Correct, to my knowledge, the R-US refund is unconditional (besides declaration, proof), similar to the 35% Swiss withholding tax on domestic dividends/interest.

Sorry, I’m really a bit dense here.

Then the guy mentioned above, making (purely from US taxed at source dividends) CHF 20k pays CHF 122 income tax, but gets CHF 3k RUS back from Switzerland? (after declaration, proof)

I would say following will happen

Investor makes 20,000 income

Pays 3000 as US WHT

Pays 3000 as Swiss RUS

Total -: 6000

At time of tax declaration, 3000 RUS would be fully refunded.

And only 122 for the US WHT part.

Gotcha, thanks!

I misinterpreted @jay’s initial reply to my first post about the CHF 20k US income guy.

This forum rocks! Thanks, gals and guys!

Edit: In my next life, I’ll skip the physics curriculum and will opt for tax law instead.*

* I’ll drop out in week 2 after recognizing my incompetence and go back to physics.

By then even tax will be part of physics like machine learning …

Atleast for Nobel prize purposes

For completeness sake, and possibly for better remembering, the full name is “zusätzliche Steuerrückbehalt USA”, the zusätzlich=additional denoting/clarifying that it is in addition to the US WHT.

The name I mentioned was from ZH pvt tax software

But I agree the full name is a bit more clearer

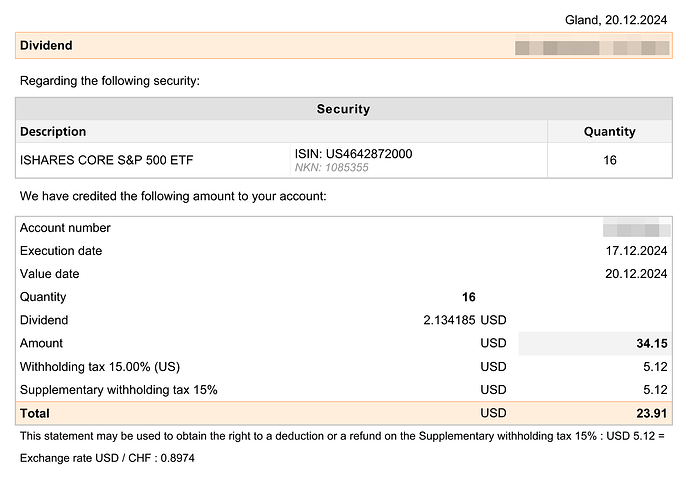

I recently made my first ETF purchase at Swissquote (I don’t remember filing W-8BEN), without having researched the tax implications. I immediately had buyer’s remorse when I received this dividend statement. I then thought I should have bought an Ireland-based UCITS ETF, but reading this thread it seems that as a Swiss citizen (or resident?), a US ETF might actually be better. ChatGPT mentioned that there might be inheritance considerations that favor UCITS. But based on the information in this thread (thanks a lot!), I conclude that:

- I will get back in full the “supplementary withholding tax / zusätzlicher Steuerrückbehalt” of 15% ($ 5.12)

- I will also “get” the “US withholding tax / nicht rückforderbare ausländische Steuer” of 15% ($5.12) in form of a reduction to my swiss taxes, thanks to the double taxation agreement betwen CH and US.

Surprising how difficult it is to find good resources on this topic. One good strategy seems to be to make a test purchase and see what actually happens. Almost looking forward to filling out my 2024 tax declaration now. I guess this is the closest to a “tax return” we get in Switzerland.

Note: there’s a 100 CHF limit on being able to get da-1 refund iirc.

@nabalzbhf Thanks for the pointer, so I can manage my tax return expectations ![]() I’m just trying to understand it before going all in

I’m just trying to understand it before going all in ![]() . Also I thought this thread could use a real-world example of a US-ETF at Swissquote as discussion basis

. Also I thought this thread could use a real-world example of a US-ETF at Swissquote as discussion basis ![]()

Edit: I see you wrote earlier:

if you know someone holding US stock at PF or SQ maybe you can ask them to check how it’s reported

Your experience with SQ is as was mine.

I moved all my USA holdings fom a oversease borker in EU. WIth this broker, I had a W8BEN filed and they deducted 15%. I always declared these on my Swiss Tax Return (in SZ). The SZ Steueramt told me (via comments on my final approved return) that the 15% could not be reclaimed (they could not guarantee the recovery if this) because the broker “was overseas”.

So I moved my holding to SQ. I filled in a new W8BEN with SQ. Actually filing this W8BEN seemt to have no affect at all.

SQ deducts 2 * 15% = 30% from all dividends regardless of the W8BEN !!

However, I expect/hope that when filing my tax return for 2024, the SZ tax office will refund 15% and also give credit for the other 15%.

Therefore, I hope to be in a better position with SQ than with the other oversease broke. Also SQ had an offer for transfer cost reimbursement which covered my costs of making the move.

@PatF Haha we will find out soon! Thanks for sharing!

Have you read this ?

@Abs_max No I didn’t, thanks! Good overview! But it makes it look at first glance as if the Ireland based ETF had no tax burden. My current understanding is that 15% US withholding tax is already deducted before they pay out dividends, and those cannot be reclaimed? Anyway seems like an important point to include in the summary.

Note to self: Maybe buy an IE-based ETF of the same index just to compare the dividend statements.

That’s clearly a misunderstanding from the tax authorities.

As long as you meet the criterias, you can get the 15% back with your DA-1. Where the broker is situated plays no role.

However, you have to prove that the 15% were withheld. This is where the quality of the documentation provided by the broker is important.

That’s the last point in the summary

@Abs_max You’re right, I see it now. But instead of a footnote, shouldn’t the summary say:

VWRL: 15% US withholding tax already payed by the ETF, non-recoverable.

It sure lead to another round of discussions here ![]()

Edit: Wouldn’t this be the main argument for holding US ETFs over UCITS/IE-based ETFs? (not trying to provoke, I am still trying to understand this correctly)

Actually the wiki was created to explain how to get refund for WHT depending on different scenarios

The topic of tax efficiency of UCITS vs US ETFs is more complex. US ETFs have better WHT tax efficiency while UCITS help avoid IRS Jurisdiction on estate taxes

Read this for estate tax topic

@Abs_max I see, thanks for the link! Personally I still think it’s misleading to write 0% withholding tax, when they are hidden in the fund.

It’s a Wiki

Feel free to modify