Just be ready for pullbacks and a roller coaster feeling. But in those strange times, don’t think of a better investment.

Unfortunately it still is somewhat coupled to the stock market. Only if the BTC moves are decoupled from the stock market trends it will explode in value.

Think that this decupling started with the news of Paypal. The access is getting easier and the FOMO started. But of course if there is a general crash and everybody looks for liquidity, next to share also Bitcoin and Gold will dive.

Is there a Bitcoin expert around here?

As a libertarian-leaning individual I certainly see the appeal of having a decentralised currency, nevertheless when I try to understand BTC there are still questions for which I cannot find an answer.

Bitcoin’s Limited supply:

My first interrogation is about the theoretical fixed amount of BTC supply. I get that Bitcoin’s algorithm has fixed the supply of coins to 21 million BTC max. This is in a sense a limit fixed by “the law of the software”. In a not so distant past, there was also a currency called the US dollar whose value was by law entirely backed by gold, so you could not have more dollars than the entire supply of gold. We know what happened since the end of Bretton Woods. Laws change, and in a similar fashion you can change a software algorithm.

Let’s say that, similarly to US treasurers 50 years ago, the BTC dev team suddenly has a great incentive to change the supply rules of Bitcoin. What happens then? That would be a fork, correct? With “New BTC” and “Old BTC” parting their ways. How would New and Old BTC be distributed? How would that affect Bitcoin’s value?

Bitcoin Efficiency

I am trying to grasp to which extent BTC can be a valid replacement for an everyday currency. Is there a point at which buying your bread/pizza/whatever with BTC is the most mundane thing?

If i remember correctly the 2017 BTC craze, there was a moment where the volume of transactions was so big that they took a considerable time to get processed and the transaction fees were getting out of control (more than 10% of the transaction amount). How has the technology evolved since? Is it possible for BTC to be as efficient as the Visa/Mastercard networks if it scales to an everyday currency? If yes, this is great. If not, it means that most likely its adoption will be limited, with the added drawback of a high volatility. In this case, how does it differ from a simple speculation tool, where participants hope to sell to a greater fool?

Bitcoin is super interesting, but these two points have so far prevented me to buy any meaningful amount. Is there somebody who can refute/confirm these problems?

You would just have same amount in each (at least that’s how previous forks work). I think if you look at cryptocurrencies as a universe and not just btc, then it’s clearly not a finite supply (anyway can either fork an existing blockchain, or create a new one).

I had the impression most people kinda abandoned bitcoin as a mean of payment and now it’s more focused as a store of value (and speculation).

Lightning Network - Wikipedia was supposed to improve the situation (but it’s a layer above bitcoin).

Not really sure if progress was made on lightning and how well it works (Bitcoin’s Lightning Network Is Struggling To Overcome Fundamental Issues seems to say there might be issues).

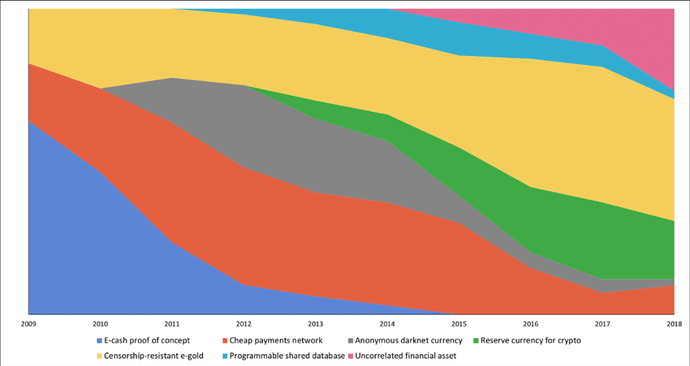

Different Phases of Bitcoin - found this some time ago and I think this is still accurate.

(maybe somebody has a more updated version of this?)

When a fork happens, it inherits the entire blockchain up to that point, with the wallets and coins. So you have both the BTC and BTC2. Your private key can “move” both currencies.

Don’t take my word for it, but ethereum is planning to switch from proof of work (those who solve the puzzle enforce the rules) to proof of stake (those who hold the coins enforce the rules).

The video is fearmongering, going for publicity.

Would I rule it out though, restrictions on purchase and conversion of Bitcoin? Certainly not.

Yes - it’s happened already, there’s been a few forks to Bitcoin.

Well, neither is gold a full replacement for everyday currency, is it?

It still kind of “just works” as a means of storing value and could be used for transaction purposes.

Honestly think that this is my biggest fear, that goverments globally restrict or forbid BTC or other digital currencies. Germany already restricted the purchase of gold without disclosing personal informations to €2000 by Januar 2020. (in the 1930 they restricted owning gold fully).

I’ve opened up an account with Bison in May of this year, to buy some Bitcoin.

Currently up 34% ony my (small) “investment”. But honestly, I’ve been merely dabbling with it so far - or cryptocurrency at all, which I had previously mentally discounted as being without any substance.

