My process of “cashing out” from Binance is via ligthning network to Kraken and sell the BTC to CHF. Withdraw from Kraken (Liechtenstein Bank) to any other Swiss account within an hour (cost 1chf).

Funny, I was just looking at LN transactions between exchanges. Kraken is upping their fees for the lower tier 30-day volumes:

| Tier | Fees |

|---|---|

| $0 - $10,000 | 0.25% Maker, 0.40% Taker |

| $10,000 - $50,000 | 0.20% Maker, 0.35% Taker |

| before | 0.16% Maker, 0.26% Taker |

Transaction costs (in BTC) between Kraken and Binance over LN:

| Exchange | Deposit | Withdrawal |

|---|---|---|

| Kraken | free | free |

| Binance | free | 0.000001 |

| Bitfinex | free | 0.000001 |

I don’t know if there are any nodes in between, and what they charge. @stojano ?

Edit: Added Bitfinex

I have found exactly 3 exchanges operating with Lightning Network:

Kraken

Bitfinex

Binance

Didn’t use Binance. LN transfers between Kraken and Bitfinex does not incur additional costs. Same with the transfer to Lightning wallet inside the mobile Exodus app.

From Kraken I never paid a sat for a LN tx. From Binance just the mentioned… There is a channel between Binance and Kraken. And 0.0199btc is the max you can send at once (at least from Binance).

Where are you taking this info from?

Email, and it is also mentioned on Reddit.

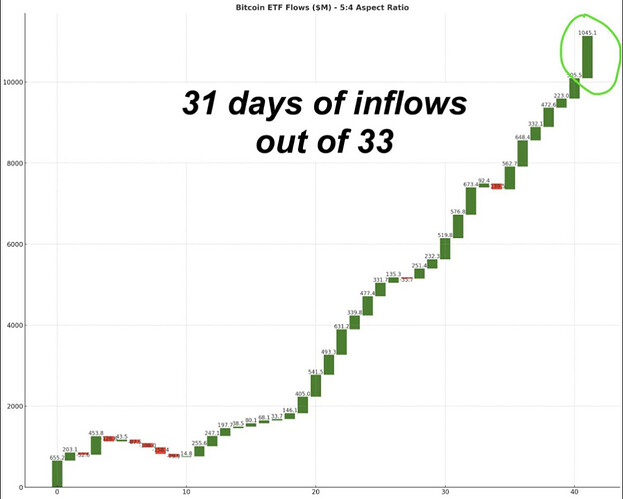

That’s scary than we didn’t have a red monthly candle since 6 months ![]()

Im still waiting for the 10k candle…

stupid question: why do you send the BTC not directly to Kraken from your wallet but do it indirectly via Binance?

just had some BTC on binance…

Just logged in Binance and realized i was sitting on a 800% unrealized gain in PEPE. From 1 to 8 usd ![]()

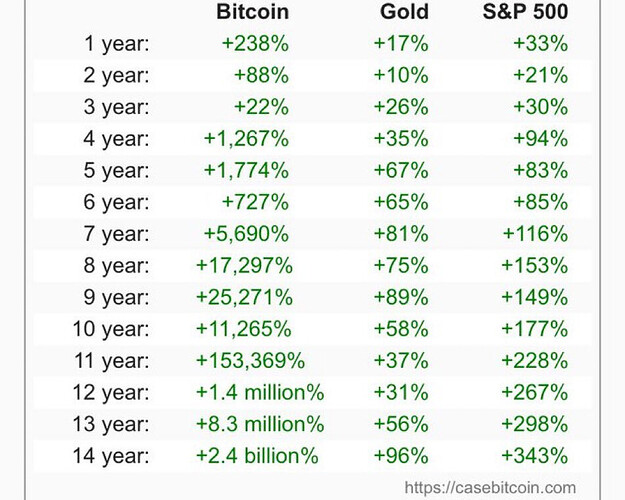

Check out this video, it explains why the performance calculation is bs if the initial value is very close to 0.

Its in german.

Only roughly +37% to 100k, less than what we did the last month (+47%). So 100k before halving?

- Bitcoin ownership is widely distributed across a variety of groups. 74% of Bitcoin owners hold less than around 0.01 worth of Bitcoin (~$350 as of November 6th, 2023).

- Around 40% of Bitcoin ownership falls into identifiable categories, including exchanges, miners, governments, balance sheets of public companies, and dormant supply.

- Significantly, some of these groups represent “sticky supply,” which could increase the impact of demand related tailwinds, including the 2024 Bitcoin halving or a potential spot Bitcoin ETF approval.

I found these facts from Greyscale interesting. Approx <10% of investors had >3500 USD exposure to bitcoin as of Nov 2023. Seems to me that there are some very large investors (most likely the early investors) who are profiting the most from the current bull run while a majority of people might have less than 1000 USD exposure to Bitcoin (assuming more than 100% return since Nov 2023). Am i reading it correctly?

https://www.grayscale.com/research/reports/demystifying-bitcoins-ownership-landscape

What time of day CET do they usually dump it, so I can BTD too? ![]()

Well, I read this: it should be now at 100k+…

so as long you buy at these prices, you may say thank you to BlackRock ![]()