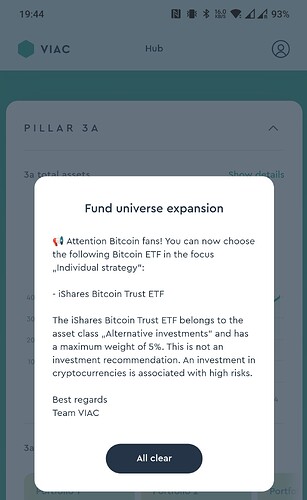

I think the safest option would be the ETF from Fidelity or Blackrock.

just 5%… well it will outperform everything else. so going to change to max possible.

I want to bring up the point again, why invest in Bitcoin in your 3rd pillar? A vehicle where you have to pay capital gains tax on withdrawal vs. outside of 3a where you only pay wealth tax on it. It makes no sense.

right. I’m already in… so don’t care that much

btw. now I can pay less taxes and buy more bitcoin. In 15yrs+ when retiring I will probably don’t care as btc will be at 10m+

What you wrote is rational, and anyone really considering bitcoin should buy it outside pillar 3. The 5% limit in VIAC/ finpension is more like spicing up the long term equity portfolio than really making a material bet on biotcoin.

Oh come on, what do you save on taxes with the CHF 350 Bitcoin contribution to your third pillar, maybe 30 bucks a year? The tax you pay on withdrawal for the capital gains of your Bitcoin that will be at 10m+ at that point will be waaay higher.

Well, not sure how they handle the 5% in viac. Is it mostly selling from IBIT to CHF to maintain the 5%? Well then…

From 26.3. my IBIT portion in VIAC of the networth will be ca. 0.8%.

Logically shouldn’t you stop contributing to 3rd pillar and instead put it all into BTC?

well 7k is not that much… I take it for the tax savings… couple of beers and a cohiba ![]()

I think for people who believe BTC will be 10 Million , any allocation less than 100% of the total investment will yield lower return.

So if max is 5%, then 5% is optimum. Isn’t it ?

5% is less than 100% of the amount that could be invested in BTC outside of 3a without taking advantage of the tax deduction.

Taking a 7k contribution and 30% margin tax rate as an example (numbers chosen to make the calculation simple):

-

7k being invested in 3a means a tax saving of roughly 2.1k, so 2.1k are invested in BTC outside of 3a and 5% of 7k are invested in 3a (500.-) for a 2.6k total.

-

7k being invested in BTC outside of 3a means 7k are invested in BTC.

Wealth tax, withdrawal tax and fees should be taken into account but you can buy more BTC by not investing into 3a than by doing it.

correct. but…

95% CHF / 5% BTC >>>> 100% CHF on VIAC

so for me is a non brainer to convert. 7k every year into 3a is optional…

I see . So you are saying to ditch 3a all together. Now I understand

Well, what I would actually say is don’t go 100% BTC and if you must put your money in it, do so reasonably with amounts you can afford to loose (and, as @Burningstone has pointed out, do so outside of 3a) but yes, if your goal is to maximize the amount of BTC you hold, then doing it outside of 3a makes more sense.

Of course and as @stojano points out, the money already in 3a is mostly stuck there so converting 5% of it into IBIT allows for the holding of more BTC related instruments than not taking whatever percentage can be taken.

Personally I won’t go more than 1% bitcoin based on overall allocation. Reason being I don’t really understand its valuation.

I was mainly trying to go with the discussion based on 10m BTC assumption.

10M would be a 210T market cap, lol.

well, it’s against USD… so nothing to laugh here ![]()