Fees exploded… 1000 - 2500 sats/vB.

An explanation by Jimmy Song.

So… where is the big increase in the price of bitcoin after the halving?? ![]()

![]()

![]()

Wait and see ![]()

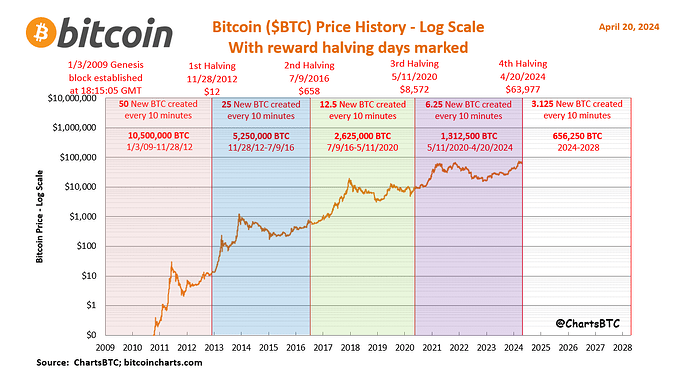

After the 4th halving, every month ca. 13500 new bitcoins are created. Inflation rate is now 0.85%.

13500 was about the neflow of a good day into the ETFs.

And if history repeats:

„After the halving“ is a period of 4 years

So just we are clear, the main reason for BTC to double or quadruple over the next 4 years would be that we can mine less of them, right?

What about the actual use , it is also increasing ? Are we seeing increase in adoption in terms of „payment transaction share versus fiat „ or „store of value replacement of Gold“.? As far as I know people are buying BTC just like a stock - they are not selling their gold to buy BTC.

Question : What’s your exit strategy on BTC for this cycle (even if maybe we’re in a supercycle and the 4 years cycle doesn’t exist anymore) ? Are you DCA out since à definit price ? Or are you watching some indicators on-chain etc ? Or do you plan to exit in one time ? It’s easy to buy but hard to sell ![]() . I won’t be this guy who dimond hand the top and endure 80% drawdown, even if I hardly trust BTC in the long run.

. I won’t be this guy who dimond hand the top and endure 80% drawdown, even if I hardly trust BTC in the long run.

Rebalance a crypto position to base asset allocation everytime it doubles or halves.

Yeah that’s me, RSI 14 of 70+ and I’ll see where I am.

I have alts though so the stones found in ancient Inca ruins said that “When the goat blood looks pale you need to wait for the white crow to fly three times, and then the moon will shine on you”. meaning the theory for alts is that they come after the BTC and ETH cycles.

Can’t wait to get out of this shit to be honest.

What is the rational behind and where (which platform/bank/broker) you would prefer to buy it?

Thanks in advance ![]()

I can‘t lose my assets. I don‘t have to worry about being hacked.

Btw holy molly ETH.

ETF approval incoming

What is the best way to buy it?

Buying FBTC where you also buy your stock ETFs.

I didn’t know that this is now available on IBKR.

Since a few days it is available to IB UK clients (which is the default for Switzerland) through their partner Paxos.

Banana Zone in coming months ![]()

![]()

@stojano ,

Which lightning network BTC wallet have you set up for your children? Could you outline the reasoning for your decision?