With the advent of low cost passive ETFs, we no longer need to pay 1%+ on holdings.

But some ETFs still charge, say, 0.3%. While quite low, on a $1MM portfolio that still adds up to $120k over 40 years and that’s before loss due to compounding.

For the buy and hold investor, would it make sense to just buy the underlying (or say top 100 holdings of the underlying) and save the ETF costs?

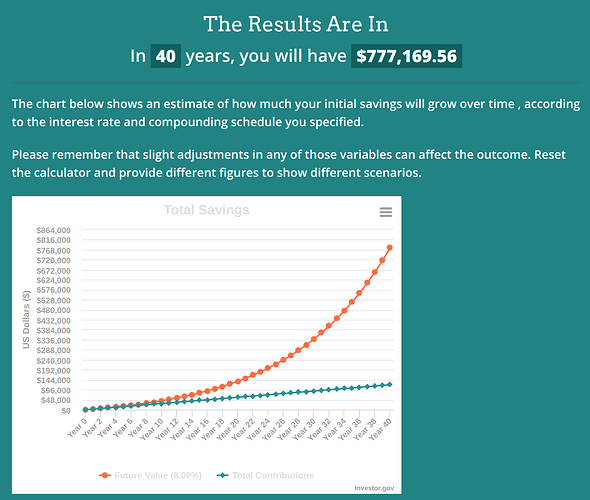

EDIT: I put the numbers into a calculator and it gave the loss over 40 years as:

(assumptions $1000k portfolio. 8% return. 0.3% expense)

I guess there are some arguments against:

-

Hassle of dealing with a lot of companies. One way around this is to take just the Top 100 in the index (if more than 100). This usually accounts for a huge portion of the value.

-

Difficulty and cost of re-balancing. You can deal with this easily by simply not re-balancing at all and saving on those expenses too. Or using the IBKR re-balancing feature to easily do the re-balacing. You could do this, say, once per year. Combined with #1, this would also be much cheaper than the ETF.

-

Hassle of re-investing. I’m anyway re-investing each month my dividends and interest, so this is no incremental hassle. In retirement, you can just let this flow to cash and use it to pay your expenses.

-

Hassle filling in your tax return. The initial loading of 100 positions is for sure a pain, but if all values and dividends are automatically pulled in future, then the maintenance isn’t too bad or at least not paying $20k per year bad.