Hey there, I’m new to this but I have a question I hope to get some feedback on.

I found the flat of my dreams. With my current situation I can put 300k and the bank would give me 900k but I am still 240k short. The price is negotiable but not that much.

I am trying to increase my income so the bank would give me more.

My family living abroad has real estate (abroad as well) that’s being rented and I thought this could be a way forward. If my parents start sending me this renting income on monthly basis would that be added to the calculations? If this is possible, what one has to do to put this in place? If this doesn’t work, we can transfer the properties to me so I can get additional income. Has anyone done something of the sort? If not possible, have you got any other ideas on how to leverage the prooerties without selling them?

Thanks in advance for your thoughts on the topic

That is an interesting observation to have. If the price is negotiable, does that mean the flat isn’t in a burning hot market? Could another opportunity meeting your dream criteria be there in, say, 3-4 years, when you’d have the full own funds needed to afford it without dropping in your family’s real estate abroad?

Also, how do you know it is negotiable and how do you know it isn’t by that much?

The usual way is to take a mortgage on it. Is there equity that could be tapped? Would your family be willing to loan it to you?

I’m writing that but truth be told, I’m not a fan of tapping into family wealth to buy a very expensive flat and even less fond of diverting income from parents for what seems to amount to a lifestyle expense. It depends on the financial situation of the family, of course. If they’re multimilionnaires, please ignore this comment. If there are chances they might be struggling, I’d think twice about the whole idea.

Sounds like you are not passing the affordability criteria for the property → Not a good idea (to “fictively” increase income to make it seem otherwise).

(Unless your family can gift/lend you the 240k difference)

Hi dbu, thanks for your response. I am not sure to understand why you refer to that as fictive income. The idea is for my family to start sending monthly payments to me until my salary increases sufficiently to fit in the affordability criteria. Or as mentioned, to have the real estate there transferred to me and still get the rental income on monthly basis. I am not trying to cheat, I am trying to overcome an issue that I have. If I cannot overcome it, I will pass on to that opportunity and wait for the next one.

Hi Wolverine, thanks for your feedback ![]()

The prise is negotiable because the owner told me so and according to the average price per square meter the place is more expensive. But those are only rough estimations.

I think that it’s not that negotiable because the difference of 240K seems big ( approximately 16% I believe).

We don’t have liquid equity to cover for the difference. A solution would be to sell the real estate we have abroad but that’s an option I’d like to avoid. The rental income of those properties is steady so I though that if we can leverage this it would be the better option. The idea is to actually get the payments wired to me. In terms of the family financial situation, that won’t be an issue as this income is mostly used to renovate a vacation place. So this would be just put on hold for a few years as I’m planning to change job and therefore increase my income anyways.

The market here is similar to the average situation in Switzerland. And yes, another opportunity may come but I’d like to take my chances with this one and if it doesn’t work then I’ll wait for something else.

I hope I covered all the questions, if you have any follow up thoughts please feel free to share

One thing since you didn’t mention it. Do you have siblings or are there other direct heirs? (I would strongly recommend rethinking this is if so).

We lack figures here.

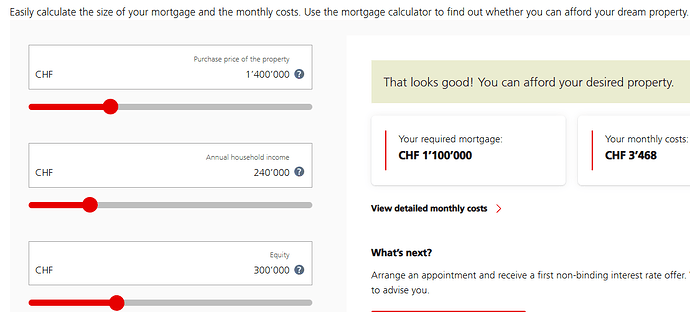

For a 1.4 million purchase (assuming 40 KCHF discount) with a 300 KCHF downpayment, the bank is expecting an annual gross salary of 240KCHF.

What is your annual gross salary ? how much is missing to add an extra 200KCHF loan ?

The bank will ask for your last Swiss tax return and will notice that you get zero rental income from abroad.

