Yes, I think this is very sound advice.

Great document explaining the situation with a fantastic example! Merci beaucoup.

Indeed, that said many brokers will just release the assets (maybe not IB, but it seems to be the case for swiss brokers).

I would assume many people then don’t fill any paperwork (many people probably wouldn’t even know you might need to, if the broker released the assets, the extra-territoriality of the US being somewhat unusual)

I think in this regard a local broker might be more useful because they might believe the Swiss tax returns as proof enough.

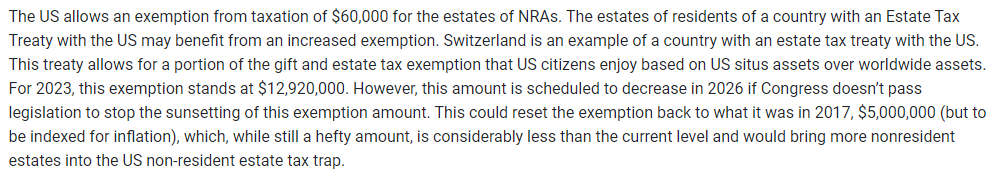

What about this 60k threshold? Is that for individual stocks?

I link a post you liked yourself last year. ![]()

tl;dr: They don’t lock the funds.

One issue I have will all this: no official documents/links from the Swiss government confirming everything.

I found that too. But where are the concrete numbers?

I tried to google some “site:.gov” links but didn’t find anything with numbers. I think we either trust private companies (see my link above) or we have to dig deeper.

My usual opinion is: If you have more than 10 millions asset, just cough up the money for a lawyer ![]()

Yep. I guess this is where I’ll end up or for simplicity just avoid US-Domiciled Assets.

It’s either ways not your problem anymore ![]()

But I agree, the numbers are high and if you want to be more on the safe side, switch after 5m into CH, LU or IE ETFs.

So you are saying IBKR doesn’t lock up the funds and the “trusted person” or beneficiary can just take over the securities or decide to sell them without ever getting involved with IRS?

Or it’s only about freezing of funds? But still an obligation to file tax return with IRS?

You can read the thread. The main finding was, that you don’t have to get any ok from the US government to take all the money and leave. The US government might still want you to file taxes.

Fair enough.

The discussion and previous threads seem competent, but all theoretical, no first-hand experience. Which is not surprising: most from older generations were much less likely to invest in stocks, let alone in US-based ETF invested by themselves via an online broker.

When getting older, I’d still be worried about the hassle my heirs might deal with and plan to get them fully informed and either switch to European assets and/or get professional advice or custody for topics like this as @ma0 suggested.

I agree. That’s the whole point. The process of actually doing all the work needs to be clear. Either via a lawyer, an accountant or rules savvy person.

I will search if there is some specific service in Zurich and how much does this cost

Sorry, I must have skipped the previous comment from you. It’s exactly what I meant.

For larger assets, I’d expect this is where wealth management with high fees comes into the game, combining investments, taxes, estate lawyer etc. But I’m far from those amounts.

Please share if you find some more tailored service

No problem.

Will share when I learn something. There has to be some reasonably priced service to manage this.

It seems following firm has offices in various cities including Zurich

I have not asked them for a quotation yet.

Another resource. How Form 706 is filled.

Nice, thank you.

Also found a website/blog (UCITS Vs U.S. ETFs - Pros And Cons For Non-US Investors) which gives an overview about pros/cons regarding UCITS vs. US ETF.

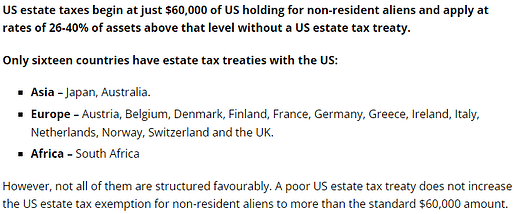

There are not many countries, which have a tax treaty with the US:

In your linked post, Switzerland seems to have a very favourable agreement: