Not sure what you are talking about. The company is doing great, record profits in 2022 for example.

That’s the problem, there is no way out and the Europe will probably end like Japan in an economic

ice age with an old unproductive population. It’s either inflation or default.

Deflation was created by technology, cheap energy and globalisation, now these times have ended with the rising conflicts, babyboomers retiring and nuclear power plants beeing shut down left and right. I agree policy maker want inflation to get out of debt, still it’s a hidden tax especially on the poor.

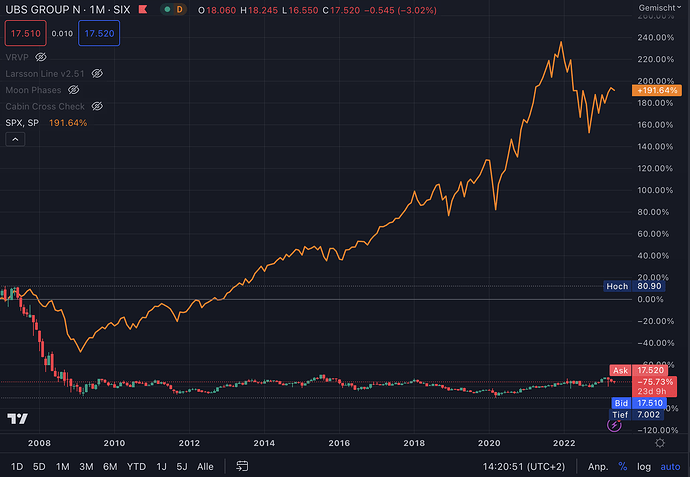

Here a chart UBS vs SP500, I wouldn’t call that a confidence vote from the market. I will spare you a comparison to BTC ![]() .

.

I don’t want too attack anybody working there or in another bank. I was a UBS (and also CS, Raiffeisen, Postfinance,…) client for decades and my wife has been working for UBS for a while, my assitant worked at CS for nearly 20 years and started as aprentice so I know a bit about the culture and processes. I just think traditional banks are being drowed in old structures, false incentives, regulation and compliance and too big and old to adapt to todays technologies. At some point in the not too far in the future they will be fully replaced. My best guess is by DeFi which will be safe and easy to use in about 5-10 years and probably a CBDC account at the SNB.

Does your chart include dividends?

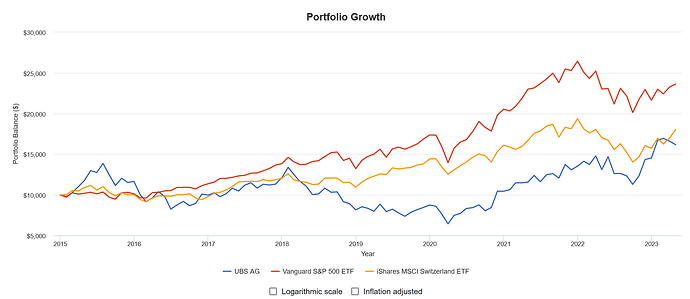

Here’s UBS since 2015 vs VOO (S&P500) and a more localised EWL (MSCI Switzerland) since 2015 (no earlier data in Portfoliovisualizer for UBS), in USD:

It didn’t outperform but it wasn’t terrible either.

4 posts were split to a new topic: Decentralized data storage

Just an example illustrating why I am sceptical about crypto ETFs etc.

short Ray Dalio’s video clip about the ideal digital coin

it sounds reasonable to me that in the future ingenious minds may design a better currency

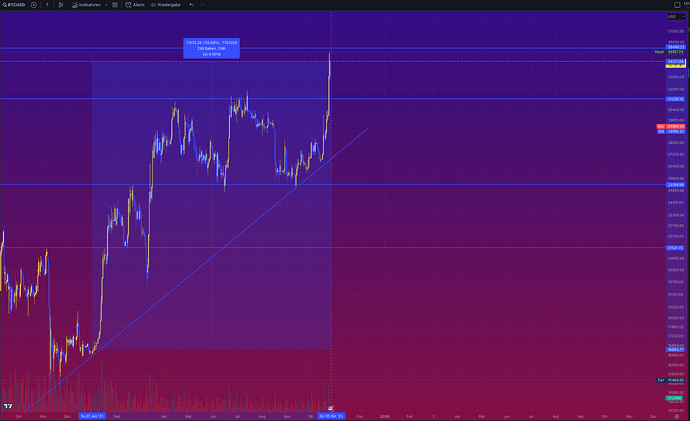

You mean, slightly less than 50% from ATH?

META 214% 1Y ![]()

So what ![]()

Or slightly more than 50% than the ATH of 2017 ![]()

I have checked my locked DOT’s and BTC today and even wasted a second to consider buying into to have even numbers, a clear indication that it’s just a pump and we should be at the top only going down from now on ![]()

So… how’s everyone feeling ![]() ?

?

![]() but what is this pump now all about?

but what is this pump now all about?

Aha, probably this:

And that it’s only the spring ![]()

38k. US is waking up to black Friday and buying Bitcoin with a 45% discount from the previous all times high. Oh, wait…

Since 2011 when considering annualized returns, Bitcoin’s rate of return stands at 230%, which is 10 times higher than the second-best performing asset class, the Nasdaq 100 Index.

Over the same period, large US stocks experienced an annualized return of 14%, high-yield bonds saw a growth of 5.4%, and gold had a return rate of 1.5%.

https://seekingalpha.com/article/4654361-bitcoin-and-stablecoins-monetary-gates-open

I like her articles, enlightening and inspiring.

150% YTD. ETF around the corner, halving in 136 days. Oh boy, we’re so fu*****ing back.

And it keeps going.

Seems like the FOMO is happening. I know I’m starting to get some ![]()