Finally, an actual proposal and not some speculation ![]()

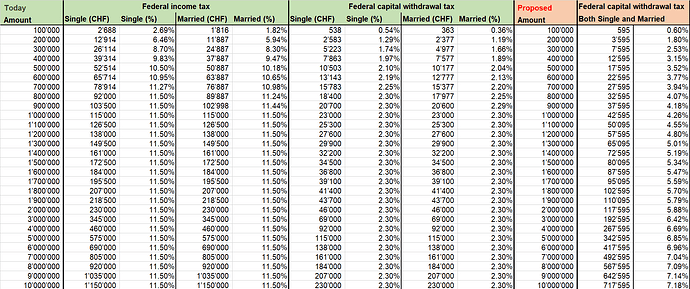

Here is the math, old and new taxes (federal only, your cantonal/communal taxes still come on top):

Other changes and notes:

- No difference between single and married

- Withdrawals within one calendar year are cumulatively taxed at the progressive tax rate

- No tax advantage anymore above CHF 10 Million capital withdrawal, and only 4% tax advantage above CHF 1 Million.

Timeline: Vernehmlassung until May 2025, planning to finalize a Botschaft until September 2025, with deliberation in parliament in winter session 2025. Earliest enactment by January 2027, tough might be delayed given that a referendum (and therefore a public vote) seems likely. Interestingly, the proposed taxation change is the only element where their own papers expect savings only beginning in 2028 anyway.

Based on this proposal, my expected tax bill more than doubles, costing me around 30k extra. Even so, I find this quite a reasonable (proposed) change. Edit: Maybe not, see next two posts with @nabalzbhf observation.