So how do i prove that e.g. the 100k I pay in is from the Vermögen from before the marriage or after. The (digital) money in my bank account is not fifo (first in first out) to my knowledge…

I believe the part about “vorehelichem Vermögen” (premarital assets) means funds you’ve payed in before you got married, or if you’re married with “Gütertrennung” (separates assets).

For inheritances you should probably have that payed out to a separate account, and transfer money from there directly to pillar 2, so that there is no doubt you added those funds from your inheritance.

I guess in some cases it is wrong, but in the majority of cases it is right. ![]()

Yes I was specifically refering in case you have „Gütertrennung“ and you buy in during you are married.

Not having been divorced…

You separate(d) funds and accounts, I guess?!

Your pre-marital wealth and marital income has also gone on record - so if shared outgoings are properly documented/split, that may also support your case.

This is forked from the thread on salary progression.

Generally on time requirements:

I would say that I probably need to spend 1-2 hours per week on managing my portfolio. I’ll elaborate below.

I probably do spend about 10 hours per week on (mostly) watching my portfolio. I’ll elaborate below.

Time requirements on the axis of minimum time needed:

Probably close to 1-2 hours per week if I wanted to? I would move my entire portfolio from Swissquote to IBKR (or any broker with the capability) and I would just switch on autopilot which would mean re-investing all returns from any issue into the issue itself (DRIP. Dividend ReInvestment Plan).

I might do this in a few years when passive income is just abundant and I won’t care about further optimizing.

At this point in time, I still feel I can allocate capital (gained from returns) better than the market and choose further investments actively. Hence …

Time requirements on the axis of time actually allocated:

Usually about an hour or two per day (including weekends).

I don’t spend all the cash flow coming in and I feel I still have an edge at allocating it better than just putting it into the market or DRIPing (as described above).

I therefore spend multiple hours looking at various sources (a paid Webinar, YouTube channels, even Twitter) looking to seek out potential new investment candidates.

This is more of a hobby than a requirement, so could easily be trimmed down.

Regarding “pay day nearly everyday”:

That’s a great observation. In fact, what brought me to my current strategy of investing was the “Zahltagsstrategie” by Nils Gajowyi, a strategy that aim at generating income in a pay day like manner.

Regarding “watching the portfolio” …

Here’s the thing I would add, and it’s somewhat orthogonal to the specific strategy that you might pursue (it is certainly orthogonal to the one I am pursuing):

Personal experience actually matters. It is different to have bought or sold something out of serious personal conviction than if you bought or sold based on following guru X on pick Y.

It is hence (for me) also personally beneficial to spend 10 instead of 2 hours per week on this: I get real time feedback on choices I make, and it informs my brains somewhat realtime, even if it influences my investment decisions only weeks and months down the road, ideally after having simmered for a while.

Until recently, i was spending easily 20+ hours on managing the portfolio. Though as my experince of the last few weeks (when I spent at most 1 hour) shows, it isn’t necessary. I might miss a few opportunities but it can tick along on it’s own.

In reality, I could get away with < 1 hour a week on it and that’s mainly to re-invest dividends/interest.

This is forked from the thread on salary progression.

This doesn’t include pillars 1e/2/3a which amount to about half of my tradable (non-retirement) portfolio. The assets at pillar 2 at my current employer are completely out of my control, a pillar 2 in a Freizügigkeitsstiftung is about 45% each in bonds and equities and about 10% in real estate.

I don’t own real estate (except via REITs and real estate funds).

Question: Since your main income seems to be from the ETFs (at least that’s what I’ve seen on yoru divydiary thing), why you just have 1/4 ETF and not more?

Oh, only 1/4 of the income is from ETFs, the remainder is from dividends from individually picked companies.

Ok then I misunderstood the graph that says that ETF are at the top of the dividend returns list.

Or are we talking about different things?

If ETF XXX has a 9% dividend and Stock ABC has a dividend of 4%, you can say that the stock give you more income only if you have more Stock ABC than ETF XXX…

That might be misleading on the Divvidiary page. My largest ETF holding (VXUS) provides me with about 9% of my passive income, but this ETF’s dividend yield is “only” 3.3%.

If you go to the Depot tab on the Divvidiary page and scroll down a bit, you can see a list of all the holdings (including their dividend yield).

@Your_Full_Name I was wondering, now that you are working on a reduced level, are you still overall contributing to your portfolio, or drawing down from it?

Still overall contributing, albeit at a slower pace.

Beautifully designed new avatar of yours, by the way!

I was just lazy and lent me something from the Interwebs.

Yes, it is a bit bling, but I was asked to pimp it up! ![]()

This resonates, good luck either way.

I switched to ETF some 10 years ago. In hindsight, I wish I just kept to my stock-picking portfolio started after graduation. Thousands of shares of obscure companies like Nvidia or AMD.The whole family would be set financially for generations to come. ![]()

You have to own your choices, I guess.

Kicking myself for selling Nvidia. All my estimates for earnings etc. were correct, but I just underestimated how rabid stock investors could be. Even after all the insanity, it is 36x future earnings.

I wonder if this will become the CISCO of the AI era? It still could have some way to go if so!

