Indeed, this seems like a conundrum.

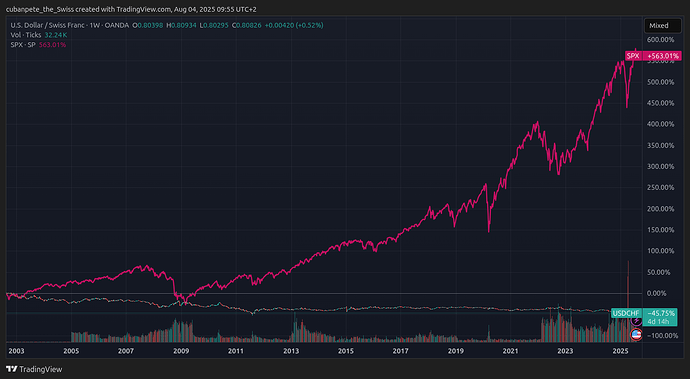

As mentioned, part of my portfolio consists of dividend growers (the stock picking part of my portfolio has grown dividends 25% since 2021, which is a fair bit more than the USD has fallen against the CHF in that period).

My other strategy that I’ve only implemented in CAD and GBP (those are fast appreciating currencies for those not in the know …  ) is to diversify into companies across the globe. It’s just damn harder to find an as investor friendly market as the US.

) is to diversify into companies across the globe. It’s just damn harder to find an as investor friendly market as the US.

I’ve mentioned this elsewhere before on this forum (and admittedly perhaps it’s a little easier to embrace the thought with a large enough portfolio/cash flow): I feel very privileged given my financial situation and living in Switzerland. I’m thus ok paying part of my (dividend) income as taxes to help those less fortunate.[✱]

Funny you’re asking …

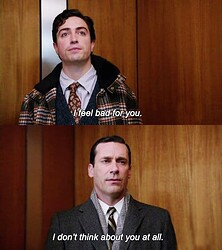

I reached the conclusion last year. A much admired (by me) co-worker retired and a new hire introduced corporate drama that contributed significantly to my decision to pull the trigger. It was either the full trigger or the 90% trigger that I am on right now, where fully remote work shields me from 95% of the new drama introduced. Almost seven months into this experience I’d say that this is what I can sustainably bear going forward.

Thanks!

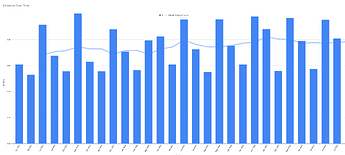

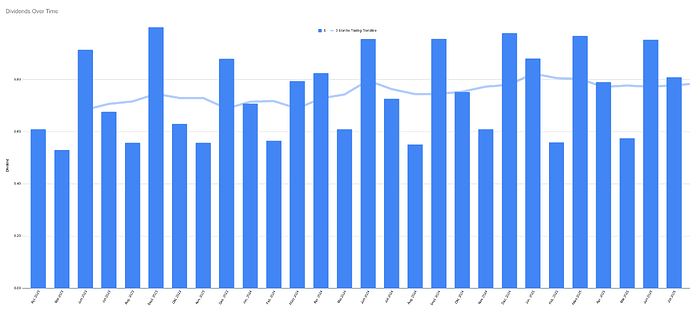

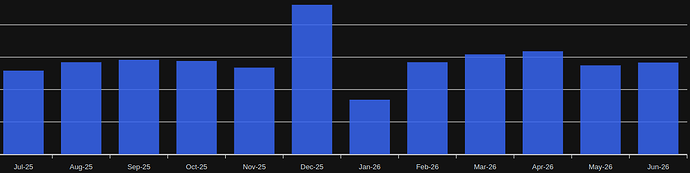

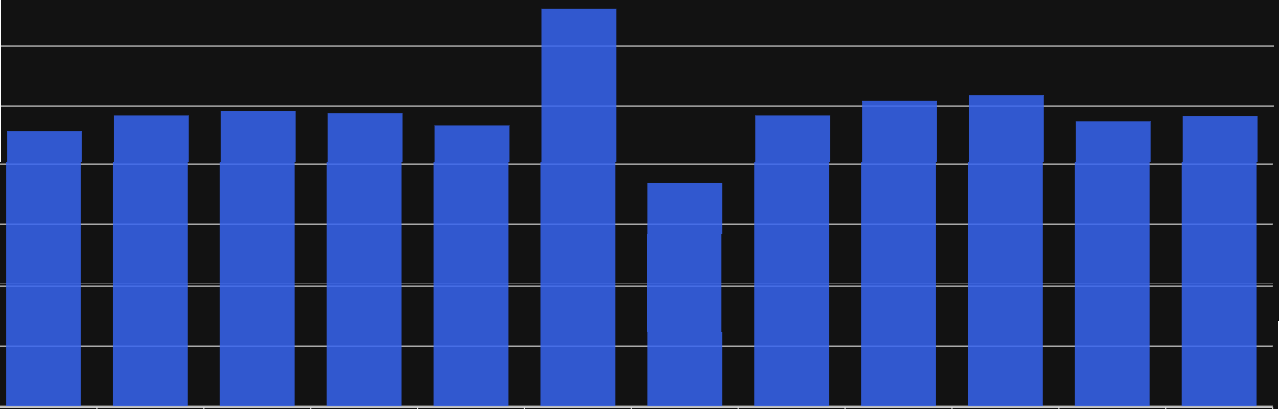

This is the bright side of investing in US (and CAD and UK) companies: they pay their dividends quarterly (instead of yearly, like most CH companies), resulting in a steady cash flow over the quarters, with some variance through the months of the quarter.[$]

Here’s what the monthly dividend cash flow looks like:

This is smoothed somewhat further by the money-like / bond investments that

@cubanpete_the_swiss hates so much. The chart has overall has faced downward pressure by the USD decpreciating (the overall trendline in CHF is still sloping upwards, though).

I agree with my brain, I don’t agree with my gut. Maybe I’ll reach your level with a couple more years of steady cash flows steadily financing the cash flow needs of my family.

BTW, no personal ownership of any property (which, IMO, is kind of the ultimate bond?).

Awww … thanks!

Goofy blushes and tries to hide that tear creeping up in his left eye by seemingly scratching his cheek and stealthily wiping away the tear.

What a great question!

I actually had to think about this for a bit.

Like a long bit.

I believe with complete hindsight I regret not having pulled the – at least part time – trigger earlier. My son was entering his teenage phase relatively early, and it would have been beneficial for him if I was already more relaxed in my late years at Google and in my early years in my then 50% gig at my current employer.

However, admitting to myself that I am the risk adverse being that I am – ask me what could go wrong and I’ll give you 100 answers – I probably could not have walked this path any differently.

I guess: for people less chicken-hearted than me, pull the trigger as early as you feel comfortable? For the dark doubters in my alley: run the numbers one more time. Look at how the past few “recessions” have really dented returns (spoiler: they have not), ask yourself whether the next GFC is really around the corner (rare Goofy prediction: it is not).

✱ And yes, I am aware, the profits of companies (and therefore dividends) have already been taxed and producing cash flow by realizing capital gains would be much more tax efficient (but psychologically a lot more stressful).

$ March/June/Sept/Dec are the tides of dollars rolling in, Feb/May/Aug/Nov are the ebbs. Remaining months are somewhat in between.