So a good strategy would be to move US-situs assets from IBKR to Swiss Broker on a regular basis, while non US-situs assets like UCITS can stay in IBKR. ----> relative peace of mind from estate tax paperwork for heirs and broker diversification too. Not to mention the low transaction costs of IBKR.

What would be the cost of doing this and doing this regularly? Move US-situs assets from IBKR to a swiss broker?

Is it possible to move ETFs that the swiss broker doesn’t propose?

A really great thing to have would be an example (even fake) of the two forms filled in the case no tax are due to the IRS. I looked for the us-swiss estate treaty and cannot find it. And I don’t understand how to find the different points/info to fill in the form 8833 for example. It doesn’t seem trivial at all.

Moving ETF from IBKR to Swissquote costs ZERO CHF.

You cannot move ETFs which you cannot buy on recipient broker. So first you would need to get them added.

Having said that standard ETFs should be available

I don’t understand the last part of IBKR’s answer

301.6114-1(a)(1)(ii),if a return of tax would not otherwise be requires to be filed…

Someone does? Thank you

Ok thanks!

There you go: Fedlex

An English version unfortunately isnt available on Fedlex.

No! It doesn’t matter if your US assets are with a Swiss or US broker. VT, for example, is still a US situs asset even if you hold it with a Swiss broker or bank

How much is “so much”? 0.15% lower TER and dividend taxes regained adding 0.1% at most vs peace of mind and eating popcorn over this discussion?

As a motorcycle rider my chance of sudden death is probably 50 times that of the general population, offset by the smile I get every time I ride, as they (we) say “you don’t see bikes parked outside psychiatrists’ offices” ![]()

Yes, theoretically but in practice it seems to make a difference ![]() .

.

@Dr.PI can you please point me and others to the comments here or in blogs / news articles where Swiss broker transferred the US situs assets to heirs without US estate tax shenanigans? It would be really helpful to keep track of such pieces of information.

Come on man, it‘s literally in this thead and it has only 172 posts…

I did the math for WEBG vs VT

Net difference post tax is about 0.1%

Great! Would be interesting to see the same for VWRL vs VT. But probably the same.

VWRL will have higher difference because of higher TER cost. Rest should be similar.

WEBG and VT have same TER 0.07%

That’s what I guestimated, good to have solid numbers.

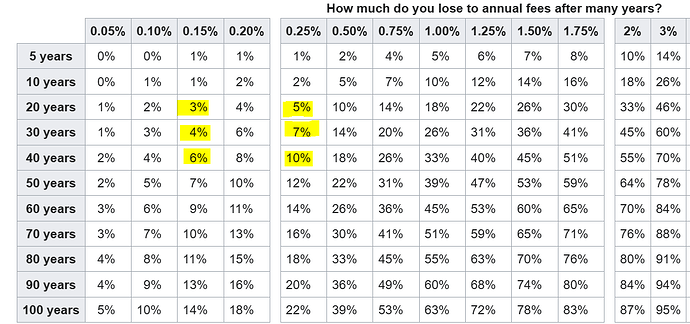

So a difference of VT vs VWRL is 0.25% and 0.1% vs WEBG in favour of VT. Even the 0.25% difference is academic to me, let’s see what Bogleheads say:

Statistically I’ll probably be alive in 40 years, and most likely dead in 50 years, while I put my “feasting - not sustaining - on investments” timeline between 15 to 25 years from today (when pensions will kick in). I won’t lose sleep over 1-2% and 3-4% difference, really won’t.

Edit: sure, in a paper exercise 4% difference is 40k in a million…so what, money is a means not an end.

Did you assume that the base currency is USD, and therefore there is no currency conversion, or did you calculate with the exchange rate included, using a 0.95% fee on Swissquote as a reference (for example)?

It’s hard to compare VT and VWRL or WEBG, as they follow different benchmarks. VT has a lot more stocks, mostly small caps, which make it different from the other two.

The cost net difference between VT and VWRL over the past 11 years is 0,32% average annual. On average, VT underperformed its gross benchmark by 0,23% and VWRL underperformed its gross benchmark by 0,55%.

These two make VT for me a more attractive offer: 0,3% cost difference and a broader index, which includes small caps.

I did some calculations in this post (pre-tax) and this post (post-tax).

Pre-tax, IE funds perform 0.14% worse than US funds. Post-tax, at a marginal tax rate of 25%, that goes down to 0.1%.

I was mainly comparing if I buy WEBG on IBKR vs. VT to try to keep comparison as objective as possible…

Hence no exchange rate impact.

Of course I am assuming that Small caps included in VT do not make a meaningful difference in long term performance.

Fair enough, whether the real difference is 0.1%, 0.25% or 0.3% (not disputing anyone’s analysis, I stuck my finger in the air and guesstimated 0.25%, which appears to be “pretty good”) it’s too small for me to justify the hassle/worry.

Make it different, indeed, does it make a difference, though? I am much less convinced about VT being better by having just more stocks, the % weights of small caps are so infinitesimal that it makes zero difference. If you want small cap +/- value you can meaningfully tilt to it (I don’t, just saying). VTI+VXUS have about 12k stocks, while VT has 9800 or so (last time I checked?). There’re diminishing returns in a glut of diversification and hyperoptimization, in my opinion.

Edit: I may be wrong (it’s been known to happen) and it may indeed make a difference, I didn’t check VT vs VWRL in USD.