Yes they can: ![]()

+7% is okay. I wonder how they are going to howl when it will be -10%.

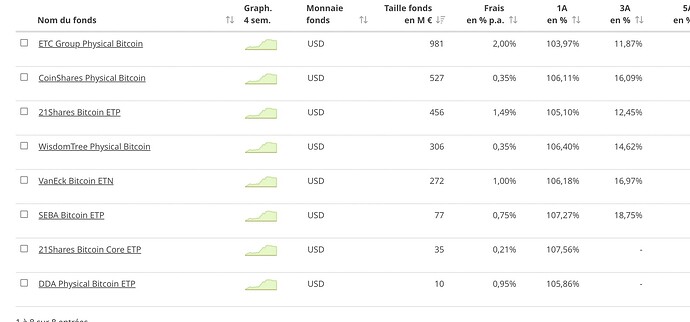

I’m still waiting to see the AUM of US ETFs on the long run. Because BTC ETFs exist since few years on the european market, with around 3 billions of AUM.

US protectionist laws will ensure that everything and everyone remotely connected to the US will only use their funds (or nowadays none at all if you can only buy UCITS ![]() ).

).

Yes very nice ![]()

I‘m also happy that I hold on to the ETH.

It’s halvening ![]()

There was 10x more demand for the bitcoin ETFs yesterday than what the network produced.

The price will continue going up until people stop buying it.

And that doesn’t appear to be happening any time soon.

Do you ever sell your crypto or buy and hold?

Where do you see BTC etc. in 10 years? Whats the potential market cap?

Would you sell something which does 5% a day? What do you buy instead of?

Assuming it reaches gold market cap it‘s 650k a coin. 10x it‘s a matter of time.

What about all the other coins? Will only BTC survive?

I dont know and I dont want to bet.

I wonder what you think about the environmental impact of bitcoin? Does this influence your views or actions? If yes, in which ways?

Bitcoin can have positive effects on the environment. Yes, it does influence my views and actions. I buy more of it every month.

But for how long? The little BTC history we have shows that after a steep curve up another steep one down regularly came.

Care to elaborate on which positive effects are effectively being measured?

I can now buy an electric car, instead of keeping my 7yrs old Nissan ![]()

No there are… will find the links.

… it’ll get a lot warmer ![]()

There are so many examples of how bitcoin positively impact the environment, this is a piece from January: https://bitcoinmagazine.com/check-your-financial-privilege/stranded-bitcoin-saving-wasted-energy-in-africa

I also posted this video a while back: https://youtu.be/xkVOJAWP688?si=j0JlaRCp9NKphOq9

Just two examples of many.