It’s very easy to sell at the top, you just need to know when the crowd has concluded that the crowd has concluded that the top is in. ![]()

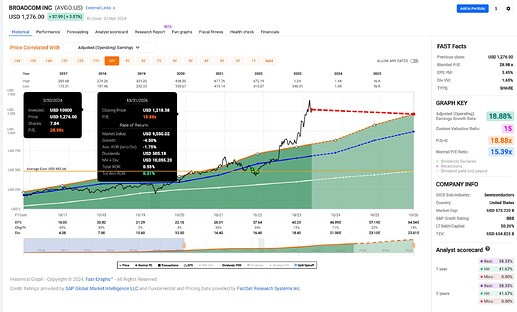

I’m in a similar position for my Broadcom position. Bought half a position (currently dividend of $1000, max position would be: dividend of $2000) in September through November in 2022 for an average price of $483.66.

The position has almost tripled - it’s f-ing up over 8% as we speak today! - and in my head I keep going back and forth between taking some profit (like, sell as much as initially invested, the remaining future profit is “free” money) and riding the AI frenzy wave a little further (reminding myself that I had the same thought of selling as much as the purchase price already a couple of months ago, but the stock is still freaking going up!?!)

Fundamentally, I feel the steam isn’t there to support the lofty valuation, and that I should sell. If Broadcom’s earnings hit the estimates one or two years out, and valuation returns to normality, I’ll just be flat (based on current price).

But FOMO has taken hold of me for now. I’ll wait a little longer. Surely, the market gods won’t punish me for taking a little additional profit? And who knows, maybe this AI thing will take over the universe…?

Ok, that last sentence makes me realize that I should take some profit.

(I won’t, yet)

Narrator: “This was a long-winded comment by forum user Uncle Scrooge that he appears to be human. He clearly has FOMO and apparently cannot logically conclude that taking some profit is healthy, etc etc.”

We’ll see. Back then, after the economic crisis, those were risky companies. I don’t have the reports anymore but it was less than 20 USD a pop. AMD was, like 2 USD. And I read there was a stock split in the meantime.

PC sales declining, big data fueled demand for data centers a pipe dream. It’s AI now, of course. I didn’t catch the crypto boom and where’s my self-driving robo taxi?

Anyway, the company makes decent money right now, sooner or later other companies will join in. My pipe dream are efficient markets, so I guess the company is valued just about right today. ![]()

2025 Update

90% pulled the trigger in January 2025.[*] About half a year ago.

Major Observations:

-

Steady Cash Flow is king for SWAN (sleeping well at night).

-

Having your approach stress tested early on is a Good Thing™ as it allows for swiftly building (or destroying) confidence that “things are (not) working despite some turbulence along the way":

- 2025 Liberation Day and tariff announcements? Portfolio value dips, but dividends keep rolling in.

- 2025 US Dollar vs CHF drops 10% or more? Bummer, but dividend raises in my stock picked portfolio have partially offset this and will continue to offset this.

Minor Observations:

-

If you want to continue to pay into 3a (before turning 65) you need to have a job that pays into AHV (or – possibly – you at least need to be married to someone who still pays into AHV according to regulation 2.03.d).

-

Even with a hand picked dividend growth portfolio, you’ll have to live with a handful of companies (per year) cutting their dividend (e.g. WBA, MMM, VFC in 2025 in my portfolio).

Diversification swiftly addresses cutters in a portfolio of about a hundred dividend paying companies as the cutters are easily overwhelmed by the raisers. -

Trading is a little more sparse and falls into roughly three categories:

- Optimizing For Dividend Yield (or, as I like to – ironically – call it, cutting the flowers and watering the weed): e.g. sold some AMGN, AVGO, and IRM to buy “less overvalued” and higher yielding companies to optimize for higher Steady Cash Flow.

- Optimizing for (bond) Interest Yield (giving up duration, the sensitivity to interest rates, as Harley Bassman would call it): I’ve exchanged some BND and BNDX for MTBA and BINC.

- Investing leftover cash: not much different than from before retiring. Perhaps a little more selective, even more focus on the company being able to generate growing cash flow, even less interest in being able to sell at a higher price.

-

I’ve grown more critical on some positions in my portfolio, favoring quality even more aggressively, and putting some positions on my potential sell list. TSN is one of those companies that I plan to get rid off. LTC was one that I’ve already shed.

-

Cash Secured Puts (or, rather, Treasury Secured Puts) continue to be a little side show, and despite me earning only a couple thousand dollars on these trades, I appreciate the dollars rolling in. Kleinvieh gibt auch Mist, as we say in German.

Orthogonal observations:

-

This forum is absolutely awesome for getting information on “how to do X with Y” (be it taxes, mechanical investing, you name it).

I have personally benefited tremendously from this and I am grateful for it. -

This forum is great for learning how others with actual practical experience of having FIREd fare with things, their investments, their strategies, their experiences. Shoutout to @cubanpete_the_swiss !

-

This forum is a waste of time if you (well, I, really) engage in opinion pieces (be it “will X go to the moon” or “ESG investing [according to my moral standards]”).

It’s still entertaining but it’s where opinions meet shady sources, mostly, IMO.

YMMV, of course.

Be well and invest well!

—

* I have a remaining 10% fully remote consulting engagement.