I’ve been trying to find historical P/E information on the total stock market (e.g. VT, FTSE global all-cap, MSCI ACWI), such as a chart, but couldn’t find any. Anybody know something?

Take a look at Yardeni, they often publish P/E across sectors, countries, time periods and etc.

I use it for a quick snapshot, I usually don’t extract data to manipulate analysis, others can point out sources for this.

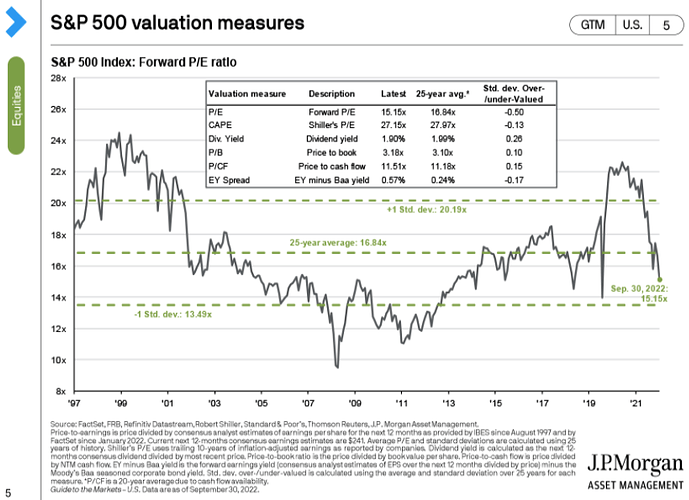

Not sure what you were looking for but to share some insights with the folks here.

S&P P/E ratios have come down quite a bit, however less for large cap and much more for small cap.

P/E are nowhere as low as the 70s, quite scary.

Don’t look at P/E in isolation, also look at PEG ratio (P/E vs earning growth - above 1.0 overvalued, opposite undervalued). Looks like there is room to go down.

Last few charts page 10, something i didn’t see in a graph but reasonate with what I heard. Value stocks were overvalued despite being cheaper, now aligned to growth stocks. Value is not in the title (definition) but rather in the intrinsic asset as buffet would say.

Enjoy the reading

Thank you, that’s actually quite helpful! I’ll have a look at PEG aswell, that’s interesting.

I’m thinking of holding a little more dry powder in the future when P/E ratios are historically high. That way, I might be able to invest a little more when some random flash crash comes around.

I know this is basically market-timing, and I also know that historically, low P/E ratios have not necessarily led to more prospective return. In the long run, it doesn’t matter much at which P/E-ratios you invest, it’s time in the market that matters more than timing the market.

Still, I’m thinking of holding a little more cash on the sidelines for when P/E ratios are, say, >25. After all, some really serious bears seem to have occurred after high P/E-ratios. It just doesn’t feel right to invest into excessive P/E ratios ![]()

What are your opinions?

If you go that way, you should probably be looking at CAPE (or Shiller PE), not “pure” P/E ratios over time.

I think it might make sense to do this if you receive a super large bonus or any other windfall.

When you do it, sit on the side 6 months to think how to invest this. Then if you think PE are elevated, you can wait to deploy cash, else do it.

For normal contributions, I would just invest regularly. I keep some dry power but not enough to move the needle, just more as additional cushion

Some other piece of info. Check out The JP Morgan “Guide to the Markets” is an interesting periodic,

https://am.jpmorgan.com/us/en/asset-man … e-markets/

It doesn’t necessarily present forward PE as a timing factor, but it does suggest there is a (low) but stronger correlation between forward PE and subsequent 5 year returns than to the subsequent 1 year return.