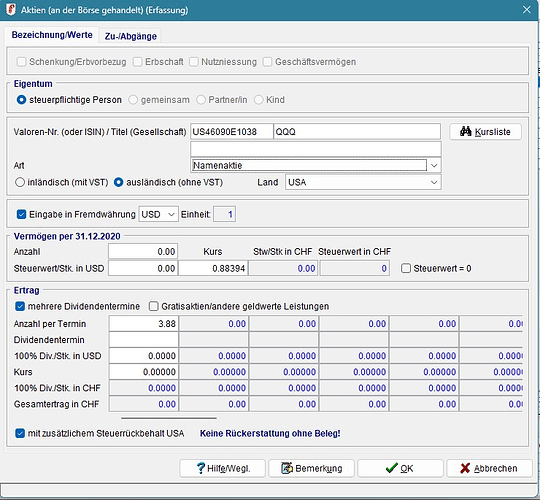

I guess I have to declare it. But looking at the form, I am completely lost. I add that I am rather poor German speaker.

I would appreciate any help.

If it turns out I have to make each entry for all the trades - could you point me out to a guide, that would provide basic explanation for those fields?

Thanks.

Hi Pekotski and welcome!

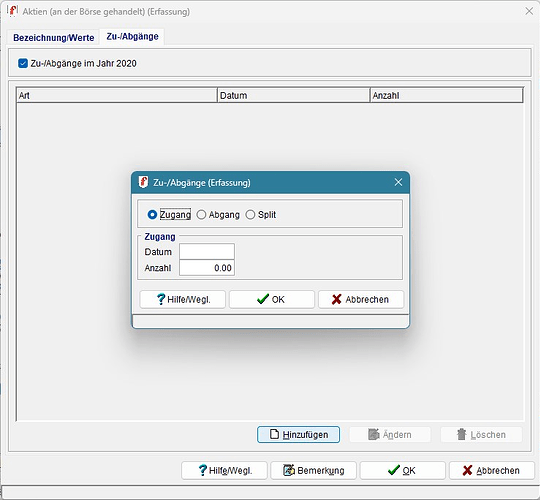

I think it’s probably in the “Zu-/Abgänge” tab that you can declare the transactions.

Are you sure about the year 2020 though?

Hi there & thanks for reply,

Looking at that tab, you have suggested (please see the screenshot) I don’t think that would be the case.

As per 2020 - unfortunately yes - have to do taxes for that year. And then some more - but that’s different story

What happens when you enter the date of your first transaction and the quantity then click OK, and reiterate?

Like 20 times? What happens when I get to a point with AAPL, which pays dividends as well, an I have traded that ticker 100’s times? And that just one ticker. Would I be spending a year entering those values into really primitive application? I am looking for a solution to declare unwanted dividends in an easy way - preferably just entering a data into few fields. Is there another way of doing it?

Yes, there is an easier way: Swiss banks issue tax statements that the tax office accepts (but there is a fee). The tax statement contains a list of all transactions but then you only need to copy the total value and the total income (one with and one without Quellensteuer) from the statement.

I think some people managed to also input just one total value and one total income for non Swiss brokers, taken from the broker statements, and it was accepted, but I don’t know what the rules are. The numbers on the broker statements do not always match the Swiss value and income for foreign brokers.

Also if you trade the same ticker hundreds of times, you probably want to be careful about (not) being classified as a professional trader and having to pay tax on capital gains.

That sounds good - thanks for an enlightenment. I am with Interactive Brokers, so there is at least 50-60 custom reports that I can generate. The only thing of concern is, how do I enter that total value - and on what form if not possible on EasyTax?

I am not familiar with EasyTax but in some cantons you can simply create one line in the document listing the assets (as a single “asset” for the broker) and put the total values there. Having in mind the tax office might not accept it or might ask for more documents.

How do I interpret the fields in my post?

I guess Vermögen per 31.12.2020 is if I still hold the security on the last day of the year or if I have already liquidated it.

What is the meanings of this field: 100% Div./Stk. in USD?

I will try do with what I have - EasyTax. If tax office asks for more data (doubtful - for mere 15 CHF in total dividends) - I will send them the report. I am sure they have better software to deal with the raw data.

There is more to it:

- Securities are held for at least six months before being sold.

- Capital gains contribute less than 50 percent of net income.

- The transaction volume during a calendar year does not exceed five times the investment portfolio value at the beginning of the calendar year.

- It is invested only with its own money, not with that of others (not even with outside capital from banks in the form of a loan).

- No trading in derivatives (e.g. warrants), except to hedge risks.

https://www.taxolution.ch/swiss-tax-guide/tax-exemption-of-capital-gains/

But thanks for the warning - there is a risk.

Obviously, if I didn’t take a risk - I wouldn’t be on this forum hehe

1 Like

FYI it’s an OR, not an AND, if you break any of those you /may/ be classified pro (but then as discussed many many times in this forum I really wouldn’t worry about this happening even if you break one or more rules).

Correct with the OR. Thanks for clarifying it and adding value to this post.

Could you point me to any of those discussions, if possible?