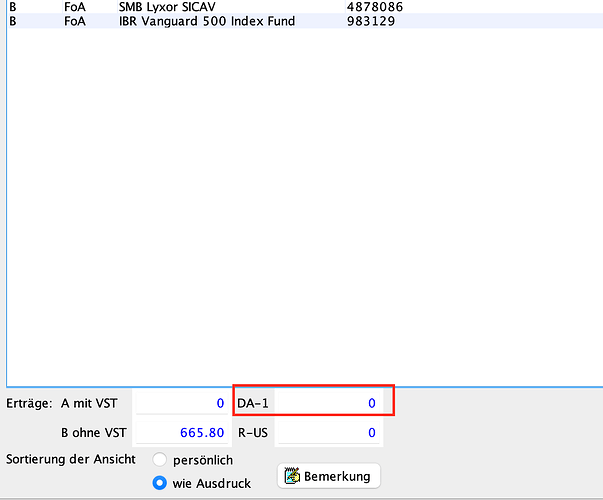

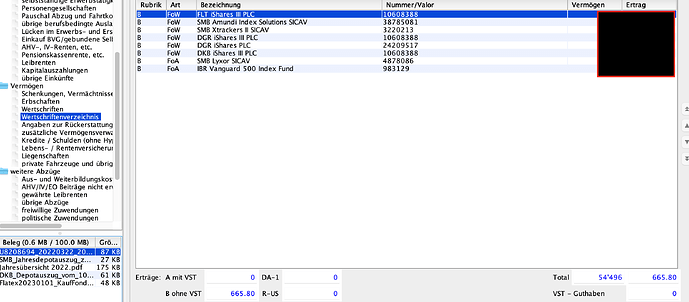

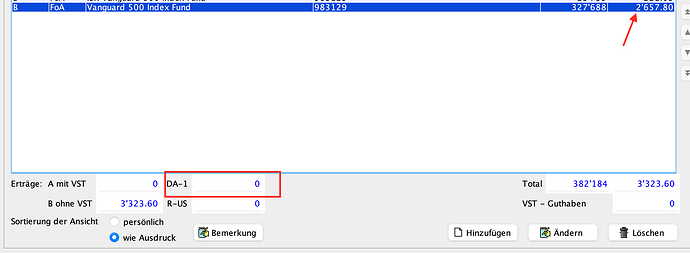

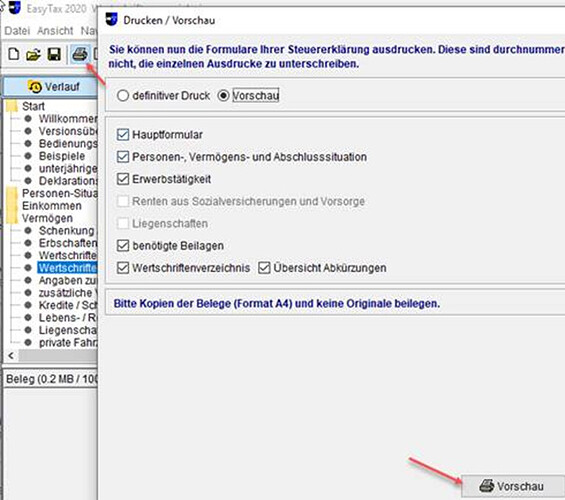

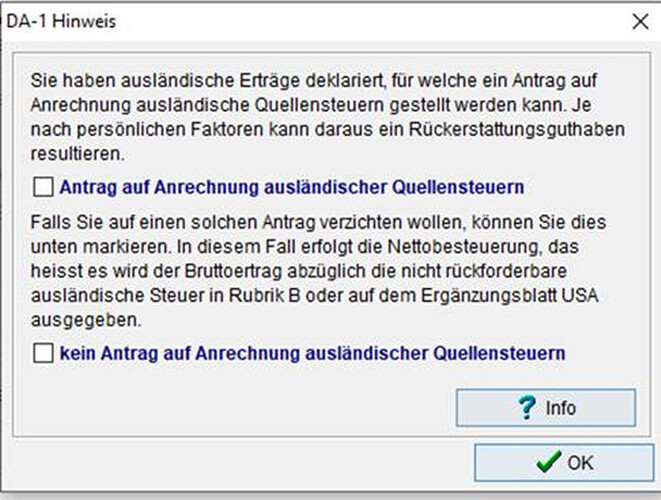

Die Auswahl, ob ein DA-1 erstellt werden soll oder nicht, wird in EasyTax erst bei der Druckvorschau angezeigt (DA-1 Hinweis → siehe folgender Printscreen).

