Hello there, does someone have a perspective on the best gold ETF (physically secured)? The NZZ “The market” seems to often suggest the Zurich Kantonalbank ETF as a gold ETF with 0,4% costs (where gold is kept with ZKB). Invesco is TER 0,19% and the biggest ETF. Anyone having a recommendation? Does anything speak against INVESCO? Thanks a lot already

I think it shouldn’t matter unless you really want the physical gold to be local

Or opt for a physical delivery at redemption.

ZKB offers it (12.5kgs gold bar only). Not sure for Invesco.

If you don’t care about the custody of the gold (swiss vs foreign) and don’t plan for a physical delivery, go for the cheapest ETF

If physical gold in Switzerland with potential physical redemption is important, the UBS Gold ETF with a 0.23% TER would be an alternative to the ZKB ETF. 0.4% TER sounds high to me.

Thanks a lot everyone. Much appreciated. I did not see the UBS one before. When I go to justetf, it does not come up (nor the ZKB by the way) - any idea what I need to be doing different to find ETFs that are good for CH Investors?

Have you selected the right country on justETF?

I also consider the counterparty risk. With gov guarantee, whatever securities ZKB are issuing, should be safe. I hold ZGLD, ZSIL and ZPLA with them.

I would check the fine print on getting the physical upon redemption. Typically, it comes with nice fees (for the bank) …

thank you everyone, this was helpful

Why does ZKB with a higher TER (0.4% vs 0.12%) have a better performance than Invesco (both in USD)?

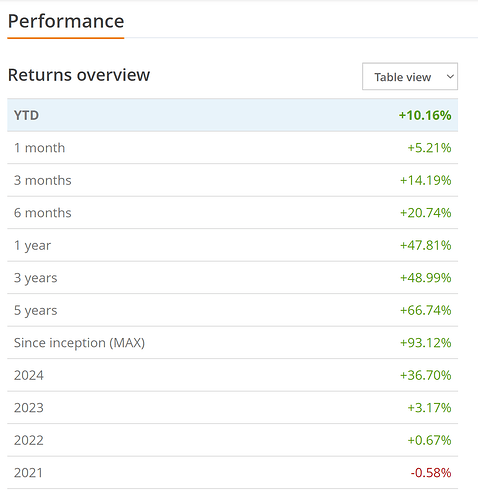

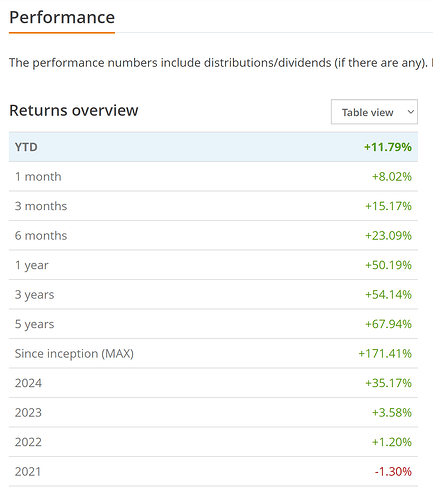

ZKB:

There’s some current dislocation between various gold storage facilities (many people are moving holding from London to New York).

Invesco is tracking the London gold price, I assume ZKB holdings aren’t impacted as much since they’re physically in Switzerland.

But isn’t that happening only recently? The performance difference in the images goes back a few years.

The difference seems more pronounced for the past few months. But yes you’re right there’s also a gap before, there might be other fees/inefficiencies besides the TER? (maybe physical handling fee, more redemption, etc.?)

One explanation maybe

That’s already what I mentioned in the earlier post ![]()

Maybe JustETF (linked behind those performance tables) is Just™ drunk and should just go home and sober up?

Here’s what Bloomberg has to say about the relative performance:

I would expect the relative performance of Invesco and ZKB trailing the index to be mainly due to fees.

And I am not surprised ZKB is trailing the pack.

Thanks for the interesting post and comments. I’m a noob so far with mostly VT USD on IBRK. I would like to get a very small portion of commodities and maybe more stocks with home bias / currency, probably also with a Swiss broker, since mostly I am looking at diversifying and getting more local, due to the evolving geopolitical situation.

Gold being one of the commodities, in this journey I have a few noobs questions, I guess might be obvious for some of you, but I don’t find clear answers so far:

I don’t find them the UBS and ZKB ETFs above in IBRK - is it because of my rights or settings, or it’s just not in their available ETF portfolio?

I would like have more of my portfolio (including broker) based in CH, it seems that at the moment Saxo would make most sense in terms of costs? Would I find the ETFs above on Saxo?

Finally I am assuming opening a ZKB account (could make sense, as I have too much cash in one bank, so could have more assurance with the 100’000CHF theoretical “protection”), will still lead to more expensive fees than an approach separating the product and (cheaper) broker (e.g. Saxo + ZBK ETFs).

Will do my own diligence, but would be great if anybody already went through this thought process and could share some views - it takes quite some time to check and calculate all.

Cheers

In Saxo, I see: UBS’s AUUSIC and AUCHAH (0.23% TER, both in CHF, latter hedged) and ZGB’s ZGLD (0.4% TER in CHF).

(Further, SPDR’s GLD in USD. But for that one, I’d go on IBKR)

The ZKB one can be found with “ZGLD” and the UBS one with “AUUSI” (that’s the Bloomberg Ticker for this fund) as a search term.

Just as a sidenote, the CHF 100k protection is only for cash, not for investments.

Thank you so much for your inputs! very helpful.

Clear on the 100k protection, thanks, I mixed it up.

I opened a Saxo account. In a nutshell, compared to IBKR, the swiss stamp tax is the worse contributor, adding to some fees related to Saxo, here’s my quick calc of the final fees for 50’000, in case it interests somebody - my small contribution:

| Transaction: | 50000 | ||

|---|---|---|---|

| ETF CH | ETF US | Custody | |

| IBKR | 25 | 0.35 | 0 |

| Saxo | 115 | 115 | 0 |

Short-term it’s not so relevant with the partner offer of 200.- fees covered for 3 months.

I can now see the ZGLD in Saxo. Not sure why I don’t find it in IBKR, will try to open a ticket.

What would be the advantage of the hedged UBS or ZKB versions?

My understanding is that in general non-hedged ETFs are preferred for broad market indexes, but what about gold?

Seems the hedging has no impact on the TER, which I would have expected. What were your thoughts in the decision making, being located in CH and purchasing a CH-based ETF?

Maybe it sounds stupid, but why a CHF hedged version of ZGLD exists, when anyway all is in physical gold in CH?

Thanks