Quick update after 1 year on this forum.

My base currency is still euro as it is still the country of FIRE but there is no plan or city defined.

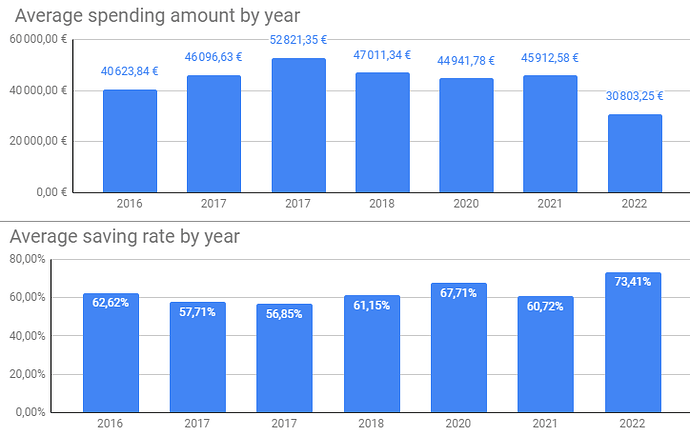

I still track my average spending with my partner without kid in Geneva. I found it useful to define the target annual expenses if FIRE.

Our average saving rate is projected for 2022.

Our expenses are useful to evaluate the target annual expenses.

| Name | Value |

|---|---|

| Debt ratio | 14,63% |

| Safe Withdrawal Rate (SWR) | 3,75% |

| Target Annual Expenses | 50 000,00 € |

| Target Net Worth to FI | 1 333 333,33 € |

| FI ratio | 65,74% |

| Guardrail to go back to work | 933 333 € |

| Calc your biological age vs chronoligical age | 38 |

I didn’t find an useful biological age calculator if anyone knows another one more accurate?

If anyone want to gain confidence to plan retirement with AI, I will recommend this podcast of Ben Optimal Retirement Planning using Machine Learning (EP.165) presenting Gordon Irlam AIPlanner.

My objectives for 2022 will be to:

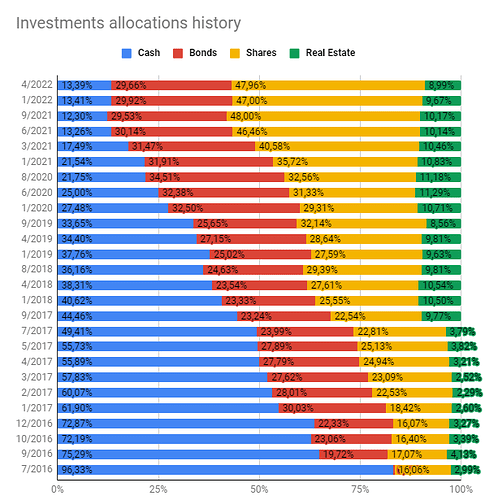

- reduce my cash allocation to 9% and increase share allocation to 52%:

- Increase my debt ratio with an investment into a flat in France.

- I do not really intend to quit my job as it is interesting, colleagues are nice, I got some flexibilty but no career progression. I would like to find something else.

FIRE objective is more to gain confidence to reduce working day to 80% or fund a project.