Dear All,

I am creating a new post as I thought it would be easy for people to look/search for this topic later.

I am filing taxes for the first time and I would to ask if I am filing correctly the data about GA travelcard costs which is part of our annual compensation package. Here are the details:

GA travel card subscription (CHF 5670) is provided by my employer and they have informed us with the following note:

According to art. 7 let. f RAVS and art. 9.2 RAVS, when an employer supports the private travel of its employees: Home - Work , the amount is an integrated part of the salary used to calculate social security contributions.

So, social contributions and taxes will be calculated on the Gross salary + 472.50 CHF* (the monthly cost of your GA: Cost of the GA – 10 % / 12).

- Our annual salary certificate has the following information:

i.e.

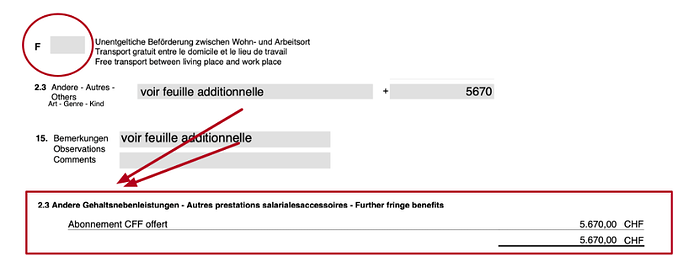

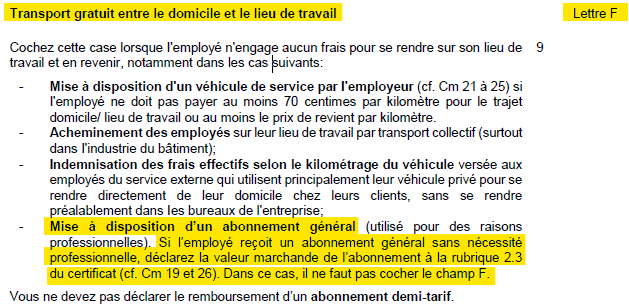

- “F” field is not checked

- For section “15”, there is a note *voir feuille additionnelle/see additional page. This additional page has the text in the red box where the GA card cost is mentioned.

- In the salary certificate I see that the Bruttolohn / Gross total (and hence Nettolohn/Salaire brut/Net salary) includes this 5670 CHF contributions for GA.

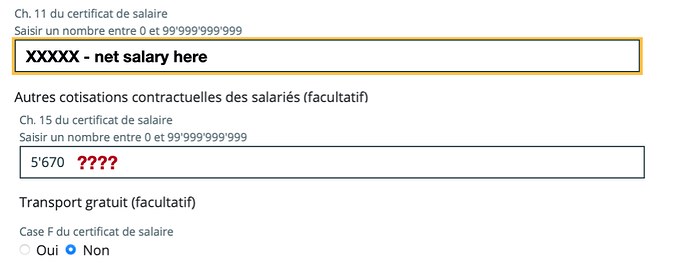

In the tax declaration we have to fill in the following information:

-

Considering my case above, the field “15.” in the salary certificate point to the additional page showing CHF 5670 of GA. But this CHF 5670 amount is already reflected in field “11.” i.e. net salary. So I assume I do not need to put again 5670 CHF in Autres cotisations contractuelles des salaries/Other contractual employee contributions field. Right?

-

Even though GA cost is part of my salary, the field “F” for “transport gratuit” is not checked. So I guess I have to answer “Non” for the same in the tax declaration? (I thought it should have been mentioned as “free transport” in my salary certificate).

-

My employer is paying for the GA cost as part of the salary. So I guess I should not report anything in the “Frais de transport/Transportation costs”. Right?

Thank you very much in advance! By reading discussions here, trying to acquire some mustachias skills and file taxes myself this year ![]() !

!