So guys, after reading over and over everything I decided for now to stay on SwissQuote, as at the end, going on IB would save me some money for sure, but no that much money to justify going with them.

I’m still torn between: ETF in USD or in CHF, on SIX or LTE.

So I’m down to 3 ETF to choose from:

EIMI (IE00BKM4GZ66, accumulating, USD on SIX, 0.18 TER)

+

SWDA (IE00B4L5Y983, accumulating, USD on SIX, 0.2 TER)

VWRA (IE00BK5BQT80, accumulating, USD on LTE, 0.22 TER)

ACWI (IE00B44Z5B48, accumulating, CHF on SIX, 0.40 TER)

So it will be one of these, and I will probably put directly 150k in it, or as lump sum, or as 75k first and 75k over the next 3-4 months.

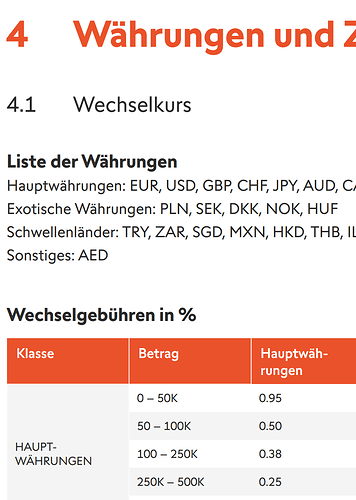

I would also need to figure out, in case I pick USD, what is the best way to exchange CHF to USD (too much money for revolut).

What are your final thoughts? If you were me, which one would you pick?

Thank you all one more time!