Whatever happens, the big winners are the brokers, with those huge swings!

No, the hedge funds. Trading is dirt cheap

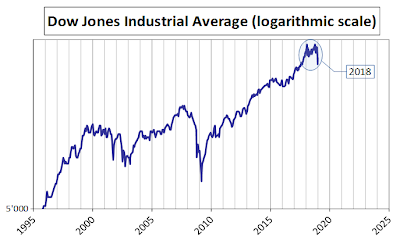

Final picture of the volatile 2018, from the DJIA perspective.

Have we reached a “permanently high plateau”, or as Mr Trump nicely says, are the markets “taking a little pause” ?

In general, Mr. Trump is never wrong. Lol

Want more ?

John Maynard Keynes in 1927:

We will not have any more crashes in our time.

For anyone interested, here’s a recent article that talks about the signals of an global economic slowdown:

https://www.republik.ch/2019/01/21/der-winter-kommt

(in German)

I didn’t see much of it this last Friday.

Interesting points nevertheless.

Perhaps we should open another topic: “How are you guys handling the recent ups?”

I am still in red :(.

How are you guys handling the recent ups ?

aaaaand … down again ![]()

I think people will have to get used to volatile markets for the foreseeable future

Hodl ! . . .  . . . .

. . . .

Have they not always been such? ![]()

Just a good training to refrain from checking in daily/weekly, and keep on keeping on buying (and holding). ![]()

I just think the last few years have been too calm on a historical basis

I’m terribly sour about not following my own advice regarding Christmas shopping…

I am terribly sour not buying IBM yesterday

It’s no coincidence, the Fed was at work with its monetary opioids.

Spot the “short volatility position” in Jay Powell’s own words here.