“often” can be many things. But if you have numbers that clearly aren’t “often” anymore, there is an ombudsman office:

I agree, this is disturbing.

The statement coming at this time of the political discussion around the tax hikes from SRF doesnt seem neutral.

I hope I’m not breaking any rules by posting this: https://www.impot-prevoyance-non.ch. In case I am, please remove my post ![]()

If I believe them for argument sake. What they are saying is

- If you take lump sum then tax payer pays the bill (which ideally should be younger generation who pays tax)

- If you take annuity then the younger generation pays the bill (as money will come from their pension contributions) because conversion rate is not easy to deliver

Not sure why #2 is better than #1

What’s the recommendation? Make mandatory BVG annuity only ? And thus, merge with AHV?

My opinion is that people who want to reduce lump sum withdrawals (by reducing incentives) don’t realise that the main problem is that annuity payments with 6.8% are not possible anyways. So what’s the point of having even more people draw annuity?

Apparently:

33% of the people who benefit from complementary AHV payments have, at some point, withdrawn something from their 2nd pillar.

Now:

33% of retired people had no 2nd pillar at all.

of the 67% who did have some 2nd pillar, 56% have withdrawn something at some point which means 37.5% of retired people have at some point withdrawn something from their 2nd pillar.

It seems to me the two statistics are aligned and there would not be a significant bia toward people who have at some point withdrawn part or the whole of their 2nd pillar among beneficiaries of complementary payments.

I haven’t found statistics allowing to link the amount received between the two categories.

Sources (2 links):

[FR]:

https://www.bfs.admin.ch/asset/fr/28786988

[DE]:

https://www.bfs.admin.ch/bfs/de/home/statistiken/kataloge-datenbanken.assetdetail.28786988.html

[EN] (only the statistics from the federal administration): https://www.bfs.admin.ch/bfs/en/home/statistics/catalogues-databases.assetdetail.28786988.html

[IT] (same): Statistique des nouvelles rentes: résultats 2022 - | Comunicato stampa

Come on, did we read the same article? It does cite some spokespersons, seems to refer to some statistics (like the one @Wolverine posted) and could be read as a cautionary warning to people with small pension pots that that they might live longer or underestimate the cost of elderly care.

Numbers above might confirm that it’s actually a thing, although I don’t care enough to form a conclusion whether it actually is or these examples are just anectodal evidence.

You can disagree on the focus of the article here, but there’s nothing disturbing or sketchy about it, at all.

The second sentence of the lede is misleading IMO:

Immer mehr Leute nehmen bei der Pensionskasse alles aufs Mal statt der lebenslangen Rente. Die Kosten tragen die Steuerzahler.

Translation:

More and more people are withdrawing everything from their pension fund in one go instead of taking a lifelong pension. Taxpayers bear the costs.

The article itself is a bit more neutral, granted.

They are quoting (and linking to) the research paper by Publica. If you read that, Publica comes to the conclusion that the majority of pensioners that take the cash are acting responsibly:

Die langfristigen Konsequenzen der Zunahme des Kapitalbezugs wird man erst in Zukunft abschliessend beurteilen können. In der Momentaufnahme der Umfrage scheinen die Personen mit (Teil-) Kapitalbezug ihre finanzielle Situation eher besser einzuschätzen als Personen mit einem reinen Rentenbezug. Wie sich dies im Verlaufe des gesamten Ruhestandes entwickelt, bleibt eine Frage für zukünftige Analysen.

That’s buried quite deep under SRF’s rhetoric. I expect more from journalism funded by tax money.

For argument’s sake it is probably reasonable to assume there is a (small) percentage of people who take the lump sum, burn through it, later need care, with the cost of that care exceeding their income out of remaining sources (AHV), resulting in a liability to the commune.

So if this indeed is the problem statement, politics may have a motivation to act, possible remedies likely restricting liberty for the majority in order to minimize that problem caused by a minority.

