True that (banks neither), although there are some situations where that is legitimate. A colleague of mine (Swiss citizen) will go on travel for two years (world trip) with the intention to settle in a non-EU country at the end of that. He has resigned his rental apartment and gone all the way to deregister in Switzerland.

@EPeon: Agree.

There may have been some confusion due to you citing that NZZ article in the same post - which basically advocates for exploiting a loophole in taxation.

Designing your life circumstances may be as simple as making a bona-fide move to a jurisdiction that has favourable tax rates and then actually pay taxes there (or possibly none).

Considering she was working a “management position”, she probably was one (income millionaire) in Denmark - and would have paid a similar tax rate.

[we’re still getting off topic here, but fwiw having deregistered doesn’t mean you’re still not tax resident, esp. if you haven’t taken residence elsewhere, but yeah as others said unless there’s an audit it’s likely to be unchallenged, but if there’s any kind of scrutiny applied it won’t fly]

Yeah there are a lot of clear cut ways to handle tax planning around pension taxation. Even before shopping for a country with lower tax rate for pension taxation, just splitting until multiple years if the taxation has a large progression (if allowed) could reduce quite a lot.

Let’s not confuse terms. A stateless person is someone who does not have any nationality. We are talking about tax residence.

Still in Zurich. That’s the whole point - you keep your Swiss tax residence/delay your new residence until you withdraw the pension fund.

Then you’d pay Zurich taxes, not at source withholding. (Which is not what people do)

ZH normally does a convoluted calculation but ultimately gets added to income tax (see here: Capital withdrawal taxes by canton - Finance, Taxes, Banking, Insurance and Retirement - Swiss Forum)

So if they do not do this, they maybe they accept that you have left and this is a ‘loophole’. In reality, you have a tax return to complete for the year you are still in CH.

Maybe a nice way to finesse this would be to de-register early December and arrange for your pension to be withdrawn early January so the payment wouldn’t even fall within the tax year you leave. However, I’d argue you are still due a tax return then for the following year, but maybe this does fall between the cracks.

It’s also worth noting that the WHT can be higher than the regular taxation!

Interesting. Where would he file and pay for taxes meanwhile (dividends, interest, potentially RSUs vesting, etc)? I assume when you deregistrer tha. switzerland needs new domicile address?

I cannot imagine you can avoid filing anywhere, even in a situation of travelling for 2 years without more than 183 days in one location

What countries would be ideal? Andorra? Thailand? Any resources on that?

If you end up being non-dom, I think countries following british system can be interesting (e.g. Malta, etc.) since foreign income is not taxed.

otherwise if you don’t use the foreign income tax advantage but the pension fund advantage https://www.oecd.org/pensions/Stocktaking-Tax-Treatment-Pensions-OECD-EU.pdf page 14 has a table to start exploring (they key point will be to make sure the country recognizes the swiss funds as tax advantaged)

Getting more off thread here, but if he doesn’t have a residence/ “Wohnsitz” because he is travelling for years (a) why would he want to file for taxes (b) on what basis would any country base a claim that he should pay taxes there? (income from real estate excluded. And the US of course which taxes for the mere privilege of holding their passport)

Look into the laws of various countries and you will find various provisions that make you liable to tax in various corner cases.

Banks and financial institutions will ask you for your country of tax residence and will report the data to tax authorities through automated exchanges.

Becoming residence-less was explored in this thread

Summary: if you haven’t established residence in another country,from a swiss tax perspective you are still resident in CH. Whether the swiss authorities will come after you is another matter.

CH-UK Double Tax Agreement says pension lump sum withdrawal is not taxed in UK. You pay the 4.8% withdrawal tax in Schwyz and you are done.

How did you figure out which countries let you withdraw 100% of the second pillar and not only the surobligatory part? I know EU/EFTA only gives you surobligatory. But what about other countries? Is there a list somewhere of countries where you can get 100% of the 2nd pillar back and the local tax rate + DTA situation?

Is the 4.8% progressive or the max?

All you need to know. The restriction on payout applies only to EU and the EFTA member states of Iceland and Norway (Liechtenstein somewhat unsurprisingly being an exception due to prior bilateral agreement) and depending on your social security status.

…if you are subject to compulsory (similar) insurance somewhere in these member states. If you are not, you’re still eligible for payout of entire amount.

Move to, say, Portugal and don’t take up employment there: you will most likely not be subject to mandatory insurance and can have the full amount paid out.l (note that other member states may be stricter in terms of defining mandatory insurance).

I have a similar situation to the OP, where, after living in CH for the past 15 years I will be taking early retirement & want to move (with my pension lump sum) to Spain where I already have property. I understand that withholding tax is payable in CH, but I would like to minimise how much tax I pay in Spain, particularly since this would be clearly a case of double taxation.

I have a couple of questions that I hope contributors to this forum can help with:

-

I have read the suggestion in the NZZ article where it mentions de-registering in CH, cashing in the lump sum & transferring to the destination country (in this case Spain), but staying in CH for around one month as a tourist. But surely the arrival of such a large sum of money in a Spanish bank account so soon after de-registering in CH and just BEFORE registering for Spanish tax will raise suspicion with the local tax authorities?

-

I understand that the UK has a different arrangement with Switzerland than the EU/EFTA, which means under Art 18.2 of the double taxation treaty between the two countries. As a UK citizen if I become UK tax resident then no UK tax is payable on lump sums received from Swiss pension schemes. However, since my ultimate destination will be Spain, but wishing to avoid any additional taxes, how long would I need to remain UK tax resident before registering as tax resident in Spain?

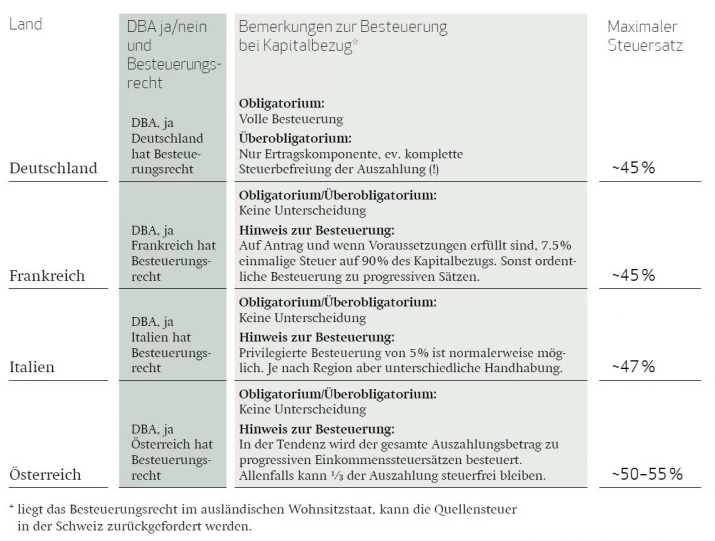

Pensexpert has just published a short article around lump sum taxation considerations in the large neighbouring countries (mentions Spain in passing).