How will you explain this sudden change? What type of contract will you sign with your family abroad? Will you become usufructuary of the property in order to receive the rent? You will have to pay income tax abroad and the rental income will be taken into account when determining the tax rate in Switzerland.

If you are not the beneficial owner, the monthly wires could be treated as a gift. Have you studied the tax impact in the 2 countries ?

Hi nabalzbhf,

I do and my sibling is fully on board with the plan. She’s all well thinking how she can help on her end.

Actually for such activities our entire family is aligned and we always help each other. I did help her for her house, we both helped our parents. For us, it doesn’t matter on whose name a property is as we are a family.

The situation is different in desirable cities than in rural areas and my experience is in rural areas but we can be surprised by how much of the price is negotiable. Nogotiating is expected, it isn’t considered rude to make a somewhat low offer because if your starting offer is on the price you’re willing to pay, where will you find the room to get to an agreement after that?

You will only know the real situation by throwing numbers you’re willing to back into the fray. In this situation, I might start with a 1.1M . 1.15M offer, stating that you can’t afford more as the bank won’t lend you that much. It helps if you can find other reasons for it, like technical things if the flat isn’t new, or undesirable (to you) layout or materials decisions have been made. You may say you’re stretching yourself thin and settle on a slightly higher number than you can currently afford. Then I might go to the bank and ask what they can do for me to help with affordability. Depending on the price negotiated on the house and your own attractivity, they may be willing to stretch the affordability numbers a bit.

What I was seeing was increasing the mortgage/taking another loan on the property (that your family would loan or gift to you). Is there room for something like that that wouldn’t require transfering ownership?

Hi Guillaume,

great points. My current income is 160K per year. The rental income I am referring to would be around 12K per year, I am not sure if this will make the difference but still.

For the modalities of this income, it could a gift or I can be the beneficial owner, from our end we can accommodante any option that would be acceptable for the banks. The income tax in the originating country is a flat 10% rate. But I believe that in the EU we are exempted from double taxing. In any case I will declare everything here as well.

thanks Wolverine!

Indeed, I was trying to see what elements of negotiation I have to be well prepared but I am not an experienced negotiator. So, in your opinion 1.1 or 1.15M isn’t too low? for the technical reasons I’ll have to think about. It really is a great place and fairly recent building (2012), solar panels, gaz heating etc.

We have discussed as well the loan option. My family could indeed contract one if needed but I don’t know the amount. this will be clarified next week and is indeed our plan B if my initial idea is not working. to be honest I visited the place Friday so there is a lot to figure out still.

I’m not an expert either and I don’t know the market. What is the listed price of similar properties in the area? Would you be willing to tell us where it is located?

It is probably too low, the idea being that they counter it. Depending on who you are dealing with, they may take offense. It’s no big deal if you don’t have to deal with them later on and you can probably mend things up with a bigger real estate agency as they’re simply doing business and you can later on argue that you were new at this and got carried away. If there are multiple offers available, you haven’t got much negociating power anyway.

I think negotiating power from the buyer’s side comes mostly from experience and not being in a hurry to close on any given deal. If you can afford to wait it out, you can offer lower prices and if you don’t get to a deal, that builds your experience which will help for the negociations on the next item.

It’s in Neuchatel. I have visited similar flats (10 m^2) bigger, new building, no garden and no partial view to the lake, similar location and it’s 1.16. The flat I want to buy has a garden and a partial view.

I’m dealing with the owner who’s actually a very nice person and I wouldn’t want to offend her. I’m not in a hurry but I really think that flat is great as it fulfils all my criteria and even goes beyond.

I just thought that my negotiation stategy would be to be honest with her, offer the maximum that I can and see what happens as in any case I won’t be able to match the full price.

In general, what counts in affordability calculation? Only employment income ? Or can you add bonus, dividends from ETF, dividend from private company, rental income?

Also, does it helps if you have significant assets? For examples more than the value of the house in ETFs ?

Hi Tokzoo,

I am not a specialist so if you want to better assess your situation an adviser would be the best person to turn to. I know some banks take bonuses as income (but count 50 to 80% of the bonus).