I still don’t understand how increasing federal taxes on lump sums will fix the problem. Will it indeed deter the people causing the problem now from taking out a lump sum? or will it merely mean they are burning through it faster - given they’ll start from a smaller amount, after tax, perhaps even increasing the commune’s liability (while national government has enjoyed additional revenues that can be assigned to its own pet projects)?

Not advocating it, but wouldn’t the “correct” fix be to ban lump sum payments altogether and make annuities mandatory for all pension funds, VBAs, and 3a accounts - or perhaps introducing a mandatory care insurance?

Since the discussed “solution” does not demonstrably fix the problem, why is it being proposed?

It may but I doubt it can gather a political majority, so would be impractical to implement and probably not be worth the time and resources to study. In order for it to work as intended, it would also require to ban early payouts for home-ownership and independent business ventures. The home-ownership part would probably get massive backlash, as people consider it too hard already now to buy a owner occupied home, in big part because of the downpayment.

That being said, increasing taxation on retirement savings withdrawals seems to also be attracting a lot of backlash so who knows what the better way to handle it is? My own understanding, given the very few data I have on the topic, is that it is a false problem and we don’t need to tackle it. It’s only on the table because the federal government is looking to cash-in more money and I’d posit it’s not actually a necessity as is.

Given the current international context and with humility because I really don’t know much on the topic, I’d wonder if running a deficit and issuing more debt wouldn’t help the SNB with it’s monetary policy, getting the Swiss franc to stay more stable in regards to EUR and USD. The higher SNB interest rates that it would allow, which should also allow for higher interests for savings accounts, should also help pension funds and people handling their retirement money (and it would also generate more taxes).

Edit: that being said, I’m biased because I really hate the economic distortions caused by negative rates and really, really don’t want to get back there.

You do realize that annuity means that money is only given to the individual and benefits to dependents or survivors are reduced significantly? Switzerland does not have state pension model like EU countries. So what would be purpose to block money of people forever?

Pension funds are already struggling to pay annuities for BVG mandatory portion at regulated conversion rate. And the “fix” would be to make it even more difficult by making annuities mandatory across the board (BVG Mandatory, BVG extra mandatory, VB, 3a, 1e) ? What problem would be fixed by doing so?

I think all these things are being talked about together, but they are being discussed to solve different problems -:

Problem 1 -: BVG mandatory conversion rate is unsustainable. VOTE was to reject govt plans to make reforms. Reform 2.0 awaited

Problem 2 -: Federal govt need to raise money and one option suggested was to increase taxes on lumpsum withdrawals

Problem 3 -: apparently people burn through their pension funds and cost tax payer later on

What typically happens is that since raising taxes is not popular, politicians come up with some “rationale to justify it”. For #2, the justification so far has been

a- lumpsum withdrawals are advantages vs annuity , so its only fair

b- people are finding tax loopholes , so its only fair

c- and actually Problem 3 also exists, so it would be best if we de-incentivize such withdrawals

My conclusion also. And perhaps to demonstrate to the misbehaving electorate how futile it is to vote for proposals the government disapproves of, like 13 months of AHV payouts…

Not sure how real the burning through money thing is. Maybe the money lasts even longer and they save the government money, otherwise if the annuity was such a great deal, they’d probably have taken that instead.

In a hypothetical scenario, wouldn’t it be more socially acceptable if the CH govt decided to introduce capital gains taxes rather than taxing the 3a (more)? The 3A is a potentially much smaller pot, and it’s already taxed on exit.

From a macro perspective, it’s good for a state to have a rich population, potentially: lower crime, more consumption, lower chance for social unrest.

Agree with the rest of your points in principle.

I wonder how much money they’d make off that change i.e. are there substantial capital gains being made.

Should it be taxed as income? Do you allow capital losses to be offset by income? If in a separate stream, do you have tax bands and a tax free threshold? Does it replace wealth tax? It starts to get complicated quickly.

Introducing capital gains tax for private investments would be a very big reform & would indeed need other changes to other taxes as well. It is not on the cards & it’s not going to happen.

