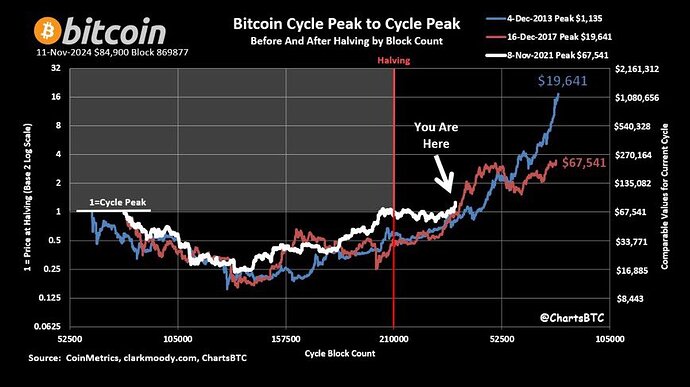

One could think it’s the first cycle….

![]() “Bitcoin mania taking over the stock market too as Coinbase and Microstrategy are both in Top 5 most traded stocks today, something i’ve never seen, only Tesla and Nvidia more. Both up an absurd 18% today. Feels like a craze, at least for the moment…”

“Bitcoin mania taking over the stock market too as Coinbase and Microstrategy are both in Top 5 most traded stocks today, something i’ve never seen, only Tesla and Nvidia more. Both up an absurd 18% today. Feels like a craze, at least for the moment…”

I am kind of surprised to see this level of hype after 2 years of bull market. But I am also sure that it can go higher!

I would say , right now the mood is RISK ON. So most risk assets are going up asset prices are getting stretched.

Let’s see how it goes. But it seems like for time being bull market continues in US.

In addition -: apparently there is also a talk to remove some regulation which stops US Banks to custody Bitcoin. This is also going to help adoption.

I am thinking one point which I don’t really understand.

At this moment, almost all asset classes are at all time high except bonds

- stocks

- Gold

- US real estate

- Swiss real estate

- I also heard Money market funds are at all time highs

- Bank deposits in US commercial banks are 1.5% below all time high

Does it mean that money moving into BTC is actually moving away from BONDS post pandemic?

The money supply is not fixed.

You can borrow today money from your bank and invest in btc…

The bank simply records the loan as a receivable. Newly created money will be wired to you.

No money needs to be moved out of any existing investment.

When you repay the loan, the bank cancels the receivable and the money disappers…

So, no, bond money doesnt move to btc

Bank cannot create money. They can only loan money from deposits they have. That’s why we have cash reserve ratios to maintain minimum amount of deposits.

As far as I know only bank that can create money is Federal reserve or other National banks.

But I understand. You are saying that BTC is not taking money from anything. It’s just taking newly created money (by national banks) like everything else is.

Sorry, but your understanding is not correct.

Banks do not create loans based on the amount of deposits.

I oversimplified by leaving out the capital requirement s.

I find a lot of very technical sources but i think this one is decent for the start

Commercial banks create money by using book entries. Take the example of an individual, Mister X, who takes out a consumer loan. When issuing the loan, the bank credits Mister X’s checking account (demand deposits) in the amount M corresponding to the loan, which increases the ‘customer deposits’ in its liabilities, and therefore the money supply. At the same time, the bank records its credit to Mister X in its assets under the ‘customer loans’ heading.

Wow

I have to read about this.

I always thought banks collect money from different people and loan a large portion of it.

What you are saying is really astonishing for me. But good that I asked this

My life would never be the same again ![]()

I couldn’t believe it either. Saw it the first time 10 years ago and was so puzzled.

Bitcoin… wife changing event.

There was even an initiative in CH addressing this issue…

Now that’s a bull run.

I’m pretty sure that a “correction” will come at some point but with how things are progressing tI also wouldn’t be surprised if the correction is a crash from like 120k to 80k or something like that so for now I will just do what I’ve always done. Forget about it, enjoy the ride and keep hodling

Impossible. I’m too weak…

I meant in the sense that I just chill and don’t think about the decisions. It’s kind of fun to open the app every couple of hours and see +1-2k. But because I know that it doesn’t change anything there’s no stress. In my mind a month ago we were at 60k. If it drops to that point or even below that, it’s always good to zoom out and get some perspective.

But obviously I’m not nearly as all in as you. With these bull runs trying to time the market would be tempting for me but if you are 96% in or something like that, there isn’t much to think about. 1 BTC = 1 BTC

When Bitcoin falls from $980,000 to $650,000, no coiners will say “I told you so, I KNEW it was going to crash!!”

i admire your conviction!

Yeah the crypto market will for sure surpass the American stock market in market cap lol.