You can read the thread. The main finding was, that you don’t have to get any ok from the US government to take all the money and leave. The US government might still want you to file taxes.

Fair enough.

The discussion and previous threads seem competent, but all theoretical, no first-hand experience. Which is not surprising: most from older generations were much less likely to invest in stocks, let alone in US-based ETF invested by themselves via an online broker.

When getting older, I’d still be worried about the hassle my heirs might deal with and plan to get them fully informed and either switch to European assets and/or get professional advice or custody for topics like this as @ma0 suggested.

I agree. That’s the whole point. The process of actually doing all the work needs to be clear. Either via a lawyer, an accountant or rules savvy person.

I will search if there is some specific service in Zurich and how much does this cost

Sorry, I must have skipped the previous comment from you. It’s exactly what I meant.

For larger assets, I’d expect this is where wealth management with high fees comes into the game, combining investments, taxes, estate lawyer etc. But I’m far from those amounts.

Please share if you find some more tailored service

No problem.

Will share when I learn something. There has to be some reasonably priced service to manage this.

It seems following firm has offices in various cities including Zurich

I have not asked them for a quotation yet.

Another resource. How Form 706 is filled.

Nice, thank you.

Also found a website/blog (UCITS Vs U.S. ETFs - Pros And Cons For Non-US Investors) which gives an overview about pros/cons regarding UCITS vs. US ETF.

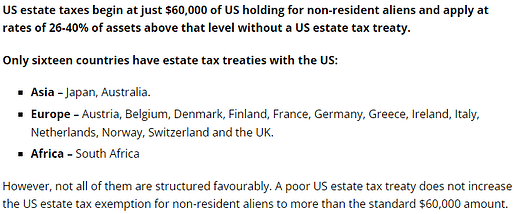

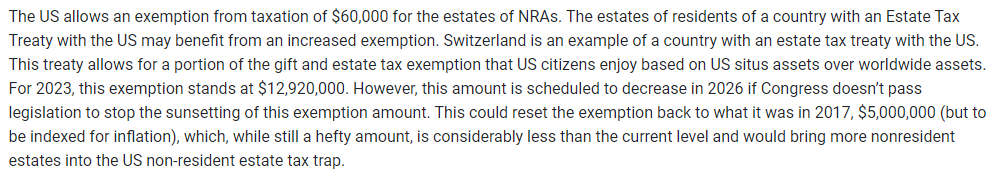

There are not many countries, which have a tax treaty with the US:

In your linked post, Switzerland seems to have a very favourable agreement:

It will happen. They haven’t found a way around death yet. Even for VT investors ![]()

Just sell when you are 80 or something and convert to VWRL, problem solved. You made enough extra tax gains by that point.

I would probably let a wealth management firm handle my finances by that point anyway (or my kids if I have some and educated them enough)

Your suggestion works well for normal situations where one can plan things in time.

The challenge comes when something happens suddenly and then benefactors don’t know what to do during the grieving period.

Thus keeping clear instructions in place is really important

My first-hand observation is that, in the real world, this tax is not enforceable for non-US persons, and practically nobody pays it. However, given the state of the US budget and the financial windfall it represents, I wouldn’t be surprised if this changes in the future.

While people don’t like uncertainties, assuming one has no US bank or broker accounts, no US real estate, I fail to see what in a real world IRS can do. With a non-US broker there is no reporting duty. Cash and bonds either in any euiropean country. Some bark but no bite. Like a chihuahua, ignoring it and never disclosing anything voluntary. And if US changes law to give them more power, adapt and change then. But that likely would lead to a more dollar-centric world so I can’t see it happening.

I was also thinking about this. The IRS has no way of knowing when someone holding US ETFs at a Swiss broker dies in Switzerland. And even if they find out, how are they going to force anyone paying those taxes?

Even though this might be true, that doesn’t mean that taxes are not owed. I would not suggest to make a plan based on assumption that authorities wouldn’t know.

Having said that holding ETFs at Swiss broker might make it unlikely indeed unless there is special reporting that happens in background at time of estate transfer

For Swiss banks, there isn’t (a special reporting in the background), this is an obligation for the heirs, so the Swiss bank will simply give the heirs (& in general to older clients with US stocks), a 1 page memo informing the client or heirs of the potential obligation in a very general way.

FATCA is Swiss law, if that’s what you were referring to.

They can’t, as long as you’re willing to stay away from the US.

Not only do they not know, but they can’t really enforce it in any case. For the rest, it’s essentially risk management, as is the case for many, if not most, things we do in life.

US IRS don’t have capabilities to enforce their tax laws? Then why there is so much discussion about it?

I find it a bit strange

that’s the reason there’s withholding tax for dividends, generally countries can’t enforce much on regular equity holding (because the ultimate beneficiary is typically not known).

(unlike things like real estate)

Maybe at some point this will change, but definitely not the case now (and most countries besides the US don’t care so unlikely to be pushed through internationally, tax reporting to the country of tax residence is what most countries care about and that’s what is implemented).

I don’t want to scare off anyone, but I have recently had first-hand experience with IBKR (UK) on that topic: A deceased account holder with no connection to the US who was a resident of a country without an estate treaty (so the basic threshold of $60K). IBKR won’t release the assets until they receive proof that either the assets are under $60K or that the estate tax was settled with the IRS.

Probably something to be aware of if you have heirs and don’t plan to retire in Switzerland.

I’m interested in any kind of proof, if there is anything you can share. I would like to blast IBKR support with it, so they need to clarify under which circumstances they lock and don’t lock assets. Because as linked above, they told me they wouldn’t.

Vice versa, you could ask them why they told other people there would be no locking. Not that they would then unlock, but maybe explain themselves.