There will be other dips… no worry.

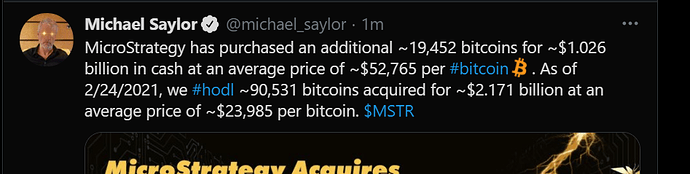

Someone took advantage of the dip :

Square announced today that it has purchased ~3,318 bitcoins at an aggregate purchase price of $170 million. Combined with Square’s previous purchase of $50 million in #bitcoin, this represents ~five percent of total cash, cash equivalents & marketable securities as of 12/31/2020

There’s already Grayscale

This thing is so much dead. I told everyone it was going to crash anyway.

Don’t Buy Bitcoin. It’s Going To Crash!!!

Amazing.

My bet: coinbase dropped 5000 btc on the market Monday to create a quick drop and generate fears so that microstrategy, and possibly square, buy their stacks a bit cheaper.

Anyway, Saylor is either a genius or a fool, time will tell.

He’s no fool. He’s betting with other people’s money.

Swiss bank Bordier will now offer crypto currency services to their clients thanks to a partnership with Swiss crypto bank Sygnum: full story

It will soon become a competitive advantage to offer this type of service, other banks will have to follow or become irrelevant.

Btw Coinbase is going public soon… anyone ready?

More or less. My reserves of popcorn are a bit low.

People who sell the shovels tend to come out ahead (coinbase has an incredible margin compared to regular stock exchanges, I think they make 0.5% per transaction on average, that’s massive). Sounds like a pretty nice business.

And even if bitcoin gets dethroned, as long as there’s a cryptocurrency du jour that people trade, they’ll still profit from it. (If the whole ecosystem fails then they’re more in trouble though, but definitely less risky than bitcoin itself)

Re bitcoin, Research & Insights — Bridgewater Associates was pretty interesting (though it misses a lot of points, it’s a bit more finance/economics/regulatory focused than technical).

Summary is:

That is why to me Bitcoin looks like a long-duration option on a highly unknown future that I could put an amount of money in that I wouldn’t mind losing about 80% of.

One surprising (to me) thing was that the btc price wouldn’t increase that much if it would be successful enough to replace half of private gold holdings.

They estimate it as an “only” 160% increase, I was expecting something much bigger, for comparison that’s 24 years of a boring 4% investment, or 14 years at a more aggressive 7%. I would expect ~10 years to realistically replace half of gold, with a good chance it might not happen. Even if someone is bullish, there must be something else to justify the payoffs?

You just not care about public key. You just need to generate all private keys and check the distributed DB if there is something behind this key so not any security at all. Security is based only on the number of the private key but range is limited and know. Quantum computer is perfectly fitted for done this job.

Why it’s a main target because the first one who retrieve all btc prove his quantum technology his better

A bank account have people behind their system and they are some alarms for lock the system. With BTC there is no for check what happen is just a public database so you just try and retry until you found something. Some webpage generate 10 private random key at each refresh and give the wallet amount

Look history of private key 0 to 9 you can generate yourself the key and check the DB.

You just need to generate 1,461,501,637,330,902,918,203,684,832,716,283,019,655,932,542,976 private keys…

And even if you find one, you are 140x more likely to find a wallet with <0.001 btc than a wallet with >10 btc. This won’t even cover your expanses to run your quantum computer.

Check the math here, it is a very good read if you like big numbers.

Also don’t forget about the possibility to soft fork for sha256 and later on to whatever will be the post-quantum encryption.

Fwiw bitcoin uses ecdsa (elliptic curve crypto) which is vulnerable to quantum algorithms (shor’s). It does target specific keys (so it’s not like finding random adresses). Estimates put such things to be usable in decades (but who knows maybe some state actors can be more advanced, that has happened)

Post quantum crypto isn’t there at the moment, but does the protocol plan for forward compatibility? (It can be a pain to rollout if a transition wasn’t thought from the start, post quantum crypto candidates have much bigger keys iirc)

That’s the equation between your public and private keys. If you change your key at every transactions, you cannot use a quantum computer to find a private key. You will have to generate random ones in the hope to find something. Good keys hygiene is sufficient.

Hence the real problem being lost coins and the mempool. My understanding is that we can solve that with a soft fork once we have found the right encryption level, which is BTW a global problem not only for bitcoin.

But it’s like 20% of all bitcoins that haven’t moved recently right? So yes if people rotate keys regularly they can make it harder for an attacker. But those 20% would already be a nice loot.

Anyway we’re publicly decades away from quantum computing being good enough for that.

Exactly, that’s what I meant with lost coins, they could easily crash the market for instance by stealing millions of btc coins. Apparently we could soft fork a “ban” of these coins, but honestly I don’t know how we could win a consensus on this. Sounds difficult.

Some news to start the week:

Banks are getting there: Bitcoin could become the “currency of choice for international trade”, says Citi

How many bitcoin will Twitter buy? Twitter, Inc. Announces $1.25 Billion Convertible Notes Offering

Edit: another bank is joining the fun Goldman Sachs restarts cryptocurrency desk amid bitcoin boom

Some news to keep this nice momentum going with two new institutional purchases:

Norwegian Firm Buys 1170 BTC for Its Treasury, Says ‘Our Strategy Is to HODL’

Hong Kong-listed Meitu Bought $40M Worth of Bitcoin and Ethereum

I really like the fact that these are not US based companies as it means btc is gaining international attention.

Edit: PayPal to Acquire Curv this is huge, Curv is a known infrastructure for crypto. It shows the commitment paypal is taking on this new financial system that is being built.