The only thing I think will happen is higher Federal tax rate for lump sum withdrawals (versus today’s rate) and perhaps some changes to staggered withdrawals rule. And even this will cause a lot of drama

Sotomo.ch published detailed survey results on how the public sees the proposed measures on fixing adapting the federal finance situation:

Barometer-Finanzpolitik.pdf (German)

Interesting (for me) take-aways:

- 48% oppose the proposal

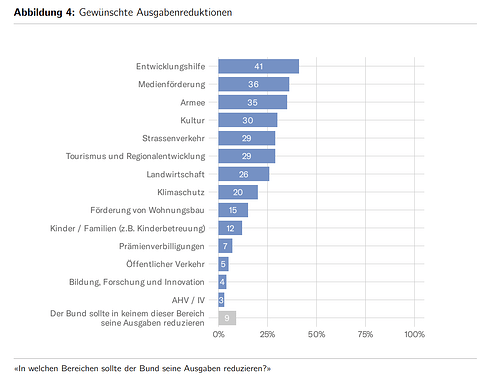

- the public wants to cut spending in foreign aid, media aid and defense

- the public does not want to cut spending in AHV/IV, education/research and public transport

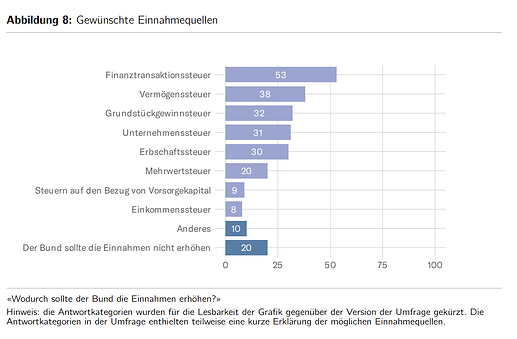

- 53% would like to introduce a finance transaction tax

- only 8% are in favor of the proposed pillar 2 and 3a tax measures

Some charts:

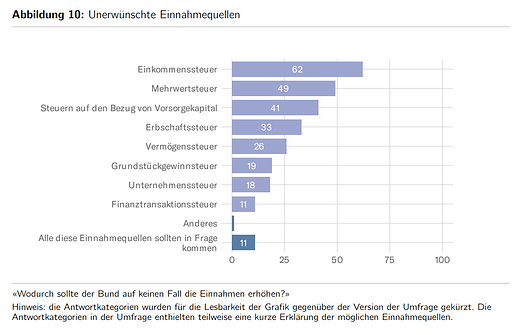

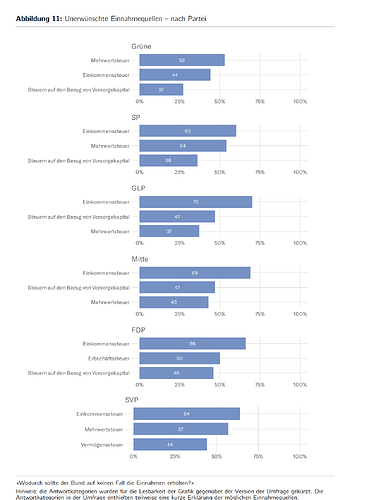

Surprising: even the left opposes taxing pillar 2 and 3a …

At least the government already said no to that.

People just dont realize how bad that would be for CH as a finance hub. These taxes also always fail basically. Look at Sweden on what that did there.

Companies will just leave/do business outside CH as a consequence.

And swiss companies that stay will be less competitive.

Short term a little extra money, longterm terrible for everyone involved.

I feel like it’s really hard for people to understand the impact, they just think all those transactions are useless so it doesn’t matter.

HFT and most financial actors have a pretty bad reputation, so it doesn’t help (even when they actually improve things, like extra liquidity/lower spread/more stable markets).

(and as you mention, finance actors can just move elsewhere)

Swiss business model is based on services… so I think this kind of taxation is not going to happen.

Already the ETF industry moved to IRELAND due to the Swiss WHT & CH not able to get same deal with US for ETFs

BTW. Dont we already have Stamp duties? CH govt is getting more revenue vs Swissquote when people buy / sell ETF leaders.