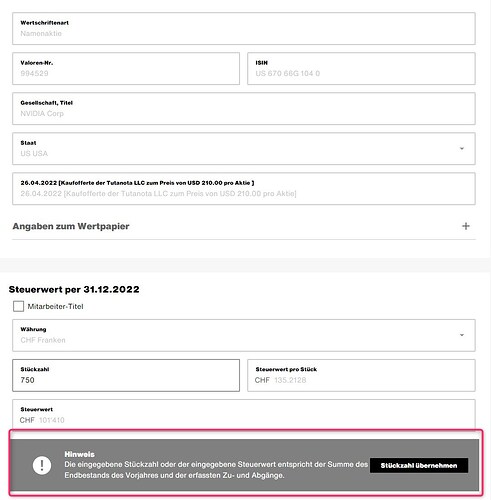

I am receiving an error/warning when entering the stock:

also, below there is another message:

Der Anfangsbestand und die Veränderungen der erfassten Zu- und Abgänge ergeben nicht den Endbestand gemäss “Stückzahl” bzw. “Nennwert”. Bitte prüfen Sie die Werte bzw. korrigieren Sie Ihre Angaben. Bei “Ignorieren” wird diese Position (Nennwert/Stückzahl) trotz Abweichung gespeichert.

Considering my German sucks and the fact that this is not really user friendly message, could someone help to decipher it?

Basically it says the amount of shares from the beginning of the year plus the amount you bought during the year minus the amount you sold during the year don’t add up to the final amount from the end of the year.

IIRC you should have a form where you declare that you bought 750 shares on date xyz. If I understand your screenshot correctly, right now you only declare that you had 750 at the end of the year but not when you bought them. Scroll down to “Zu- & Abgänge” and enter each transaction.

3 Likes

I don’t think this is doable timewise for 100/1000 of transactions during a year.

I buy, I sell. Sometimes caught with long positions during dividends pay out - being forced to deal with unwanted dividends.

How to do it properly without committing seppuku at around 150 entry?

I had over a hundred pages of transactions last year. Just get a good bottle of wine and get on with it.

A more technical way would be to learn javascript and script the entire thing. It might take just as long in the first year, but should pay off in future years.

2 Likes

Get a broker that provides you with an eTax file, so you don’t have to enter it manually.

2 Likes

What about just providing the overall status for 30th of December - cash + opened positions?

I have seen these option as valid and sufficient.

Obviously, it doesn’t work out of the box with dividend stock, but I am pretty sure there is a solution to that as well.

Btw. like your idea with javascript. Going further… you can use any language you know with Selenium to automate the shit out of it.

I don’t like the wine idea though. At the end of the bottle I would be prone to not recognizing some of the trades - like they never happened.

If you’re not going to use the prefilled stuff, you’ll need to compute things yourself, figure out the dividend etc.

Just don’t use the ISIN etc. so that it doesn’t try to fill stuff out (and then ignore the warning)

1 Like

Bingo. That’s the way. Thank you Nabalzbhf.

Btw. you could have written half a novel or 100 minutes screenplay, instead.

I was wondering why 750 NVDA is only worth 100k (your screenshot), until I saw that it’s the value on 31.12.2022.

Are you really only doing 2022 declaration now? Just a heads up, so that you’re in the right year before adding a hundred lines of transactions

1 Like

Cheers Rollandinho - appreciate your pointer.

I am in 2022 with taxes currently.

Seems like different universe.

2 Likes