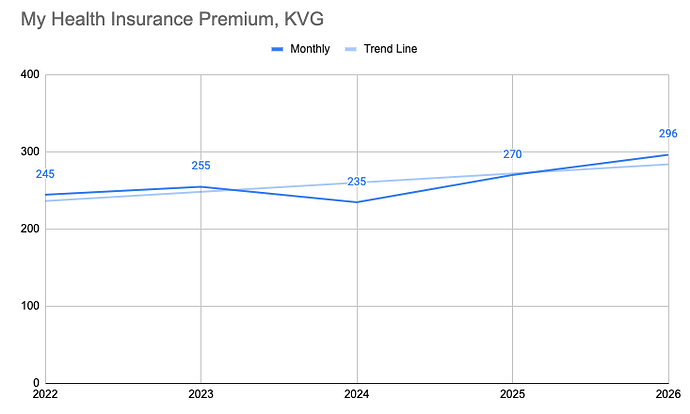

And the game starts again ! The new premiums will be published today at 15:00 on priminfo.

Ready for the increase ?

I am ready to update my future monthly health insurance budget!

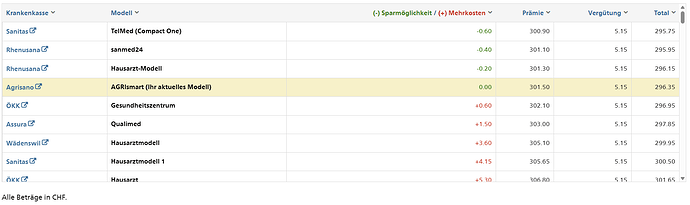

Update: The data ist now live. My new premium: 296,35 / month

9.6% increase… The cheaper options seem to bleed more than their equivalent more-expensive parts this year (at least for me as well).*

*just realized that makes total sense though, as cheaper options are in average more affected than the more expensive (e.g. 2 insurances: A) 100.-/month, B) 200.-/month, average = 150.-. 5% increase → 157.5/month (on average 7.5 higher). → 107.5 and 207.5 → thats a 7.5% and a 3.75% increase)

Another 9% increase for me (and that is after switching from my curren provider, else it would be 15%). After 15% last year and ~10% the year before.

We know how compounding works in investing…. How long until health insurance is as much as housing?

This is shaping out to be an insane problem, and there need to be taken action.

Here is a summary of the cheapest premiums in 2026 for all regions, ranked from smallest to highest increase (relative, compared to the cheapest one in 2025).

Data for an adult (>26 yo), without accident cover and deductible of 2500 CHF:

