The Disappearance of the US-based Grayscale Premium Demonstrates the Importance of Europe’s Crypto ETP

It’s less than this number the “real” or most used private key. People not use all possibilities but only some methods or dictionary words. Quantum computer are perfectly fitted for this type of search and are pretty fast. One day or other it can be done and everyone or most know that. Computing power evolve pretty fast.

Rotate key it’s not safer. Each new private key you should send some btc for check if someone monitor this private key before put the real deposit that’s time consuming. Some private keys are monitored not forget that’s a public database you can check quickly transactions on public key linked when you have the private key for retrieve coin faster than the real owner.

“Not an asset class”

https://t.co/LJaHNvxzI7?amp=1

“Bitcoin is now ranked as an asset class”

https://t.co/JXrGsnwAqZ?amp=1

I think you are confused by the scale of what you are suggesting, and why would you have a private key to monitor to begin with? I think you would have better chance at winning the lottery, quantum computer or not.

And if you have a quantum computer to attack, you also have one to generate new encryption algorithm.

Capital Allocators (Ted Seides) has an interesting mini series on investing in Crypto.

Including NFTs, for noobs like me.

And another interesting one (also part of a bigger series), explains a bit Layer 1 vs. 2 and Lightning pools etc.

Preston Pysh is an amazing host that I can only recommend. His podcast BTC007 is with Jack Mallers from Strike (cf another thread in the forum).

Other recent news:

- Bitcoin reached a new all time high of $61,556.59 over the weekend, a nice return of +1500% for those of you who bought during the March crash last year.

- Nigeria, Africa’s biggest crypto market, has seen a 15% surge of activity in peer-to-peer transactions since the Central Bank of Nigeria ban on crypto.

Guys it is not a crypto asset itself but is betting on the blockchain technology the Invesco Elwood Blockchain ETF. Admit that I bought only in February unfortunately not in 2020…

Too many goods news, not enough time, here are a few from the past 10 days:

- Visa plans to enable Bitcoin payments at 70 million merchants

- Both Fidelity and Goldman Sachs have filed for a Bitcoin ETF

- Kentucky passed two laws to give BTC miners tax breaks on electricity and clean energy incentives

- Germany has now more connected bitcoin nodes than the USA

- Microsoft has launched a decentralized identifiers solution on the bitcoin layer 2

- Nigerians are trading over $200m of BTC per month, most of it outside exchange through Wechat and Telegram

I was REALLY not expecting this, and I am not convinced it is the future of Bitcoin… But btc is really becoming mainstream.

Both Chipotle and the Teletubbies are announcing something tomorrow related to bitcoin…

Early April fool?

Very likely. 20 chars

Worth noting that the Teletubbies tweet got more engagement than Goldman Sachs announcement about their bitcoin offering.

Looking forward for the new Teletubbie with a bitcoin symbol shaped antenna. I’m… kinda not sure it’s a good thing when we make financial pranks with young kids stuff, that’s very young for such an exposure but oh well, I’ll just enjoy the April Fool’s jokes and have a good crack.

Boring news: 63500k ATH

Just another 6x and I’m FI…

You will soon move to Fat Fire territory if it continues as it should

If you are reading this and wondering if it is too late to buy bitcoin, think again, at $63k it is still cheap. It is almost irresponsible to have no BTC these days.

A few things that are happening:

- US politics are warming up to BTC, see Minority leader of the US house of rep. Kevin McCarthy who encourages the government to better understand Bitcoin. Or SEC commissioner Hester Peirce saying they are past the point of banning BTC

- Southampton FC will let players get their bonuses paid in BTC.

- TIME magazine will accept BTC and is planning to hold.

- There are now 9 ETFs filled in the US

- And of course, Coinbase IPO due on April 14th

The party is just starting!

Tomorrow will be very interesting because of Coinbase going public, I expect higher volatility than in the past couple of weeks. No idea of the direction though, if I had to guess I’d say

Just reacting to this: money left on the table, especially when it is a bet, is not an irresponsible thing. Slow and steady works, sticking to it is as responsible now as it always has been.

Adopting it now is not a necessity. If the world globally turns to defi and gives up fiat, people like you (the reader, not Oliv, I know you understand defi better than us random Joes ![]() ), and me, and our parents will have to be eased into it. People who don’t have milions now will have to be able to use defi without loosing everything they have or the change just won’t happen. They won’t be richer but they won’t be significantly poorer either.

), and me, and our parents will have to be eased into it. People who don’t have milions now will have to be able to use defi without loosing everything they have or the change just won’t happen. They won’t be richer but they won’t be significantly poorer either.

Dragging people into a bet is what I would consider irresponsible. Governments may be irresponsible and fiat may be due for hyperinflation but Bitcoin may not be the solution that makes it to the finish line. It may crash, big time. Diversifying some part of our assets that we can afford to loose into it may fit our strategy, or it may not, but it is in no way a necessity that it would be utterly and blatantly foolish not to do.

Edit: my personal beliefs as a note: the US have just had a new round of stimulus. Every asset is inflated today, people have money to invest burning in their pockets. That money will enter the markets, a good chunk of it will end up in BTC that is rising. Then, the free boost will have passed and the growth of assets will slow, or stop, or they’ll deflate, potentially big time.

Now may be a time for short term plays (think two weeks, don’t get attached, don’t make your plays longer than that if they are based on opportunity and didn’t fit your strategy one month ago) but it is especially a time to let things play out and be ready to jump in early in the aftermath. Opportunities will probably abound when most people around won’t have money to pour in anymore (in contrast as of when everybody can compete with you because they’ve got free money to spend on whatever).

I was last few weeks quite irresponsible… convinced several of my friends to invest in BTC. I think, the key here is again risk management and having a strategy for the crypto part (my is 99% of liquid investments in crypto). But my friends are now from 1% to 10% in. They understand very well, that BTC can drop to 5k or even 0.

There is a slight chance, that if you are not invested in crypto, one day you may be ruled by crypto kid billionaires ![]() . Why not mitigate this risk…

. Why not mitigate this risk…

Unless they put an end to democracy, that doesn’t register as a risk in my chart: there are billionaires with way more money than I have right now, there will probably still be billionaires with way more money than I in the future. Does it really matter who they are?

What I’m trying to say here is that missing an opportunity to be the wealthiest man on Earth isn’t a risk. Having an option to become said wealthiest man on Earth is an opportunity (that comes with risks). Both must be considered together (what risks do I take to seize what opportunities?) but shouldn’t be assessed in the same way. It’s totally reasonable to consider that some opportunities (for example owning BTC) are not worth pursuing. It’s probably also reasonable to consider that the opportunity is worth the risks and to, indeed, own some BTC.

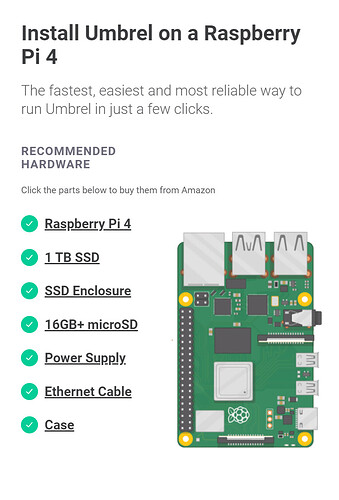

Is anyone of you running a bitcoin node? With Umbrel it’s pretty easy once you have the hardware (around 250chf since you need 1 TB ssd)

Find more infos here https://getumbrel.com/