Just to clarify, SSON is available on Degiro

Really?? What am I doing wrong?

I cannot see it in degiro.ch or degiro.fr using the search function and SSON. I know of another degiro.ch user who also no longer sees SSON or SMT in degiro.ch.

May I ask how you search for it please? Or did you need to contact Degiro for it to be available? (like a permissions thing?)

Thanks!

Have you tried searching by ISIN?

Have just tried searching for GB00BGJWTR88 on both FR and CH Degiro platforms…no results

Yes, I have bought I446196529 (GB00B4M93C53) 3 times this year, as recently as the 8th of March.

Could you please let me know if you’re searching degiro.ch for GB00BGJWTR88 and that it is visible there for you? If so, I will get back in touch to ask Degiro support why I can’t see it…thx!

Not a customer with them, sorry.

I bought Smithson through another EU broker recently though.

Ah ok, thanks for the info…

Just for info in case anyone else runs into this on Degiro: I was eventually able to speak to someone at Degiro and apparently the reason I cannot see Fundsmith on degiro.ch is cos I have a custody account and certain classes are only available to basic accounts. So it seems I finally have my answer!

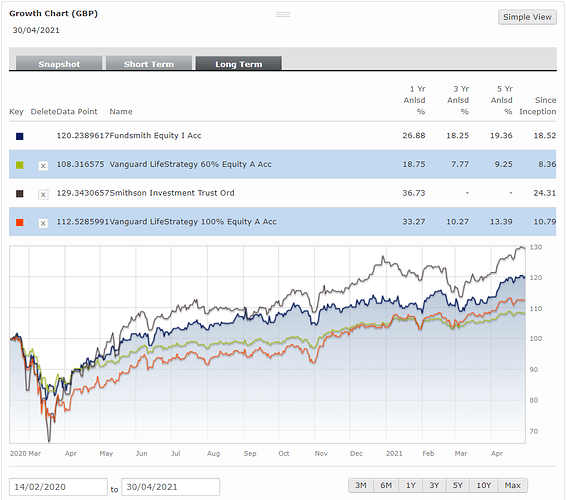

I don’t follow the classic bonds vs. equity allocation because my personal view is that bonds don’t make sense right now. I got wondering how much downside protection focusing on Quality stocks (Fundsmith) would give me vs. buying global stock trackers.

A comparison between Fundsmith and Vanguard Lifestrategy fund 60 (60% equities 40% bonds) shows that from 14 Feb 2020 to Covid trough the dowside was almost identictal. Vanguard lifestrategy 40 (60% bonds) is not on the chart, downside was average 3% more favourable than FS during the crash period

Smithson and Vanguard 100% equity went down more (Smithson focuses on quality smaller companies but smaller companies are more volatile)

Hope it is helpful / thought provoking

Note: Downside for all of the funds in CHF was about 10% bigger than then the chart which is shown in GBP

Hi Barto

Thanks for the interesting comment.

I currently have all my investments in equity ETF trackers, VTI mostly and I have some cash to invest.

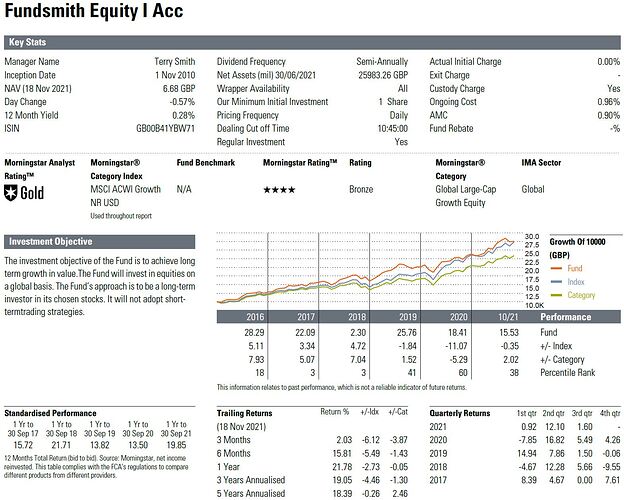

I was thinking instead of bonds, to see how hard it is to invest into the Fundsmith Equity trust. It seems like a defensive hedge (even though it is an equity fund). The fund invests in Dividend paying companies, so to me seems like a good option instead of the Bond ETFs

Any thoughts anyone?