| Region | Cheapest monthly premium | Insurer | Model | % |

|---|---|---|---|---|

| ZG | 196 | CONCORDIA | HMO | -19.08 |

| NE | 403.5 | SWICA | FAVORIT SANTE | +2.65 |

| BS | 416.3 | CSS | Gesundheitspraxisversicherung | +4.28 |

| GE | 442.7 | Assura-Basis SA | PharMed | +4.36 |

| BE2 | 343.6 | Visana | VIVA – Gesundheitsplan | +5.33 |

| FR1 | 346.7 | Vivao Sympany | FlexHelp 24 | +5.44 |

| BE1 | 388.3 | Vivao Sympany | FlexHelp 24 | +5.49 |

| VD1 | 412.2 | Sanitas | TelMed (Compact One) | +5.5 |

| BL1 | 400.4 | Sanitas | TelMed (Compact One) | +5.59 |

| FR2 | 314.8 | Visana | Managed Care | +5.74 |

| SH1 | 333 | Helsana | BeneFit PLUS Hausarzt R2 | +5.88 |

| SZ | 275.3 | Agrisano | AGRIsmart | +5.93 |

| GR1 | 302.9 | Sanitas | TelMed (Compact One) | +6.02 |

| ZH2 | 329.9 | Atupri | HMO | +6.15 |

| ZH1 | 366.9 | Assura-Basis SA | Qualimed | +6.63 |

| JU | 403.5 | Assura-Basis SA | Qualimed | +6.75 |

| SG2 | 293.8 | Agrisano | AGRIsmart | +6.76 |

| SG3 | 276.7 | Agrisano | AGRIsmart | +6.83 |

| AI | 215.9 | Vivao Sympany | callmed 24 | +6.83 |

| BE3 | 317.2 | Visana | VIVA – Gesundheitsplan | +6.95 |

| AR | 286.8 | Agrisano | AGRIsmart | +6.98 |

| LU2 | 291.5 | CSS | Gesundheitspraxisversicherung | +7.52 |

| SH2 | 301.6 | Assura-Basis SA | PharMed | +7.56 |

| BL2 | 365 | ÖKK | Gesundheitszentrum | +7.73 |

| GR2 | 285.8 | ÖKK | Hausarzt | +7.89 |

| GR3 | 276.6 | ÖKK | Hausarzt | +8.17 |

| SG1 | 326.9 | Vivao Sympany | casamed hmo | +8.28 |

| SO | 346.3 | Visana | VIVA – Gesundheitsplan | +8.52 |

| GL | 296.8 | KPT | KPTwin.smart | +9.08 |

| LU3 | 279.45 | Luzerner Hinterland | Telmed | +9.2 |

| ZH3 | 300.9 | Sanitas | TelMed (Compact One) | +9.3 |

| TG | 303.3 | GALENOS AG | Combi Care | +9.53 |

| VD2 | 380.4 | Assura-Basis SA | PharMed | +9.56 |

| UR | 253 | Agrisano | AGRIsmart | +9.81 |

| OW | 258.8 | Agrisano | AGRIsmart | +9.89 |

| NW | 261.3 | Agrisano | AGRIsmart | +10.02 |

| AG | 326.25 | Sanitas | Hausarztmodell 1 | +10.03 |

| LU1 | 307.1 | Atupri | HMO | +10.03 |

| VS2 | 277.4 | sodalis | Digimed | +10.3 |

| TI2 | 406.9 | Helsana | BeneFit PLUS Hausarzt R2 | +10.81 |

| VS1 | 334.05 | Sanitas | Hausarztmodell 1 | +11.61 |

| TI1 | 449.9 | Agrisano | AGRIsmart | +12.93 |

Die Republik has published what I find to be a very interesting article on why drug prices are becoming increasingly expensive. tl;dr: Because the pharma industry is allowed to set prices on there own, there is no competition, and the federal government’s Federal Office of Public Health (FOPH) simply has to accept the prices (currently the political will).

Here is the interactive map for the cheapest premiums in 2026. At the top right you can navigate between age groups (young/adult), inclusion/exclusion of accident cover and deductible. For each combination of those parameters, the map has 3 layers:

- “Recommendation” which gives you an advice for the cheapest premium for the next year (assuming you had already the cheapest premium in 2025). The color code works as follows:

-

Red: another insurer will offer the cheapest premium;

-

Yellow: another model (within the same insurer) will be the new cheapest option;

-

Green: the current cheapest insurer/model is the same for next year.

-

“Change of cheapest premium (YoY)” which shows how the cheapest premiums changed across the KVG-regions.

-

“Cheapest premium” which shows the cheapest premiums (absolute) across the KVG-regions.

Hovering your pointer over the municipalities displays more information in each of those maps.

Feel free to share any suggestions you may have or any mistakes you spotted.

The interactive map is available here.

the prices in the french part are ballooning up. I am not sure why such huge difference between cantons.

I don’t know for the latest round, but previously is was mostly that Romands were simply using more healthcare, significantly so.

After 10 years with Assura, I want to switch to Helsana. I have never been REALLY sick, which means I never got to test Assura, but everybody always says Assura is so bad. I don’t want to test them… What do you think? Price is basically the same between the two, Assura isn’t even cheaper right now.

Btw, what do you think are the most valuable supplementary insurances? One that I always look for is the international coverage, to avoid any surprises if I had an emergency in USA, for example. Also, it usually costs just 8-15 CHF per month.

Another one I always check is the fitness subscription reimbursement. But each time i ran the numbers, it’s just not worth to take it. You pay like 300 extra per year and you get 200 back.

What else is there… Any hospital insurance, I feel like it’s not worth the money. Paying like 50 CHF extra per month to have a halb-privat room once you land in a hospital? Idk, feels crazy expensive.

All in all, I think I’d only look for an insurance which can save me millions in a one-in-a-million scenario. An insurance which saves me a few thousand, forget about it. I have the money to cover that. Only interested in being insured against things that could bankrupt me. Do you know something like that that I’m missing?

I have and really like the complementary insurance from CSS: “MyFlex Outpatient Balance”, which includes emergency and legal coverage abroad, and “MyFlex Hospitalization Economy”, which provides CHF 150 per year for fitness expenses. On top of that, it gives you free access to the Health Account, which covers up to an additional CHF 500 per year for fitness costs. Plus, with the active365 app, I usually get ~ CHF 250 back each year. All of this for just CHF 34.20 per month, so if you add it up, they are basically paying me ~ CHF 500 to have complementary insurance with them!

Staying with the same provider (Vivao Sympany, flexhelp24) → +7.8%.

Savings potential not drastically bigger by switching providers (Assura/Atupri, <5chf/month).

So I’m staying put.

halb private can actually be very useful if something bad happens due to speed of treatment, doctor choice, etc.. there is a thread about it.

Mine stays the same at 421. Hurrah again for Basel-Land. ![]()

What’s the deal with ZG and why don’t I move there?

Before signing with the cheapest one, have a look here in order to read a synthesised strength and weakness report of the targeted model. Some conditions does not worth the money.

It will be a +3,8% increase in GE canton for Assura PharMed modèle. There is no optimisation I can do. I will reach 440chf/months for 43 y.o.

I am using a lot the LAmal 0 chf franchise with my son and it is working well so far. Assura are doing thirdparty payment nowadays and it is working well.

I like the app, I scan everything and it is processed efficiently. At the end of the year, they send you the summary of the year.

However if you contest/challenge a medical bill and ask the doctor to update the bill, they are a bit slow to take it into account. I have to submit a request in the online platform.

I am looking for a complementary insurance that will cover the drugs not coeverd by the base. In case, the treatment does not go well another drug my not be cover. Assura cover only up to 50k chf of drug for the whole contrct. It does not seem a lot in case of cancer …

Do you remember another thread comparing complementary insurance ?

Can’t believe it. Same price for me ![]() only one would be 5 cents cheaper per month. (double checked if I really did calculate for 2026 and yes, I have).

only one would be 5 cents cheaper per month. (double checked if I really did calculate for 2026 and yes, I have).