Couple of random thoughts on it:

-

I’m increasingly convinced that Bitcoin might be “here to stay” and become adopted more by big businesses (not necessarily retail or for transaction purposes though, possibly more akin to gold)

-

If any cryptocurrency is to stay relevant, I’m betting it’s most likely Bitcoin. It might not be the most technologically advanced or convenient one among many cryptocurrency or coins, but it’s achieved a certain relevance and brand recognition that transcends the bubble of internet cryptocurrency nerds. Even my mother has heard of and knows what Bitcoin is.

-

99% of “copycat” coins/currencies will probably turn out short-lived fads, struggling for relevance. If they aren’t downright run as quick cash grabs (with their “staking” schemes etc.) by their creators. All likely to rather sooner than later lose relevance and value. So choose wisely what to play with or invest in. Me, I probably won’t go beyond the “original” Bitcoin anytime soon.

-

I’ll want to buy the “real thing” (if you can call it that), so actual Bitcoin that I can transfer to an external wallet, rather than just “virtual” trading in price, without being able to transfer Coins out (Revolut, for instance doesn’t allow you to do so). I chose Bison since it’s run by Stuttgart Stock Exchange, so at least not some fly-by-night company in a questionable jurisdiction.

It would take a very concerted effort to do this on a global basis. And I don’t think they can “forbid” Bitcoin itself - though certainly restrict means of conversion into other assets (exchanges).

On the other hand, big businesses might adopt Bitcoin and lobby politics and politicians to enact friendly legislation. Also, I doubt that governments will agree on a global basis. There will always be some governments and jurisdictions doing things differently. Did Germany disallow, or the US? Yes. Did Switzerland, Canada or Mexico follow suit at the same time?

Liberty and individual freedom from government repression isn’t achieved through voting or political activism. It isn’t guaranteed of defended with (or a in a court of) law. Conversely, the law is not what one should fear most in this regard. When it comes down to it, I think these depend more on being able (and ready) to move. Be that moving yourself and your family to another jurisdiction through migration, or your assets through a financial transfer.

Bitcoin will never replace fiat currencies issued by a government, such as e.g. CHF or USD.

For that, it’s missing some crucial elements, both technological and political.

For example, it lacks something like a government-controlled money creation process, which is essential to economies as we know them today. It also simply doesn’t have the technological capability to replace the amount of money currently floating around. Big Ern wrote a good article about it here.

There are some advantages in having an own government-issued crypto currency, however.

For example, if a government wants to launch a full-out negative interest rate policy (“NIRP”), everybody would run for cash. But if there is no cash, only a digital currency, then people wouldn’t be able to hoard physical cash anymore. And if we look at the enormous public debt that countries have been piling up, there are two only ways out of it: default or inflate. Default might actually be the better option, offering the chance of a fresh beginning. But politically, inflation is more convenient. And with Bitcoin, it is not possible to pursue an arbitrarily set target inflation rate.

For these reasons the blockchain technology will probably be used by governments to create their own crypto currencies, but they will not use the existing coins. Governments might actually try to ban Bitcoin if it starts to seriously interfere with their plans and activities. That might sound far-fetched, but don’t forget that not long ago, it was forbidden for private persons to own gold in the USA.

Personally, I treat Bitcoin as digital gold, though its easy tradability gives it some characteristics of a currency, and think that it is here to stay, tolerated by governments as an alternative way to make payments.

So to continue the Bitcoin topic:

Some people here hold some amount of Bitcoin. What is your plan with Bitcoin? Never sell Bitcoin or only at certain price points? If so: What are your price targets to sell your Bitcoin?

For those interested, Horizon Kinetics (1) published some interesting article on Bitcoin and cryptocurrencies in general. Some are on the supply curves and others on acceptence. I have not read all of them but I usually read their quaterly letter, which are usually quite insightful.

- Horizon Kinetics LLC, founded in 1994, is an independently owned and operated investment adviser. We adhere to a long-term, contrarian, fundamental value investment philosophy that the founders established in 1985 at Bankers Trust Company. Horizon Kinetics has over 70 employees, with primary offices in New York City and White Plains, New York.

I sell at certain price points. They are pre-established because we know how difficult it is to sell when the market goes crazy. I bought bitcoins (not enough though!) when it was mostly unknown so my position is perhaps different from most.

The price points are every 1000 but not on round numbers to avoid adding to the price walls. After 20k, they are every 5k. It is asymptotic  . I would not have dared thinking that it would reach more than 10k so I don’t make previsions any more.

. I would not have dared thinking that it would reach more than 10k so I don’t make previsions any more.

I will hodl my BTC until they hit 100k USD each. And then go shopping for a nice house…

Very interesting…

Edit: This is actually why I think, that a global BTC ban eventually come some day, but might not work. There will be always China, Russia or even Switzerland who might not agree with that ban.

https://www.coindesk.com/china-bank-government-bond-blockchain-bitcoin

On a side note, which is preferred exchange to buy BTC in Switzerland. In the past, I was using Coinbase mostly. Since the Coinbase does not accept CHF deposit, I have to convert to EUR using revolut. Kraken and Lykke offer both CHF to BTC pairs.

Using Kraken since forever. I can really recommend them. Transfered CHF both ways also high (10k+) sums. I like that you can also change fiat currencies (USD, EUR, CHF) on Kraken.