Anrechnung ausländischer Quellensteuern für ausländische Dividenden und Zinsen

Die Anrechnung ausländischer Quellensteuern dient zur Vermeidung der doppelten Besteuerung von Wertschriftenerträgen aus ausländischen Staaten, mit welchen die Schweiz ein Doppelbesteuerungsabkommen abgeschlossen hat. Eine doppelte Besteuerung erfolgt, wenn der ausländische Staat auf Wertschriftenerträgen eine Quellensteuer erhebt (wie z.B. die schweizerische Verrechnungssteuer) und dieselben Erträge in der Schweiz mit der Einkommenssteuer erfasst werden.

Aufgrund der Doppelbesteuerungsabkommen besteht bei den meisten ausländischen Staaten ein Rückforderungsrecht für einen Teil der dort belasteten Quellensteuer. Anstelle eines solchen Rückforderungsrechts findet vereinzelt aber auch bereits im Zeitpunkt der Ausschüttung eine reduzierte Belastung statt. Für den im ausländischen Staat verbleibenden, nicht rückforderbaren Teil kann in der Schweiz mit dem Ergänzungsblatt zum Wertschriftenverzeichnis (DA-1) die Anrechnung ausländischer Quellensteuern geltend gemacht werden. Dieses Ergänzungsblatt wird durch EasyTax automatisch erstellt, sofern beim Ausdruck nicht ‘kein Antrag auf Anrechnung ausländischer Quellensteuern’ gewählt wird (siehe Abschnitt ‘Nettobesteuerung’ unten).

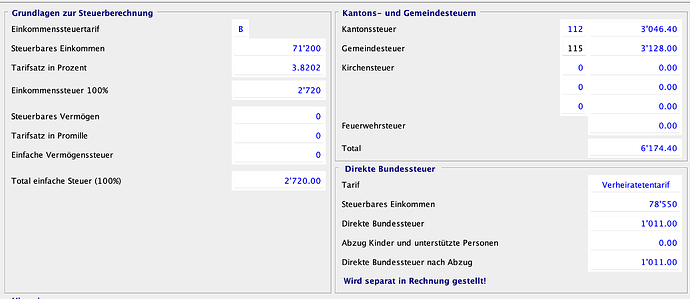

Das Kantonale Steueramt berechnet anhand der persönlichen Veranlagungsdaten die sich aus den ausländischen Erträgen für die Einkommenssteuern von Bund, Kanton und Gemeinde ergebende betragsmässige Belastung. Dieser Betrag wird mit dem Total der nicht rückforderbaren ausländischen Steuern verglichen und der geringere der zwei Beträge ausbezahlt. Die Auszahlung stellt keine Rückerstattung der ausländischen Quellensteuer dar. Sie ist vielmehr die Vergütung der andernfalls aufgrund des Doppelbesteuerungsabkommens in der Schweiz zuviel erhobenen Einkommenssteuern.

Die Anrechnung ausländischer Quellensteuern kann laut eidgenössischer Verordnung nur gewährt werden, wenn die Summe der nicht rückforderbaren ausländischen Steuern in einem Jahr den Betrag von CHF 100.-- übersteigt. Ist dies nicht der Fall, so gelangt die Nettobesteuerung zur Anwendung.

Nettobesteuerung

Bei der Nettobesteuerung wird die Brutto-Dividende abzüglich die nicht rückforderbare ausländische Quellensteuer (in der Regel nur ein Teil der gesamten ausländischen Steuer) besteuert. Anstatt einen Antrag auf Anrechnung ausländischer Quellensteuern zu erstellen, wird daher durch EasyTax der entsprechende Nettowert in Rubrik B des Wertschriftenverzeichnisses ausgedruckt (bei USA-Positionen ev. im Ergänzungsblatt RUS). Beispiel: Eine Brutto-Dividende von CHF 200.-- mit einer nicht rückforderbaren ausländischen Steuer von 15 % ergibt einen steuerbaren Nettoertrag in Rubrik B von CHF 170.–.

Kein Antrag auf Anrechnung ausländischer Quellensteuern

Anstelle eines Antrages auf Anrechnung ausländischer Quellensteuern (DA-1) kann die Nettobesteuerung beantragt werden. Dies geschieht in EasyTax durch das Markieren des Feldes 'kein Antrag auf Anrechnung ausländischer Quellensteuern". Dadurch wird wie im Beispiel oben automatisch der Nettoertrag in Rubrik B oder allenfalls im Ergänzungsblatt RUS ausgedruckt.

Die Nettobesteuerung ist dann von Vorteil, wenn aufgrund von deklarierten Schuldzinsen ein sehr geringes oder gar kein Guthaben aus Anrechnung ausländischer Quellensteuern resultiert. Der Entscheid - Nettobesteuerung oder Antrag auf Anrechnung ausländischer Quellensteuern - ist einzig Sache der Steuerpflichtigen. Eine Beratung seitens der Steuerbehörde ist ausgeschlossen. Wenn jedoch ein Antrag auf Anrechnung ausländischer Quellensteuern gestellt worden ist, kann nicht nachträglich die Nettobesteuerung gefordert werden.