gift. (I contributed fully to Pillar 3a so that already does a big chunk.

However, when I opened this post it was regarding my tax return for 2021 which I still haven’t received ![]() . At the end of that year I was living in Zurich city and now I’m in a different gemeinde so maybe that bit is delayed. Still a bit weird though.

. At the end of that year I was living in Zurich city and now I’m in a different gemeinde so maybe that bit is delayed. Still a bit weird though.

A pleasant surprise was that the returns for 2022 and 2023 were in the same envelope. In fact there wasn’t much different from my place so it would have been much more efficient to do it like that.

And last but not least I got 27CHF and 19CHF in interest respectively ![]()

![]()

This weekend if I have time I will go over the submission I did and check if the numbers match. I only had a quick look but I didn’t see any sort of justification or clarification.

TLDR;

I (ZH) received my final bills for both 2021 and 2023 in June 2024.

For the 2021 bill that means significantly longer than the stated 18 months.

I did call a few times in the mean time to make sure it did not get lost on my end.

FYI I recently followed up about my 2021-2023 taxes / pending Nachträgliche ordentliche Veranlagung.

According to the very quick (same day) and friendly response from the canton ZH agent who first replied to me last June, they are still waiting for August 2021 Quellensteuer to be processed ![]()

I don’t understand why this happens in a country that is otherwise efficient.

In Portugal my tax declaration was processed in under a month (this included receiving the tax refund in my account).

Is it a lack of people? Does this improve when you get C Permit?

My understanding is that they already have your money, so they’re not particularly hurried. Generally anything foreigner related seems deprioritised, probably for political reasons.

I believe the first transition from at-source to regular filing is the one that often take years. Regular filing takes a few months here in VD.

They are understaffed, they where looking for wertschriftenprüfer in Zurich for years lately…

My 2021 declaration has still not been processed… ![]()

![]()

![]()

Did anyone receive the tax return papers (FY 2024) yet for Zurich city?

I see some posts about people filing their taxes but I was wondering if it’s city is lagging behind

Hey there,

I have a B permit and I am taxed at source.

I recently filled the following online request (Nachträgliche ordentliche Veranlagung beantragen | Kanton Zürich) in order to declare what I put in my 3rd pillar + medical expenses.

The step 4 of the link says that it takes time for the tax office to send the document with the access code to my place, but I have 2 questions please:

-

does someone have a vague idea of how much time it takes to receive the doc with the access code after making the demand?

-

When I filled and created the demand, it was quite straightforward, and after maybe like 2 hours a PDF file was available, resuming my request, but at the top of the PDF, there is a barcode and an address (I guess the tax office address). In the link to do the request, it is written that filling the online form is enough, but this document with the address and barcode makes me doubt. So my question is: Do I need to send them the document by the post? Or everything is fine and I just have to chill? I am asking because to get a criminal record extract in Switzerland, you have to fill something online then send it via post.

Thanks if you can help!

Just chill. They use barcodes on online documents because they sometimes like to print it out, work on it and scan it again. Crazy, but true.

If you mean the letter with the codes I got them earlier this week yes. ZH canton but not city for reference

Friday, I received letter from the first gemainde I was living in canton ZH. They returned me all what I paid them for 2021. When I moved I didn’t have time to calculate this so when they sent me a bill I paid it, however the truth was that I’ve already overpaid tax for the whole year in the previous canton, as tax at source.

So now it’s a bit weird. I don’t have yet the final tax assessment for that year, but the municipality is already returning the money they held (with interest). Well, where’s the money from tax at source? I guess the previous canton finally sorted out the papers so ZH received confirmation that I have overpaid the tax. Will the previous canton refund it soon to me directly?

Just wanted to ask if anyone already received final assessment of 2024 tax return in Zurich city?

last year I received by this time the decision. But not this year. I think it’s due to some ETFs I have which didn’t have earnings in ictax until mid July

I did a few weeks ago (later than usual). One of the ETF was publishing in June (a new holding for me), which probably explains the delay.