Sounds like a good idea to me, to be on the safest side.

A post was merged into an existing topic: Using margin loan at Interactive Brokers

Hello!

I had a question for a while regarding Margin on IBKR and It is time to ask because I can’t find the answer anywhere.

So… Current margin rates in USD are 5.83%, and 1% in CHF. Let’s say I want to use margin on CHF, how that works? When I buy VT for instance on margin, I get a margin loan in USD at 5.83%. How can I do to get the margin loan on CHF instead (that I FX to USD and then invest in whathever I want)?

Is margin on CHF only possible when withdrawing cash to a CHF bank account?

Do the base currency I use in IBKR have any role on this?

Thanks for your help ![]()

You may also say that it makes not difference and that interest rates in CHF and USD are equivalent, considering the interest rates parity and the devaluation of the USD against the CHF…

The cash report shows you how much of each currency you have. What you mean by “loan” is a negative cash balance in a given currency.

If you have 0 CHF and -10,000 USD then you pay interest on USD.

You can then buy 10,000 USD (and sell CHF).

You will end up with sth like -9,000 CHF and 0 USD.

No, but it might make things easier. You can “close” any FX position and it will be converted into your base currency. Both positive and negative! If your base currency is CHF, you select your negative balance in USD and press “Close”. This will lead to an automatic buying of the corresponding amount of USD and a negative CHF balance.

Works with their app.

You can sell the currency pair CHF.USD

Hmmm I am still confused… I have USD as base currency,

- When trying to close the position it says that I have no currency other than base currency. Which makes sense…

- If I try to do just a currency conversion it says that it is not possible having a negative balance.

How is possible to buy CHF (or wathever currency) on margin?

I am changing my base currency to CHF to try to close the negative USD position to CHF to see if that works.

Do you agree it makes more sense to have 1% CHF rather than a 5.8% USD interest?

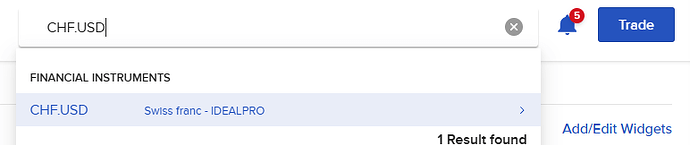

Search for CHF.USD in the search bar and sell.

The amount you sell is in CHF so if you want to exchange USD to CHF you first have to convert that USD amount to CHF in a calculator and then go to the CHF.USD currency pair and sell that calculated CHF. This will turn your USD margin into CHF margin.

As long as your income is in CHF, yes, it’s better. If it’s not in CHF, then you’re taking a currency risk (the currency of the income depreciates against the currency of the loan, thereby making the loan more expensive).

Prff that makes totally sense… I should have figure it out myself, thanks! ![]()

I come back to this just to have a better insight… Long term is USD that devaluates against CHF so it may play in my favor as well right? In any case 5.8% USD seems quite high as compared to 1% CHF anyway…

Did you already change your account to a margin account? You should only get this error if you don’t have a margin account.

Yes yes, it’ve been a long time I use margin but it’ve always been in USD. I just sold CHF.USD to get the -CHF cash as expected.

I can now see the “close position” buttom (to convert CHF back to USD) so it means that this is only available to exchange towards your base currency but not the other way around, which makes sense too…

I always invest in ETFs, I didn’t took the time to see how to “trade” forex in IBKR. Well, thank you all for your help! ![]()

That was the only way to do currency conversion few years ago so we were forced to learn it ![]()

It still is when you have negative balances. The standard convert facility doesn’t allow me to make one balance more negative.