I’m mostly dealing with people in the public sector, few of which have real responsabilities. I probably don’t spend nearly enough time with my friends. xD

I heard that “it’s for the taxes”. Obviously a monthly salary can only be enough to cover income tax if you earn little.

Yeah, in IT / banking they talk about annual salary. I found it annoying that my gf deals with 13 salaries. Either way, how do you explain this: in Salarium I put 13 salaries, the median is 8’800. With 12 it drops to 8’200. Wtf, nonsense.

The explanation I’d deem less likely is that people with a 13th salary are generaly employed in companies who pay them more. I don’t believe it, but that would be an option.

Another explanation would be that Salarium applies the 12-13 salary modification on its data themselves, rather than on the query, making it very hard to trust their data because:

-

there could be problems when it is gathered, as people registering 12/13 salary may be confused and enter normalized or not normalized numbers indiferently, making the data an eldritch mix of the two.

-

it may apply the normalization twice, both when registering the data, then again when answering to a query, making the displayed results the eldritch beast themselves.

Both wouldn’t make sense and I wouldn’t take Salarium data as anything else than a very gross estimate (the categories themselves are very broad and can be interpreted in various ways - I don’t know how to accurately classify myself, for example -).

I haven’t read Salarium’s methodology (I know I should have), so I’m willing to be proven wrong if there is some kind of logical reason why the results are displayed this way that doesn’t rely on sloppy design or execution.

Wrong choice probably if you’re on a B permit and subject to withholding tax.

I‘ve „restated“ my monthly salary for my own budget planning to account for my 13th salary.

There’s not much difference though to just earmarking it for the tax bill indeed.

My first full time job was for a company which provided remuneration reports. We always tried to normalize all data. I.e. convert the monthly salary, bonuses, benefits, LTIs into a total annual compensation. Salarium should do the same if they want people to be able to compare. They also don’t ask for the number of holidays, where it can range from 20 to 30 or more, so it matters a lot (+/- 5%).

If Salarium worked correctly, I would expect the number of salaries not to influence the monthly average. Also, what is the point of adding the 13th salary, bonus and benefits into the monthly salary? You don’t know what to do with that number anyway. It only makes sense to compare this number with other settings in that db, but not with your own actual salary. So they should either put the base monthly salary or the annual total, IMO.

There are no pension fund deduction on 13th salary. At least in my case. So 13 is actually better than 12.

Yeah, this is either false or illegal. I get 12 salaries and a bonus end of year. The bonus has all social contributions deducted.

If that’s anything like mine, the premiums/contributions are counted on the yearly salary, 13th included, then split in 12 installments. Less hassle for the pension fund, more for the employer if the employee leaves during the year and the pension contributions don’t match the salary paid, I guess.

Social contributions are deducted, but not pension fund ones.

That is very possible, thank you for pointing this out. Well, then I am sorry.

At the top of social contributions (applicable in all cases), 2nd pillar contributions could apply to bonus paid.

It depends of your employer and its pension fund rules.

I wouldn’t say it works incorrectly, it’s just statistics.

But they should give the option to average over both. 13 installments: Yes/No/Both.

I think that’s what most users of the tool are presumably interested in.

Hi guys

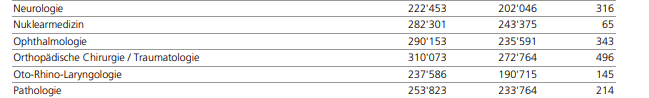

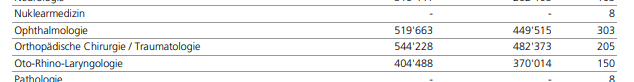

I recently looked at doctors salaries, crazy what they can earn.

Have a look here:

Non self employed Eye doctors have a median of around 235k, so 100k is very low. Since there are only around 600 Opthalmologists in Switzerland, she should have a very strong negotiation position.

I know someone who also just got their “Facharzt”, and earns much more than 100k right from the start.

All the other statistics seem to be misleading if you look at the official salaries from the BAG (which are based on AHV contributions, so correct).

In general, I think the public is not aware of the crazy salaries that doctors can have. The “doctors” lobby in Switzerland does a good job here.

What do you think about the BAG numbers?