My opinion about bonds is above

Fundsmith Equity Fund is an open ended fund or mutal fund, not a trust. I buy it on Interactive Brokers, steps are as above.

Fundsmith Equity Fund does not target dividend paying companies, quite the opposite, see this link. It targets companies with above market Return on Capital Employed (similar to the approach applied by Warren Buffett)

Edit: this is why Terry Smith would argue the downside risk on the fund should be less than market. The companies the fund owns are making higher returns relative to the rest of the market they are more likely to continue to make good returns in a downturn. Annual letter to shareholders 2020 on Fundsmith webpage goes into this

Perhaps confusingly there is a spin off “Fundsmith Emerging Equities Investment Trust”, they tried to reapply their method to emerging markets, it is not one I invest in and performance has not been good vs index so far

Thanks for your help. On the Dividends , he must have changed his policy. I am halfway through his book and in 2011 he mentioned that 19 out of 20 of his holdings paid dividends and he saw that as important.

I guess as I get through the book i will learn more

I signed up with the Fundsmith SICAV in Lux and have not the choice to buy T or R class shares (only ACC classes relevant for me).

Website says:

T Class Acc, OCF*: 1.11%, € 57.15

R Class Acc, OCF: 1.61%, € 54.62

both classes have a min. investment of EUR 2k

*OCF: ongoing charges, similar to TER in my view.

The KIIDs are identical except for the slightly different OCF/return:

I struggle to understand why one would want to buy the R Class Acc shares? When buying Inc shares, I see the advantage of receiving potentially higher dividends due to the higher number of R shares one could buy with the same amount. But when accumulating and the return is invested, I don’t see the advantage.

Can anyone enlighten me please?

From https://www.fundsmith.co.uk/faq:

T Class – Named after Terry, this is our retail share class for direct investors

I Class – Institutional investors only with high minimum investment requirements

R Class – Retail advised share class which accommodates renewal commission to a financial adviser. This share class is not available to UK new business, however, non-UK advisers may still invest in this share class.

Or in other words, R is what financial advisors sell their clients, the advisor get a 0.5% kick back. As a direct investor you should buy the T class.

Fundsmith Equity Acc I is one of my major holdings besides SP500 ETF as a retail investor. I’ve had it inside a tax-wrapper ISA with AJBell (UK platform) since 2017. Consistently outperforms the Benchmarks and often SP500, & holds value better in a crisis - highly recommend if you can access it.

I’ve been reading this thread with interest and I’m wondering what is the advantage to open an account with Fundsmith UK vs Luxembourg? What made you guys @San_Francisco @mabi decide for UK instead of Lux? (not challenging, this is genuine interest as I’m considering opening an account with them) - Thanks for your insights!

I don‘t know if there’s a great advantage.

IIRC, the EU units have slightly higher expenses (after all, there‘s other EU entities involved), don‘t get the app or online access, do not allow for debit card payments or low monthy investments starting at 100£. Also, while I‘m pretty sure I could register to (COVID measures eventually permitting) attend the AGM as holder of their UK share classes - I’m not sure about their EU SICAV shares. Technically their holders are investing in another fund/entity.

Redemption of EU shares will be less expensive, since Fundsmith UK will wire funds to a bank account. I don‘t have a UK bank account and they might not accept non-bank accounts (Wise, Revolut) for withdrawal. But I‘m not concerned with redemption yet.

Where it may also bite me is if I‘d move to a EU country and have to pay taxes, since some EU countries discriminate against non-EU investments/funds for tax purposes.

I saw you opened an account at IBKR. The simplest option is to buy Fundsmith GBP T class there. Cost per trade is GBP 4.95 which I find reasonable.

Exactly. I think the Lux SICAV fund is useful for residents in some countries where there are tax implications holding the UK fund. Spain may be one such country.

Note the composition of the Lux SICAV fund does not exactly mirror the UK fund. I am not sure why nor that we can predict if one will perform better than the other

Thanks for the explanation, this is helpful ![]()