Hello guys,

I am filling my tax declaration in Geneva canton and would like to double check if my logic is correct.

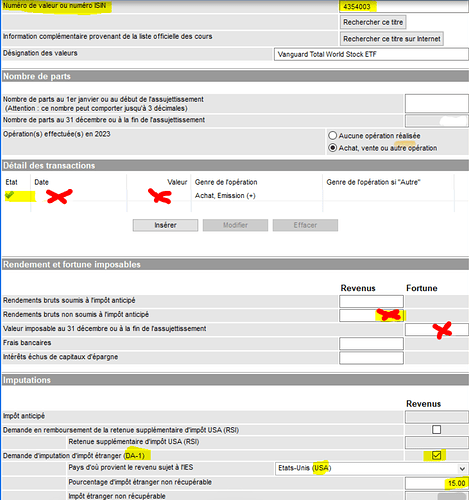

I have purchased regularly VTI via interactive brokers over the last year.

Below is screen shot from tax system with all data filled by me.

- one question is what type of security from their list corresponds best to ETF?

- Action ou part sociale

- Fonds de placement

I also listed all my purchases over the year. so noting tricky.

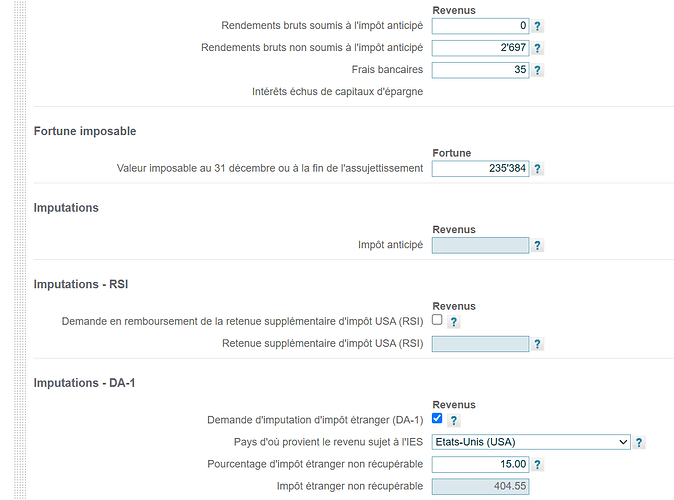

- for below screen shot I would like to double check my logic:

Rendements bruts soumis à l’impôt anticipé gross income subject to swiss withholding tax =>non relevant for me since i do not hold securities domiciled in switzerland

Rendements bruts non soumis à l’impôt anticipé gross income subject to swiss withholding tax => which includes dividends paid on my ETF (value taken from broker statement)

Fortune imposable value of my investment on 31 dec (value taken from broker statement)

DA 1 calculation

All my purchases were done via Interactive Brokers which is a foreign broker with the status of “qualified intermediary” => which results in 15 % of non recovered withholding tax on my dividends ie abt 404 chf that i will be able to recover next year.

i plan to attach statement from interactive brokers showing all transaction, withholding tax paid in the USA and dividends received

any thing that i am missing or my logic is wrong ?

I appreciate your time and advice