Wasn’t quite sure where to post this, ideally under a category like “(General) Financial Planning”, as it seems somewhat overlapping with but still mostly orthogonal to most if not all the existing categories (or maybe I missed some)? If there is already a suitable category, please move it there?

I’m curious if anyone else is doing this kind of planning at this level of detail, and if so, if they’re willing to share their approach(es). I’m of course willing to share mine, if anyone is interested.

My suspicion — drawing general conclusions from my own experience — is that you only start doing this once you’re close to FIRE or have FIREd.

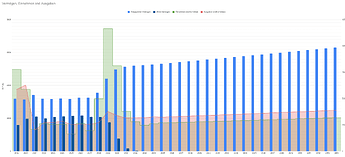

Anyway, before digging into the details, some summary graphs sketching out scenarios up to my statistically expected expiry date covering taxable and non-taxable wealth accounts as well as expected cash flows.

-

Here’s my somewhat* worst assumption — asset appreciation just 1% and no dividend growth from my current base of 4.3%:

Seems my wife and I will pass on to greener pastures with a bunch of money left. -

My better case scenario allows for capital appreciation of 2% (and still no increase in the dividend payout ratio):

Well, dang! Looks like the person with this plan is … maybe still a little too ascetic?

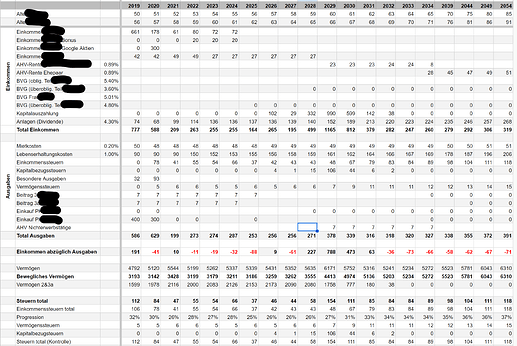

The planning** takes into account on a yearly basis everything and the kitchen sink (at least in my simplistic view, YMMV), i.e. her income and mine, federal and Staats- und Gemeinde- taxes (with progression built-in), AHV payed out and payed in depending when you retire and on your wealth and married-couple specific work situations (for having to pay in), retirement accounts, general and rent inflation, asset growth, asset return growth, staggered capital withdrawal with appropriate progressive taxes, etc.

This is what the Income / Expenses tab on that spreadsheet looks like:

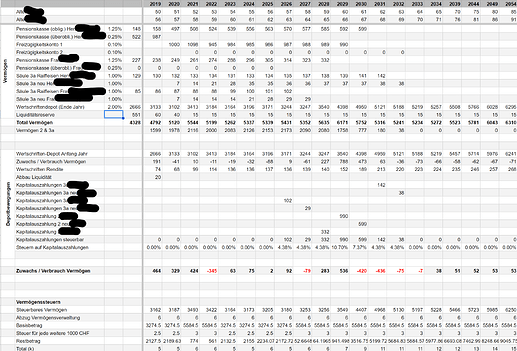

And then the wealth tracking tab:

There’s also a couple of helper lookup tables to calculate the federal income tax, the Zurich Staats- und Gemeindesteuern including the wealth tax, the AHV Nichterwerbstätige tax for any years this would be due, as well as an “Assumptions” tab for, well, assumptions that I make, like the capital appreciation, etc (in order to quickly change all tabs/numbers instead of updating each tab individually), and finally a “Final figures” tab to state the actual numbers stated by the authorities up to the current tax year which will then overwrite the calculated number up to that completed tax year.

For completeness:

- my entire initial motivation for building these spreadsheets was to understand and get comfortable myself with the numbers initially calculated by an independent financial advisor

- my nowadays motivation to keep the numbers up to date is when I sense one of my plans might change, i.e. when I am considering leaving my employment, and I’d just like to run the numbers to see how things will work out if I remain unemployed (spoiler: fine).

Running the numbers gives me peace, it reassures me that my general plan will likely work out cash flow wise — which I kind of already know, but it’s still reassuring to punch it into the (spreadsheet) calculator and see the numbers change a bit but in general work out just fine - my initial implementation of my own Google Sheet merely mimicked the professional’s financial planning spreadsheet**** which in subsequent iterations of mine I refined, mainly to find my own errors in understanding things correctly, and to suit it to my specific needs to calculate things.

Oh, all numbers provided in the screenshots above are purely fictional, of course.

A … ahem, friend provided those.

* WWIII could always Trump things, but then neither my spreadsheets nor anyone’s plannings probably won’t matter that much …

** My original spreadsheet also contained another half dozen options with partial capital withdrawal, pure pension and everything in between. Based on my current plans I’m focussing on full capital withdrawal and I am updating the spreadsheet with employment income as it takes place or is planned.

*** The planning is based on a template I constructed myself after getting & paying for professional financial planning by a independent advisor.

**** Generated by TaxWare, a professional software solution that (among other things) allows financial advisors to do financial planning for their clients in all Swiss tax jurisdictions.