The common database for European ETFs is https://www.justetf.com and for US ETFs http://etfdb.com. What I cannot figure out about the US ETFs is how to see if the ETF is accumulating or distributing. Where do you find it? On the Vanguard website it’s mentioned that “The fund remains fully invested.” Does it mean it’s accumulating? Do the US ETFs also come in two versions: accumulating and distributing? Or you have no choice?

I think there are no accumulating ETFs in USA, I may be wrong though.

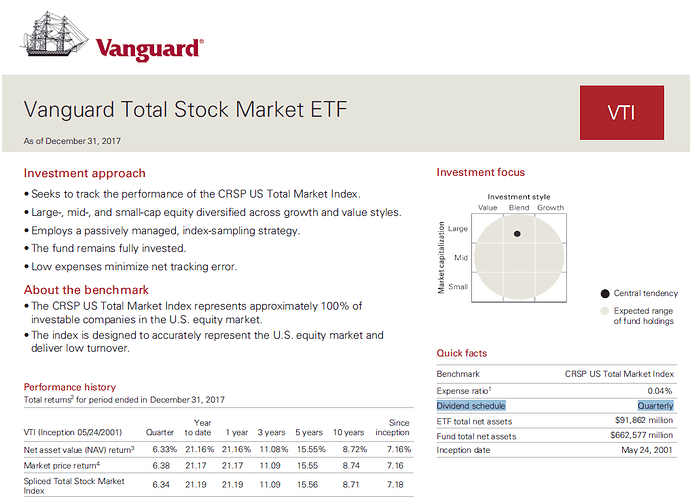

all the Vanguard ETFs from US I have (VTI, VXF, VBR, VXUS, VSS,VOO, VWO) are distributing. I think the majority of vanguard ETFs is, but i could be wrong.

No, they dont usually come in two versions.

you find that info in the factsheets, if not already on Justetf or etfdb:

For more info: https://www.bogleheads.org/forum/viewtopic.php?t=118381

US funds must distribute dividends

Does anyone know how long do you need to own an US or IE ETF to be eligible for dividends? I read that it’s two days for stocks, but I can’t find it for ETFs.

You just must own the shares at close of the trading day before ex dividend. You could buy a second before close if you want. But in CH it’s better to buy on or after ex dividend and enjoy the tax free dip in stock price - dividends are taxed, gains arent

Don’t you think that if everybody follows that logic then the tax could be, at least partially, factored into the price? It’s better to sell right before ex-date and to buy right after. What I mean is that after the dividend payout, the price of the stock would drop not by the gross dividend, but the net dividend. Just a thought…

Yeah, there’s probably some tax drag factored into price dip, it would be an easy exercise to figure out exact values with pandas and ohlc data from yahoo. But I’m pretty sure it’s nowhere near 40% (marginal rate) that i’d pay myself. Most american investors for example would pay only 15% on long term dividends, some 0%, and i hope that the big boys from wall street also have a bunch of tricks up their sleeves to dodge unnecessary taxes

watch out for this topic, there has been a huge scandal in germany “recently”, drawing much attention to the topic: