I’d say most of that “Provision” is UK Stamp Tax which will be due in every way you buy.

The 2020 shareholder AGM video is out:

One of the most striking features: In 2020, the average company in the fund enjoyed a return on invested capital of 25%, and grew its Free Cash Flow by 8%. If that’s what happens when the economy is suffering as it did in 2020, I can definitely cope with that.

Smithson has returned 21% since inception. I don’t know which benchmark you are using, but I’d like some of it ![]() .

.

And if you are referring to the Jan-Feb 21 perf, then:

- Two months is awfully short to judge any performance

- In the same time, GBP/CHF gained around 10%, so I can definitely live with that.

I was going to post here but you were faster! Love the 2020 results and the new beard of Terry Smith ![]()

Thanks a lot, I will definitively watch it.

Also, for those interested, there have been some short interviews of him recently:

https://www.youtube.com/c/interactiveinvestoruk/videos

and this one on the fund size:

Regarding this topic, he already talked about it in previous AGM but basically, at 20 billions, he his not worried.

By way of comparison, it has been discussed that Berkshire Hathaway may struggle to deliver such high returns as in the past due to size. Its market cap is USD 580 Bn

In my opinion minute 6:08 in this video explains why he has been able to beat Mr Market over a sustained period of time

mod stands for moderator. Or maybe they are also models…that would be a nice side income ![]()

(sorry I didn’t resist)

Haha yeah  maybe auto correction or some kind of subconscious desire who knows…

maybe auto correction or some kind of subconscious desire who knows…

As Rolandhino correctly mentioned, the hefty commission you paid is mainly a 0.5% stamp tax levied by the UK government. See here. That’s not optimal, but as long as the fund strategy is sound, I’ll stick to it. Otherwise it would be an example of being penny-wise and pound-foolish…

A bigger “cost” to be aware of is that UK Investment Trusts can trade at a premium or discount vs. Net Asset Value (=value of underlying investments). SSON is currently trading at a premium of around 2%. I am still buying shares as I believe the investment philosophy will outperform the market by more than that over the long term

I‘ve seen a few instances where the premium was substantial for a while.

On the other, I‘ve bought FEET at a substantial discount.

I’m not that worried about the NAV premium as there’s at least a chance I’ll be able to sell for the same or a even higher premium in the future.

Taxes and fees are lost most of the time. If I can avoid it with buying OTC in Ireland or some other trick I’ll take that, but if I can’t 0.5% aren’t a dealbreaker for me. Especially for a fund that charges 1% OCF.

I’m way more concerned about the legal trouble a niche fund (in Switzerland) could cause.

But @Julianek convinced me anyway. He should charge them a commission.

I’m trying to buy into the Smithson fund, but it’s proving difficult. If this is too much of a tangent from the original equity fund, I’ll be happy to open a new thread…

Degiro CH and Degiro FR both have FEET available, but none of the other Fundsmith ones. Degiro support have stated that they will not make them available but would not say why.

I have an account with Boursorama in France and they have SSON available, but it’s pretty steep at 33 EUR minimum per transaction, and I’m only looking to invest 500 monthly. After getting used to Degiro’s 4 EUR fees, 8 times that is a bit hard to accept!

So I thought I’d turn to your collective wisdom for any ideas you may have on other options for a frontalier living in France and working in Geneva to gain access please?

Thanks!

Hi all,

Newbie question. I was able to find fundsmith equity T acc on IB under I444363269 code. But it says 5.51 as price per share. Shouldnt be 550s ? why its 5.51?

The price per T Class Acc share yesterday was 551.38 pence (5.5138 pounds) per the factsheet on Fundsmith webpage. Note FS is an open ended fund priced once per day at noon. If you place a buy order today the price you will get is the price at noon the next trading day

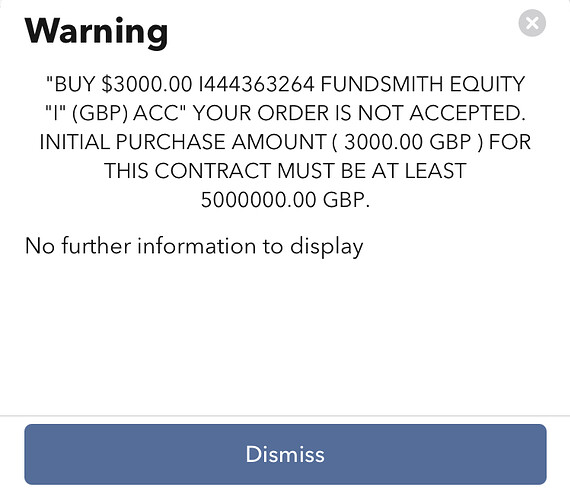

TrickMcDave the screenshot you show is for the I class, which has a minimum quantity £5million. OP is buying the T class

Open ended funds are not traded on markets so I understand why they don’t have Fundsmith. Change to IB to buy FS

SSON is a share traded on LSE so if Degiro lets you buy other uk shares including FEET, this doesn’t make sense. Maybe call them again and say you can’t find this share? (don’t mention FS mutual fund so as not to confuse the issue)

UK has a tradition of quoting stock prices in Pence (often without decimals). Beware of the difference.

Edit: sorry, was a bit late.

Was somebody (ever) able to buy FS T class on IB?