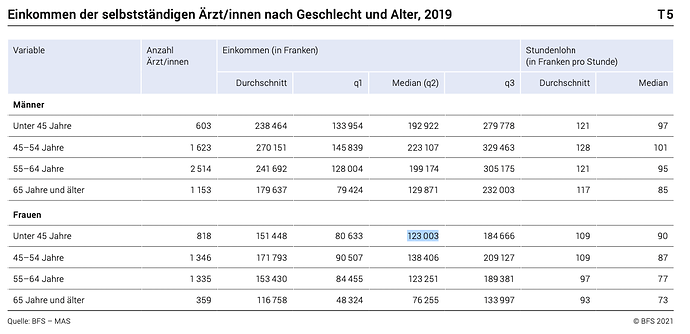

The BFS (Federal Staistical Office) did a similar study published last year (MAS data from 2019), translated in D/F/I : Einkommen der selbstständigen Ärztinnen und Ärzte in Arztpraxen im Jahr 2019 - Statistik der Arztpraxen und ambulanten Zentren (MAS) | Publikation | Bundesamt für Statistik (admin.ch).

T13 on page 25 is particularly interesting, it shows the effect on salary of many variables, when all others stays the same (regression model). For example, being a man, all other effects excluded, translates in a increase in salary of 25%. This is quite surprising, as they all bill according to the same tarif model (TARMED)… Being able to give out medicaments direct at the praxis translates in an 18% salary increase.

What people don’t know is how easy it is for physicians to “optimize” their revenue. However, the insurances can sometimes identify those who earn significantly more than their peers and oblige them to give it back, which is often then put in front of a court… I have read a tribunal decision where a doctor, according to his billing practice, would have worked about 23h some days, on a 24h scale… Ridiculous.

You are absolutely right when you say that the doctors lobby do a great job. Every week we see doctors on media complaining about how difficult it is to do their job in Switzerland. Not that I think a doctor should earn nothing, their knowledge and work must be rewarded ! But we should be more strict for what is payed by the KVG.

I think this refers primarily to medical professionals working in hospitals (@NicoFireDoc ?). And I think there it is really difficult, I see some people around me doing this. Opening own practice is another level, Lean FIRE for docs, so to say.

Thanks, these are some interesting statistics, and 235k is a great salary. The problem is, her title is not doctor she has a diploma from a Höhere Fachschule (HF). It takes 3 years and gets you specialized in a niche. But of course then over the next 15 years, what you’ve learned on the job practically diminishes most differences in education. Still, I guess it’s a strong bargaining chip…

Look what the association itself recommends:

https://www.orthoptics.ch/fachperson/lohnempfehlungen

So the upper bound for her age and location would be CHF 7’710, which puts her current salary way above this limit, but still extremely below what a median opthalmologist can earn. I think the difference is in the fact that an opthalmologist can open his own praxis and pocket the patient bills directly, whereas a HF is not allowed to be selbständig.

Nice one, thanks for the link.

So we can see that for the “demographic characteristics” of my gf, the median is not much above her current salary:

It somehow matters a lot if you’re a man and how old you are. A 50yo man would get a median of 223k, a 40yo woman only 123k. I wonder if this is due to career gaps caused by pregnancy, the on-average lower willingness of women to push extra hours and focus on career, or pure sexism.

I wasn’t referring to doctors in general, more to those actives in the Gesellschaften, i e. Eggimann in Vaud (SVM), we often see him on the media trying to blame insurers and their costs/reserves, also when only 3% of total KVG costs are administrative costs and the rest are related to health services. It would be better to act on thes 97%. The same argument applies to the creation of a unique public insurer : you won’t spare much money doing so.

That is only the administrative costs bourne on the insurers side. You have to add the costs linked to having more insurers bourne by the health professionals and/or institutions. For a housedoctor I have in mind that 20% of his time is spent with administrative tasks, so there is a lot of potential gain if this could be done more efficiently.

The unproductive time is already priced into tarif models (TARMED for example), so that a doctor also receives money for the x% that aren’t related to a specific client. Example in physiotherapy, the model integrates a productivity rate of about 80%. The 20% unproductive time are then priced into the bills to clients.

Plus in the case of doctors, costs of a secretary is also partially included. And they often calls the ärztkasse to bill clients which saves them time.

Of course it is billed and paid by the health insurance, but that was not my point.

What I was saying is that this cost is, as far as I know, not included in the 3% admin cost you were citing, but is part of the 97%.